Mapping out Climate Tech Funding: 50+ VC's Across the EU & North America

Incase you haven’t heard, 2021 has been a great year for climate tech investing, and as we approach The UN’s Climate Change Conference, also known as COP26, its important to look at how funding climate technologies is, and must continue to be, included in our efforts to decarbonize.

Ecosystem Overview:

Research has found that “Climate finance needs to rise sharply to $5 trillion a year globally by 2030 to fund measures to fight climate change”.

In other words, we have no time to waste when it comes to funding efforts to achieve net-zero. We’ve looked at the rise in these investments during the release of our first two lists (found here & here) of the VC firms funding climate tech founders. If you’ve missed these, here are some of the key highlights that we looked at from the year:

- In the first half of the year VC-backed climate tech companies raised more than $14.2 billion worldwide (88% of the total for all of 2020) (Pitchbook)

- In the first half of 2021, climate tech startups raised ~$16b across ~250 venture deals (Climate Tech VC)

The Rise in Generalist VC's

There are plenty of firms out there funding urgent climate technologies, but it is important to note the number of generalist firms funding climate as well. In a Tech Crunch analysis of SOSV’s Climate Tech 100, they highlighted the most active and sizeable investments made into Climate technology by general VC’s (many of which we’ve included in this list). There have also been many notable investments into climate by more surprising, funds and firms (Which Susan Su shows here), a few of which exist outside of the EU and US and are important to keep on founders radar. What this funding tells us is that the work done by the ClimateTech community until this point has not gone unnoticed and is gaining traction in the mainstream. This is great news for the planet, and the founders & investors working on these solutions!

Where are Investors Based?

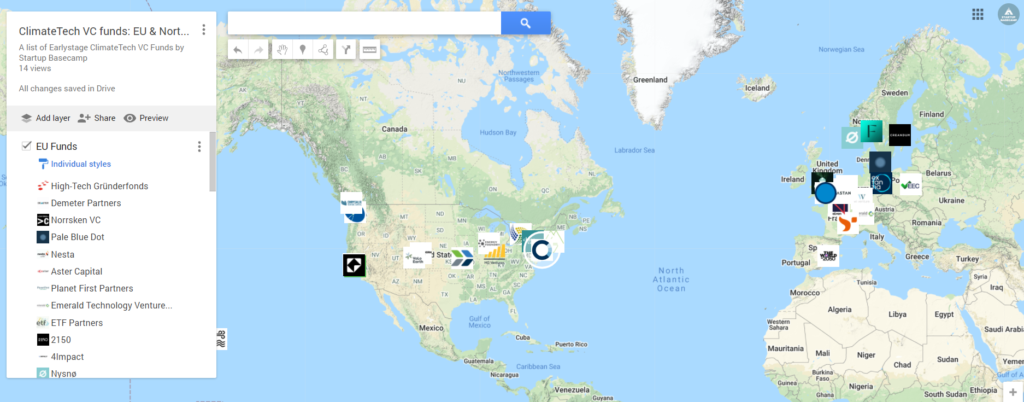

In the map below we have tracked some of the most active VC’s investing in climate technologies, both general, vertical and climate specific. Keep in mind that while this map only shows the head offices of the funds around the EU & North America, many have offices across the globe and invest internationally (for more information on this see the full database).

We hope to add to this list as more funds appear and we encourage you to add any funds or firms investing in climate tech to our running list in this form.

What's Next?

We Accelerate Capital Deployment To Climate Startups.

This resource from Startup Basecamp aims to support founders & investors by giving them access to networking opportunities that help them scale and finance their Climate Tech.

More than that, we are proud to announce the upcoming launch of our Investor/Founder Matching Platform, a service designed for members looking to access the individuals in their country, climate niche, and ideal stage. If you are interested early bird sign ups to this platform, we hope you get in touch with any comments or questions.

