With a flurry of global companies facing pressure from both consumers and governments to improve climate performance, carbon offsetting is experiencing a colossal surge. It is viewed as a cheaper, and easier method for companies to become ‘carbon neutral, and in doing so mitigate emissions related to products or services that could enable carbon offset prices to grow more than fifty-fold by 2050 (and reach total market forecasts of $100bn by 2030.)

Starting with the basics, carbon offsetting refers to a way of balancing the scales of pollution, this means reducing or removing CO2 emissions to compensate for emissions made elsewhere.

Whether at the discretion of one person or legally enforced within the carbon offsetting compliance or voluntary markets, these markets enable individuals or organizations to offset greenhouse gas emissions (GHG) by investing in environmental projects. These projects can range from renewable energy projects and tree planting schemes to paying companies to capture carbon from the atmosphere. In exchange for these acts, investors can earn carbon credits.

Yet, a sharp divide for the sector remains. Skepticism of how carbon offsetting works and how it can truly revert the climate crisis continues to flourish. This includes finalizing details and dates around the global voluntary carbon offset markets’ new “definitive set of global threshold standards”.

Prices for carbon offsets equivalent to one ton of carbon each could be as high as $120/ton in 2050 according to BloombergNEF.

Business as Usual

Company offset initiatives have been widely criticized for carbon accounting issues, their longevity, and negative impacts on local communities, with many claiming that carbon offsetting allows companies to justify business as usual activities. This is because the initiatives allow companies to offset carbon instead of prioritizing in-house emissions reductions and could lead to double-counting carbon credits, or investing in non-verified credits. These practices have been likened to “papal indulgences”, referring to developing nations’ attempt to absolve environmental offences in the same way middle age Catholics paid the church to eliminate their sins.

“This is because the initiatives allow companies to offset carbon instead of prioritizing in-house emissions reductions and could lead to double-counting carbon credits, or investing in non-verified credits.”

It is also an issue exacerbated by companies purchasing cheap offsets. Most clean energy offsetting projects occur in developing nations, where carbon reduction per marginal dollar is much higher. Offsetting offers a pathway for wealthy companies to subsidize renewables in places where local politicians prioritize rapid development over environmental concerns. This is marked by critics to be driving colonial-style land grabs and causing deeper ecosystem destruction.

Many carbon offset programs, even those well-established such as the United Nations’ REDD+ program, have been criticised for failing to deliver on promises. Image: Sourced (Chennawit Yulue, Pexels)

Delivering Offsetting Results

Positive results of offsetting projects are crucial. The Finland-based non-profit Compensate found that 90% of offsets fail to deliver or come with damaging side effects for local communities. Similarly, The Indigenous Environmental Network and Indigenous Climate Action state that offsetting is “a false solution that… gives polluters an excuse to continue polluting.”

Some argue that even if carbon offsetting projects do work, governments should be funding the projects and companies should focus on reducing their carbon footprints themselves.

It is a deep concern that carbon offsetting is being used to cover a continuing reliance on fossil fuels, and allows carbon to continue to enter the atmosphere off the ledger for both governments and companies. Because of this, it is becoming increasingly important that we not only change our practices, but also change our behavior.

The Compensate team and its advisers consist of climate change experts, business leaders, an independent panel of scientists, and more, all of who work together to ensure transparent, sustainable carbon removal. Image: Sourced (Compensate.com)

Rigorous Standards

Primarily, companies should only purchase carbon offsets after initially exhausting all other options to reach ‘net zero’ status.

To help replenish the integrity of the voluntary carbon offset market, it is also crucial to standardize and regulate the carbon accounting and quality control of emissions. The voluntary carbon offset market not only needs to have rigorous standards, but also needs to become a lot larger.

As of now, there are only a limited number of carbon offset registries. This includes only four registries in the US: Verified Carbon Standard or Verra; The Gold Standard, The American Carbon Registry, and the Climate Action Reserve. All are non-profit and non-governmental organizations.

