Invest in Climate-Tech Leaders Working For Your Next Generation

A premium access for Family Offices & Angels to thrive in climate-tech investments.

Join our exclusive network

Invest in the next generation of Climate Leaders

Our unfair advantage to fight climate change

We do more than invest

We connect the best

Founders

Investors

Experts

We Collaborate with Over 170+ investors

Alliance Members Benefits

Connect with a global network of investors

Monthly Investments opportunities

Access to deals always lead by the best VC's

Global portfolio diversification

In person & Online Exclusive Events

How does Our Climate Investors Alliance Work?

We Curate, Share & Structure the Deal

Alliance Members access to the deals

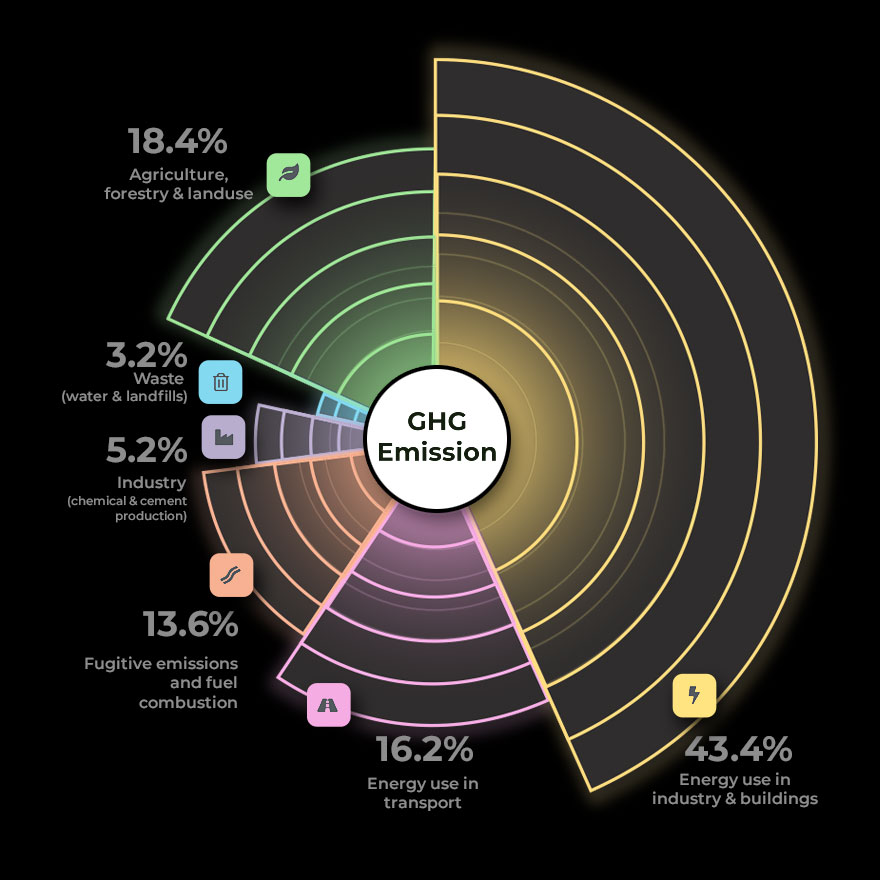

Which Startups Fit our Thesis?

Type

Highly scalable climate tech startups with the potential to transform industries for the better, all while attracting substantial venture returns.

Stage

Pre-seed to Series A Rounds lead by top tiers VC's.

Field

Hardware & Software Technologies.

Agnostic Across Climate Tech.

Prioritizing High-Impact Solutions for Mitigating and Adapting to the Climate Crisis.

(energy, Transportation, Food & Agriculture, Industry, and the Built Environment)

Region

Global - EU, UK, US, Canada, Israel, Singapore, Australia, and New Zealand.

Are you a Founder looking for funding?

We support & invest in tech-driven companies developing ground-breaking solutions to tackle climate change.

Send us your company details to be considered for funding.

Investing from €100K up to €1M

Founder First Approach

Investing in VC-led rounds

FAQ - Alliance Members

Direct sourcing & Referral Deals: While inbound are strong numerous investors and players collaborate with us by sharing exceptional startups. We screen over 100 companies per month & select only on average 3-4 companies fit our thesis criteria. Then, only VC’s lead deals will be presented to the Alliance

On average, we structure 1 deal per month for our Investors Alliance that include a deadline for each deal.

The minimum investment amount is €10k per ticket. However, it is the sole discretion of each accredited investors to decide if the investments fits their personal criteria for investments.

No, our Climate Investor Alliance is invite-only for qualified and accredited, ensuring top-quality investors collaborate within an exclusive network.

- 0% Management Fees

- 20% Carry

- SPV Costs pro-rated to deal participants

- €99 (Eur.) Monthly Club membership fee

We encourage investors to also perfom direct investments with the company if the founders find it a fit.

A Special Purpose Vehicle (SPV) is set up for each investments via the platform regulated Kapital. This SPV serves as a dedicated legal entity tailored for managing and executing the fund’s specific investments.

More about the “Kapital Platform” or “Platform”. The Platform is operated by HackVentures Ltd., a subsidiary of the HackGroup SA with offices in Switzerland and Luxembourg (HackVentures Sàrl, a registered Swiss limited liability company with registration number CHE-325.110.014.). They provide Financial Advisory Services under the Swiss Financial Service Act and Luxembourg based issuer services under the Securitisation Act 2004 & the Fiduciary Act 2003.

Yes, we encourage all the club members to be an active participant in the ecosystem by giving support with their network and provide expertise to each startup.

An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.

The “Accredited Investor” standard is set by the SEC and defines who is able to invest in certain private securities offerings.

All investors must at least meet US accreditation requirements.

Non-U.S. investors should also review the standards under their local law.

In no case shall STARTUP BASECAMP INC and its affiliates be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. This Platform is operated by STARTUP BASECAMP INC, a registered C.Corp company in USA.

Investing in private markets, venture funds and early stage companies involves risks, including illiquidity, lack of dividends, loss of investment and dilution. This communication is intended for accredited experienced investors, with sufficient experience and knowledge to understand the processes and risks involved. If you feel that you are not in a position to assess your expertise, please refrain from proceeding.

This website (the “STARTUP BASECAMP Platform” or “Platform”) is operated by STARTUP BASECAMP INC. Please note that the investment schemes mentioned are not subject to the supervision of the SEC, European Regulators or the FINMA, may not be distributed to non-qualified investors, and that investors, therefore do not benefit from the protection offered to retail investors. In no case shall STARTUP BASECAMP INC , its related entities and partners be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. The content of this website does not constitute an offer to enter into any transaction and is intended for general information purposes only. This is not an offer, solicitation of an offer, or advice to buy or sell securities in any jurisdiction where the STARTUP BASECAMP INC and its related entities & partners are not registered. The information contained on this Platform should not be considered by users as an alternative for the exercise of their own judgement, a careful analysis is necessary, and it is recommended to potential users, before making any decision, to always consult a qualified professional advisor to obtain appropriate advice, in particular financial, legal, accounting or tax.