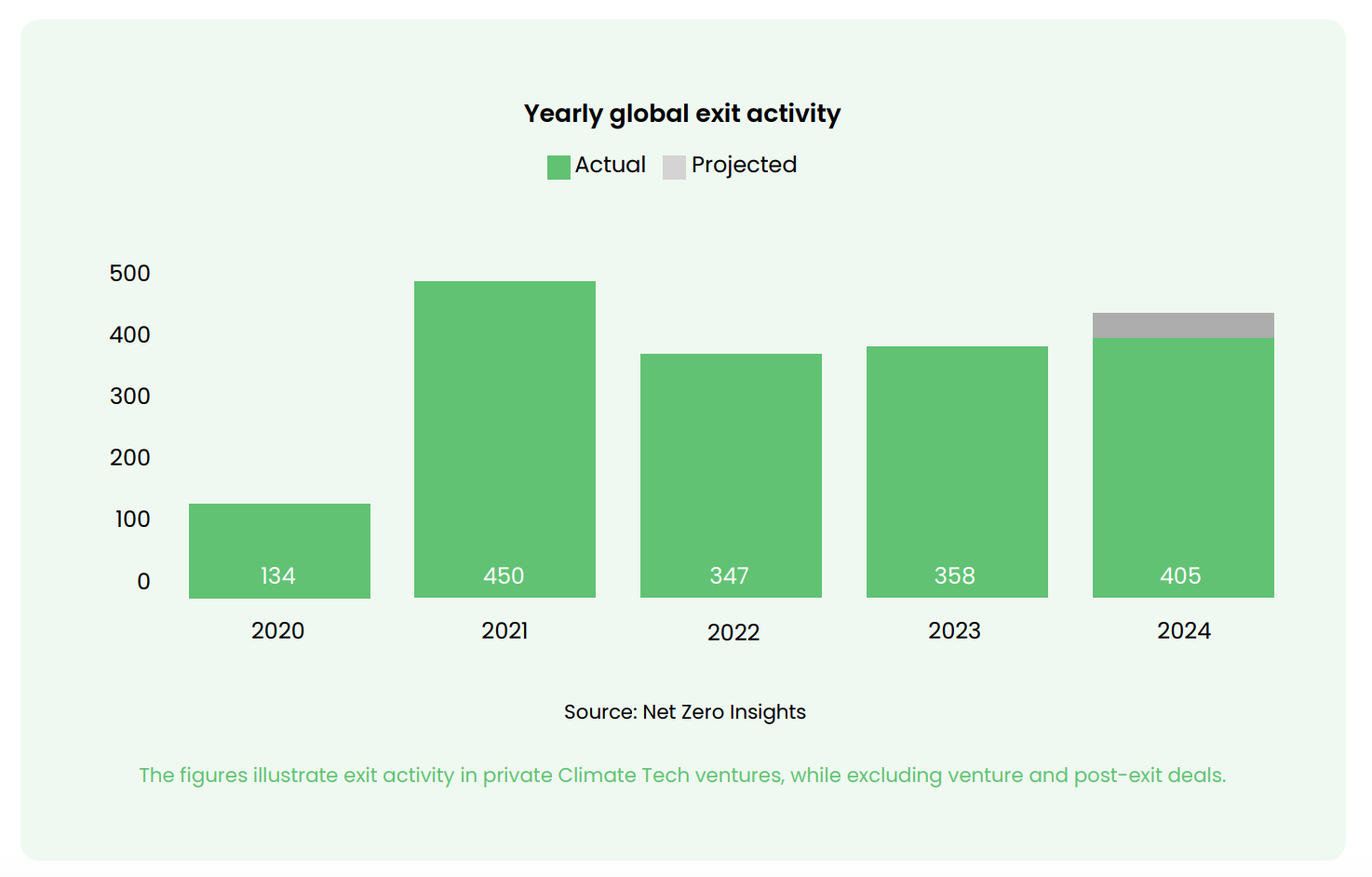

As part of our ongoing efforts at Startup Basecamp to provide valuable insights to the climate tech community, we’re excited to share a deep dive into the climate tech exits trends of 2024. This past year has been pivotal for the industry, signaling a steady maturation in a sector that continues to attract significant investor attention despite broader market uncertainties.