Current Carbon Market Setbacks

In 2020, Mark Carney, UN special envoy for climate action and finance, and Bill Winters, CEO of the Standard Chartered Bank, launched a private-sector task force to unify standards and expand financial instruments for the carbon market.

The Voluntary Carbon Market Integrity initiative (VCMI) that emerged from Carney’s task force stated that voluntary carbon markets “are only going to have that kind of impact if they are truly high-integrity and inclusive. And therein lies the rub.”

However, the taskforce targets to increase the size of the market and promise of a pilot market this year have both been discarded. The taskforce has been embroiled in disagreements over a clear exchange and standard path for the voluntary carbon market as unable to deliver a ‘core carbon principle’ that could be used to mark offsets and meet its standards.

Startups Filling the Carbon Offsetting Gap

Building on the back of increased corporate demand to reduce their carbon emissions, startups have enormous potential in helping bring quality control/credibility to existing offsetting practices, and hopefully one day prevent the need to offset carbon entirely through the use of successful CCUS technologies.

To target the accounting/credibility gap carbon offsetting platforms are becoming increasingly relevant in ensuring offsetting transactions are compensating real, impactful projects by rating these carbon offset projects. This is similar to how the carbon accounting space is starting to enable companies to disclose and reduce carbon pollution, specifically, to disclose all three vital Greenhouse Gas (GHG) protocols of Scope 1, 2, and 3 emissions.

Below are some start-ups who who are grasping the opportunity and leading the way in managing carbon offsetting, or supporting companies to account for their emissions.

Successful Startups working in Carbon Offsetting and Accounting

1. Sylvera

Location: London, UK

Funding Type: Series A

Funding: $39.5M

About:

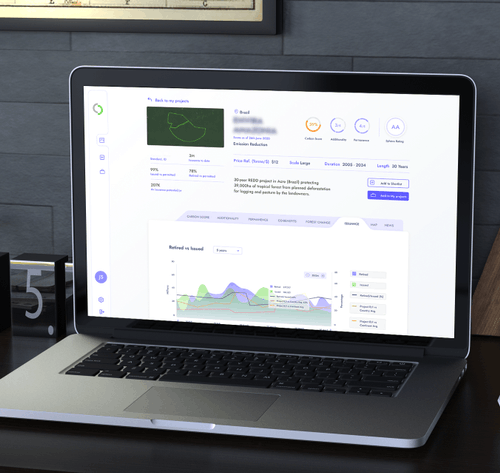

Founded in 2020, Sylvera develops machine learning-based tools to track the performance of nature-based carbon offset projects. This covers data such as raw carbon performance, additionality, permanence, co-benefits, and risk.

The London-based start-up uses proprietary data and machine learning to produce accessible insights and market intelligence on carbon projects, delivered through an online platform.

Unlike other players in the carbon offset marketplace, Sylvera does not sell carbon offsets, making its rating free from conflict of interests. The company’s ratings are available to its customers through a web application and via an API.

2. Pina Earth

Location: Munich, Germany

Funding Type: Pre-Seed

About:

Founded in 2021, YC-backed Pina Earth is aiming to tackle problematic incentives around carbon offsetting projects by building the first ever suite of digital tools that enables forest owners to receive financial rewards and connect with carbon credit buyers.

As well as this, the platform gives landowners the necessary tools to facilitate carbon output quantification of each project by digitizing the manual certification process, aided by remote sensing and artificial intelligence.

Led by CEO Dr. Gesa Biermann, Pina Earth hopes to increase the speed and quality of carbon credits from forestry by making it as easy as possible for forest owners to be rewarded for the ecosystem services they provide.