Request your Invite to our PRIVATE BETA:

Do not hesitate to join our collective movement by requesting your membership.

With Care,

The Startup Basecamp Team

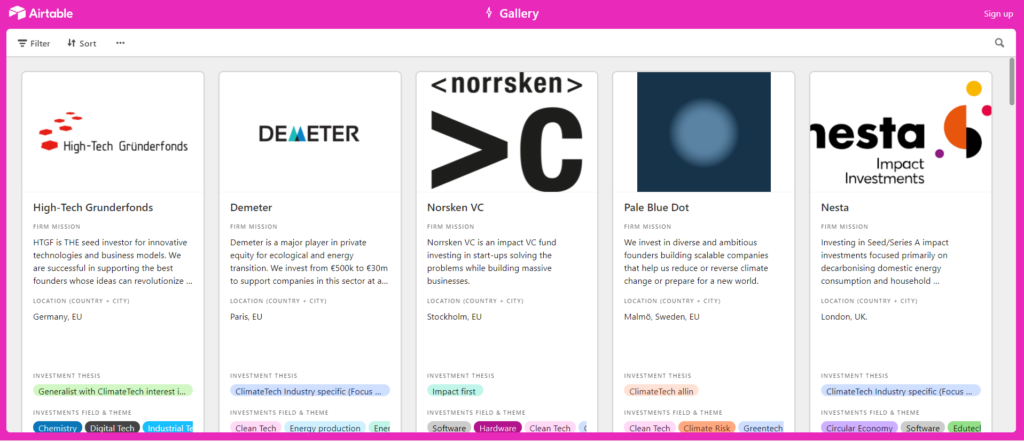

50+ Climate Tech Investors and VC's Database:

Below is a preview into some of 10 newest firms added to our running list database: For full access, request your Membership here

Mission:

Creandum is a European venture capital firm, focusing on innovative and fast-growing technology companies within the consumer, software, and hardware industries.

Over the last decade, the Creandum Funds have invested in more than 80 companies including Spotify, iZettle, Small Giant Games, Kry, and Depop. It seeks investments in early-stage andgrowth-stage companies and prefers to invest in technology companies operating in the consumer internet, software, and hardware sectors.

HQ Location: Stockholm, Sweden

Investment Thesis: ClimateTech Industry specific (Focus on specific vertical)

Investment Fields: Hardware, Software, Internet, Digital Tech

Region of Operations: EU & North America

Mission:

Closed Loop Partners is a New York based investment firm comprised of venture capital, growth equity, private equity, project finance and an innovation center. We invest in the circular economy, a new economic model focused on a profitable and sustainable future.

The circular economy is the most significant restructuring of global commerce since the industrial revolution. It is an overhaul of how products are designed, manufactured, sold, refurbished and recycled. It is a framework for global corporations and start ups alike to reimagine capitalism in order to reduce costs, increase efficiency, and protect the environment we share. It is a platform to amplify opportunities for growth in a natural-resource constrained world.

HQ Location: New York

Investment Thesis: ClimateTech Industry-specific (Focus on specific vertical)

Investment Fields: Circular Economy, Recycling Technologies, Supply Chain, Foodtech, AGtech, Fashion

Investing in Stages: Early Stage

Region of Operations: North America

Mission:

Astanor Ventures – where tech meets nature – is an impact investor that backs ambitious entrepreneurs in Europe and beyond with disruptive, scalable solutions that will create systemic change across the agrifood value chain, from soil to gut. We partner with founders that are committed to restoring balance and sustainability to the land and oceans, prioritising nature and culture, nurturing change and feeding growth.