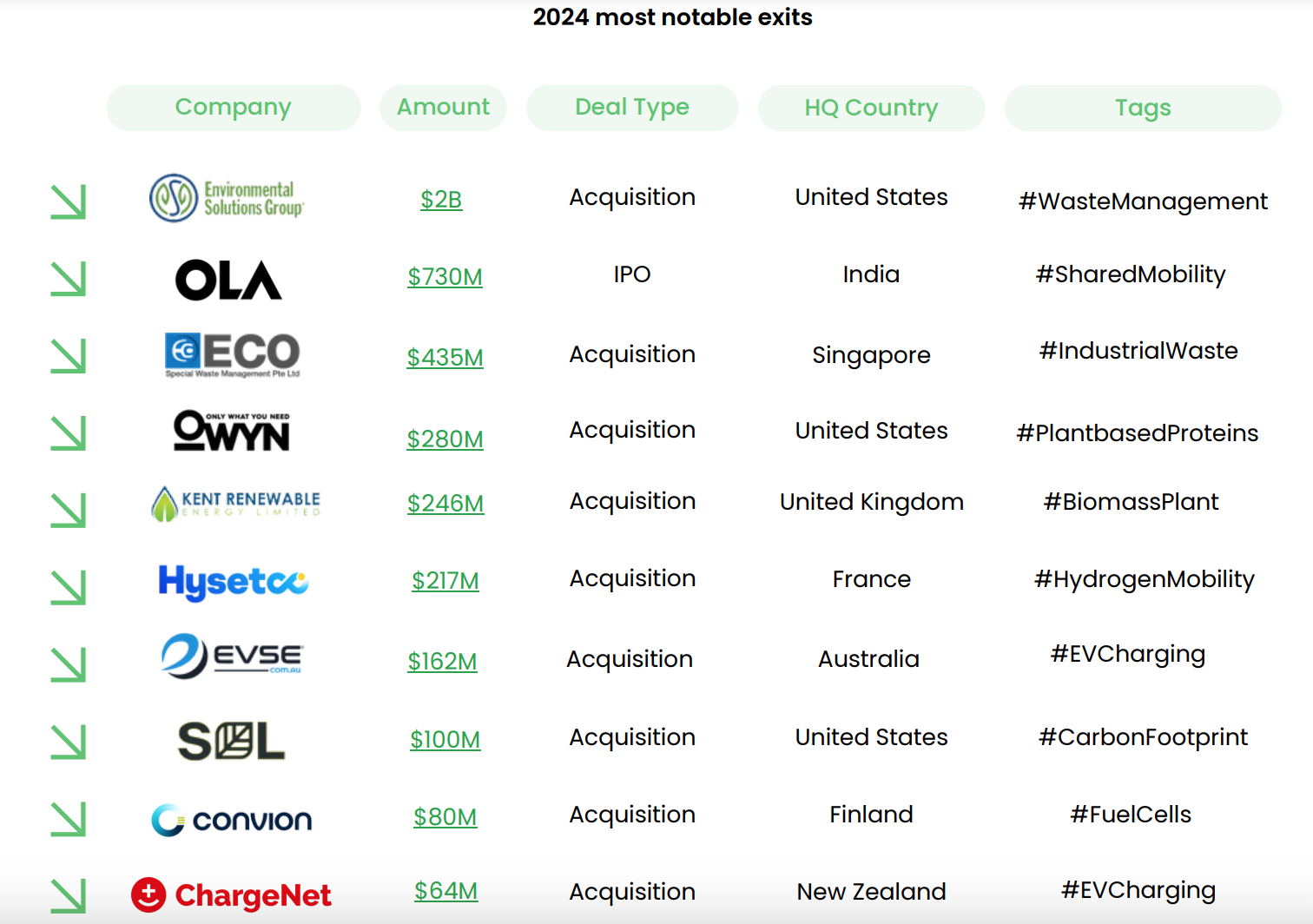

1. Key Climate Tech Exits in 2024

Below, highlighted list of some of the most impactful climate tech exits in 2024, focusing on their significance for the broader market.

2. Trends in 2024 Exits

Investors are prioritizing startups with proven scalability, particularly those addressing core climate challenges such as renewable energy, sustainable agriculture, and carbon capture.

The prominence of solar energy, EVs, and waste-to-energy solutions in 2024 exit deals underscores the maturity and scalability of these technologies. Solar energy remains central to global decarbonization, while advancements in EV charging infrastructure and batteries are accelerating the shift to sustainable transportation. These exits reflect strong investor confidence in solutions driving tangible climate impact and market readiness.