3. Plan A

Location: Berlin, Germany

Funding Type: Series A

Funding: $15M

About:

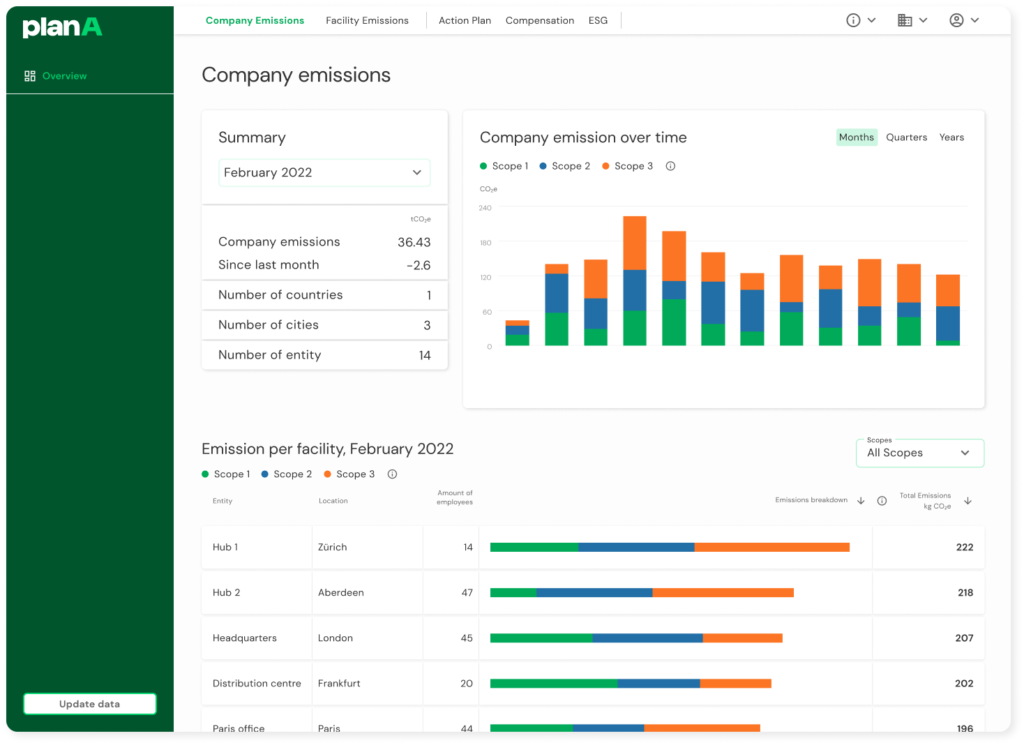

Founded in 2017, Plan A is a GreenTech company that developed a science-driven certified SaaS platform for automated carbon accounting, decarbonization, ESG management and reporting.

Its clients range from big corporations like BMW, Société Générale and Trivago to fast-growing startups like on-demand grocery startup JOKR.

4. eAgronom

Location: Tartu, Estonia

Funding Type: Series A

Funding Raised: $10.5M

About:

Founded in 2017, eAgronom was initially a farm management software solution for grain growers to improve their record-keeping, organize their tasks and plans, and analyse their seasons.

Since their latest round of funding, eAgronom has pivoted the majority of its business and developed a farming-based carbon credits platform to transform the voluntary offset market.

It currently has 1,500 agribusinesses clients that cover more than a million hectares of arable land across Europe.

5. Supercritical

Location: London, UK

Funding Type: Pre-seed

Funding Raised: £2M

About:

Founded in 2021, Supercritical’s software helps businesses to measure, reduce and offset climate impact in weeks to ultimately offer an actionable plan with a matrix of viable solutions to achieve net-zero goals.

Supercritical focuses on effective carbon removal offsets and provides companies with a number of carbon removal projects that act as a marketplace. The startup already has a list of early clients, including accuRx, Faculty, Tide and what3words.

Final Thoughts

As the world enters a new era of ‘conscious capitalism’, it is fundamental for companies of all sizes to acknowledge the need to prioritize eliminating carbon emissions rather than relying on poor offsetting practices. To do this, governments need to increase pressure on companies to explore all options for embracing the energy transition while living up to net-zero pledges.

If government institutions are unable to regulate carbon offset markets properly, start-up innovation will increasingly act as the best means we have for developing tools and technology to address climate change. Hence, it is fundamental that funding reaches technologies focused on carbon offsetting and capture technologies before we become over reliant in the grey carbon offsetting zone.