HQ Location: Belgium

Investment Thesis: ClimateTech Industry-specific (Focus on specific vertical)

Investment Fields: Foodtech, Ocean Technologies, AGtech

Investing in Stages: Early & Late/Growth Stage

Region of Operations: EU & Global

Mission:

Sequoia helps daring founders build legendary companies from idea to IPO and beyond. We spur founders to push the boundaries of what’s possible. In partnering with Sequoia, companies benefit from 48 years of tribal knowledge from working with founders like Steve Jobs, Larry Ellison, Larry Page, Jan Koum, Brian Chesky, Drew Houston, Adi Tatarko, Julia Hartz and Jack Dorsey. In aggregate, Sequoia-backed companies account for more than 25% of NASDAQ’s total value.

HQ Location: California

Investment Thesis: Generalist with ClimateTech interest if a good fit

Investment Fields: Energy, Fintech, Health, Internet, Mobile

Investing in Stages: Early & Late/Growth Stage

Region of Operations: Global

Mission:

Chloe Capital is a seed-stage venture capital firm that invests in women-led innovation companies. According to Chloe Capital, only two percent of female founders receive venture capital funding, with only .2 percent going to African American founders. Their mission is to travel across the US and move capital into the female founders they find.

HQ Location: New York

Investment Thesis: Impact First

Investment Fields: Tech & Tech Aligned

Region of Operations: North America

Mission:

Founders Fund is a San Francisco based venture capital firm investing in science and technology companies solving difficult problems. The firm invests at all stages across a wide variety of sectors, including aerospace, artificial intelligence, advanced computing, energy, health and consumer Internet. The firm and its partners have been early backers of some of the most impactful companies of the past decade, including Airbnb, Facebook, Palantir and SpaceX. Founders Fund pursues a founder-friendly investment strategy, providing maximum support with minimum interference. Formed in 2005, the firm has more than $3 billion in aggregate capital under management.

HQ Location: San Francisco

Investment Thesis: Generalist with ClimateTech interest if a good fit

Investment Fields: Transportation, Aerospace, BioTechnology, Advanced Machines & software

Investing in Stages: Seed, Early Stage, Late Stage

Region of Operations: North America

Mission:

For five decades, Kleiner Perkins has made history by partnering with some of the most ingenious and forward-thinking founders in technology and life sciences. Through twenty venture funds and four growth funds we’ve invested $10 billion in hundreds of companies including pioneers such as Amazon, Genentech, and Google. Today, Kleiner Perkins continues to help founders and their bold ideas make history investing in companies like Desktop Metal, IronNet, Ring, Spotify, Slack, and UiPath.

HQ Location: California

Investment Thesis: Generalist with ClimateTech interest if a good fit

Investment Fields: Digital Tech, Life Sciences, Health

Investing in Stages: Incubation, Early & Late/Growth Stage

Region of Operations: North America & Asia

Mission:

Potential Climate Ventures helps to find, foster and fund innovative startups to have a global and gigaton-scale impact on the climate.

HQ Location: England

Investment Thesis: Climate Tech aligned

Investment Fields: Climate Tech, Clean Tech

Investing in Stages: Early Stage

Region of Operations: EU

Mission:

The vision of wi venture is to make our energy supply, mobility and agriculture sustainable. To do this, we support startups that share our vision.

Together we are driving the change that gives everyone access to sustainable basic services. On this basis, we bring growth and prosperity into harmony with a healthy ecosystem.

HQ Location: Germany

Investment Thesis: Climate Tech aligned

Investment Fields: AGtech, Mobility, Energy

Investing in Stages: Early Stage

Region of Operations: EU

Mission:

The Zero Carbon Fund is an EIS fund investing in early-stage companies on a mission to address climate change through hard tech innovation. We’re looking for awesome teams with breakthrough ideas that could scale to reduce greenhouse gas (“GHG”) emissions by half a gigaton per year.

HQ Location: Havant, England

Investment Thesis: Climate Tech aligned

Investment Fields: AGtech, Mobility, Transportation, HVAC, Carbon Capture & Storage

Investing in Stages: Early Stage

Region of Operations: EU

The database is accessible to the members of our community as part of other exclusive content we provide to them. Learn more about the membership options here.