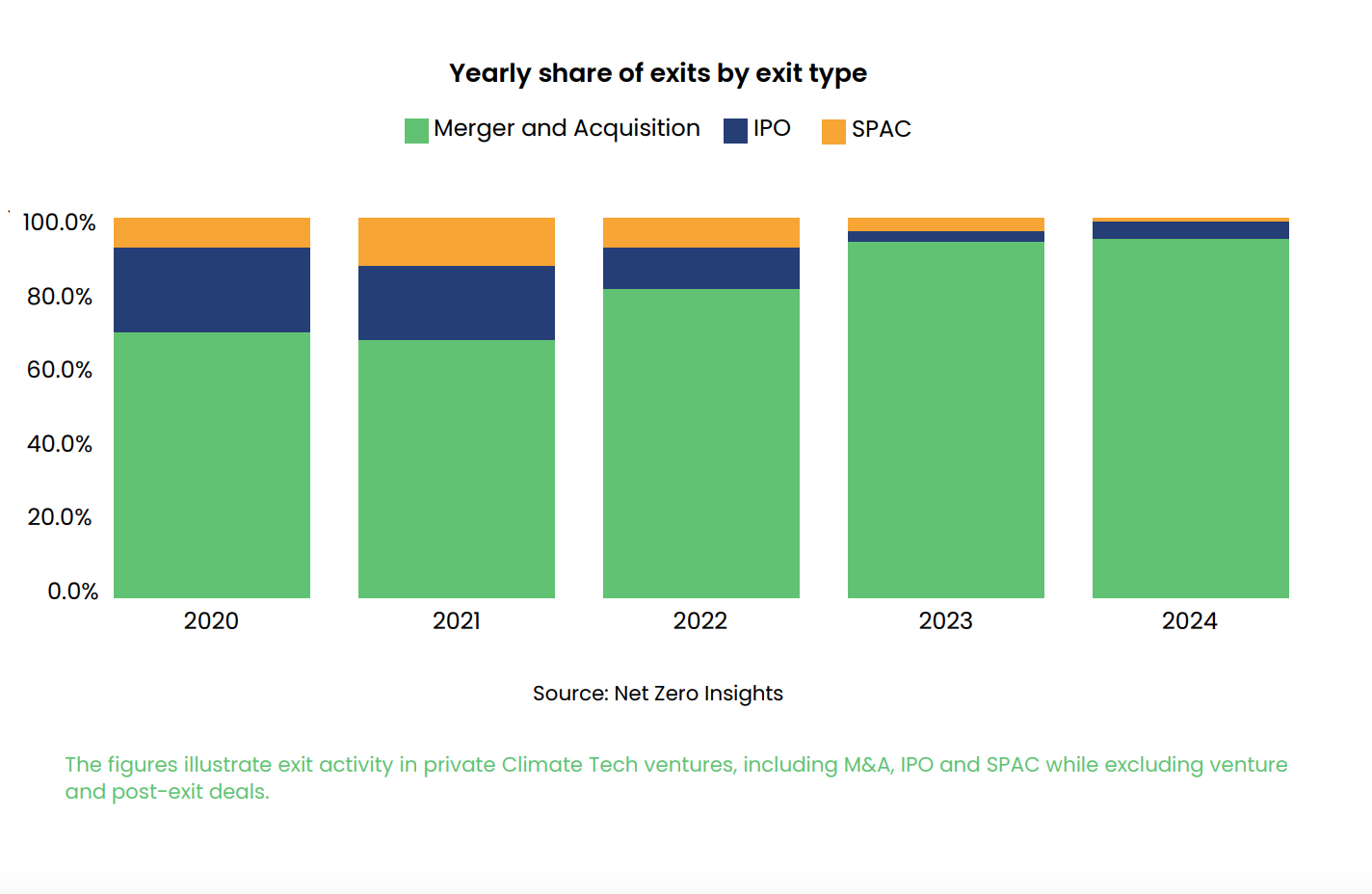

While IPOs remain an attractive exit strategy, mergers and acquisitions (M&A) are becoming more common. Large corporations are acquiring startups to accelerate their sustainability goals. In fact, M&A accounted for 95% of exit activity in 2024, with corporations driving 84% of these deals. This reflects rising market confidence and sector consolidation, driven by ESG integration, regulatory incentives, and corporate ambitions to lead in sustainability through innovative Climate Tech.

In 2024, Europe and North America led acquisitions activity, with Europe leading despite a slight decline and North America showing robust growth. Asia and Oceania are emerging as new hubs. Corporations increasingly dominate M&A, leveraging acquisitions to integrate innovative technologies and bolster their Climate Tech portfolios.

3. What This Means for Founders

- Scalability matters. Investors are looking for startups with the potential to scale quickly.

- Corporate partnerships can drive exits. Building relationships with larger companies can open doors for M&A opportunities.

- Focus on core climate challenges. Solutions addressing critical climate issues are more likely to attract investment and exit opportunities.