Investment Opportunity

Climate Alliance

£300k Allocation - £200k Committed So Far...

Fusion energy propulsion to aircrafts

Investment Memo

AeroFuse

Deal Details:

Stage:

Pre-Seed

Round Size:

$1M

Valuation:

$7M

Allocation:

$100k until 30 April 2024

Minimum:

£5K

Technology Readiness Level (TRL):

3 (Experimental proof of concept)

Location:

USA

Closing in:

February 2024

The Highlights:

🚀 UK-based and Y-Combinator startup backed by some of the best VCs in climate tech (Lower Carbon Capital, Climentum (Lead), & more).

🦄 Booked $1M in revenue so far, pipeline of 54 projects (incl. 9 mega-projects in partnership with Bühler) worth over $400M.

🏆 Following a $5M Series A round in 2023, Entocycle surpassed the initial Series A+ target, extending it to $2M, with $1.7M already allocated.

1. What is their mission?

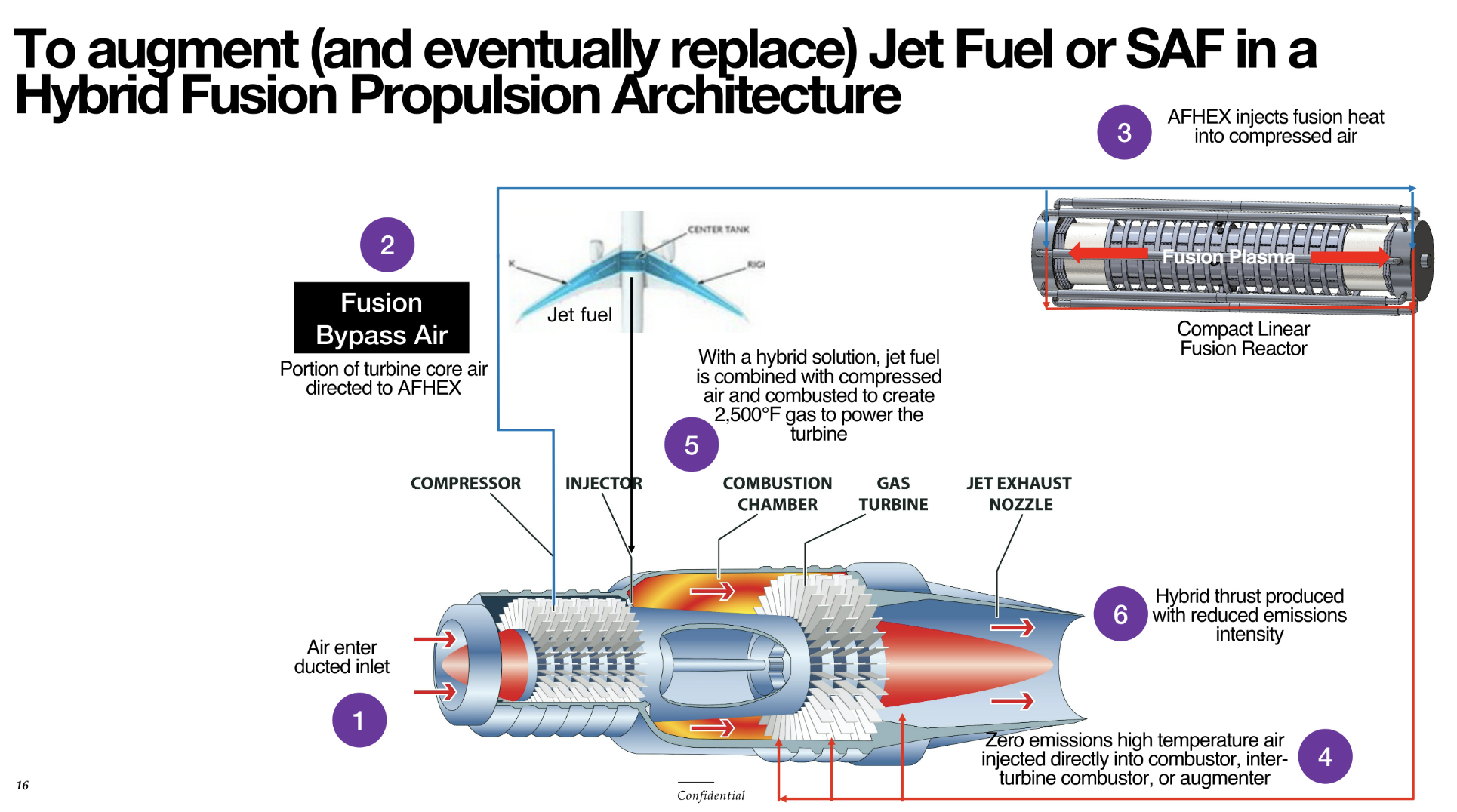

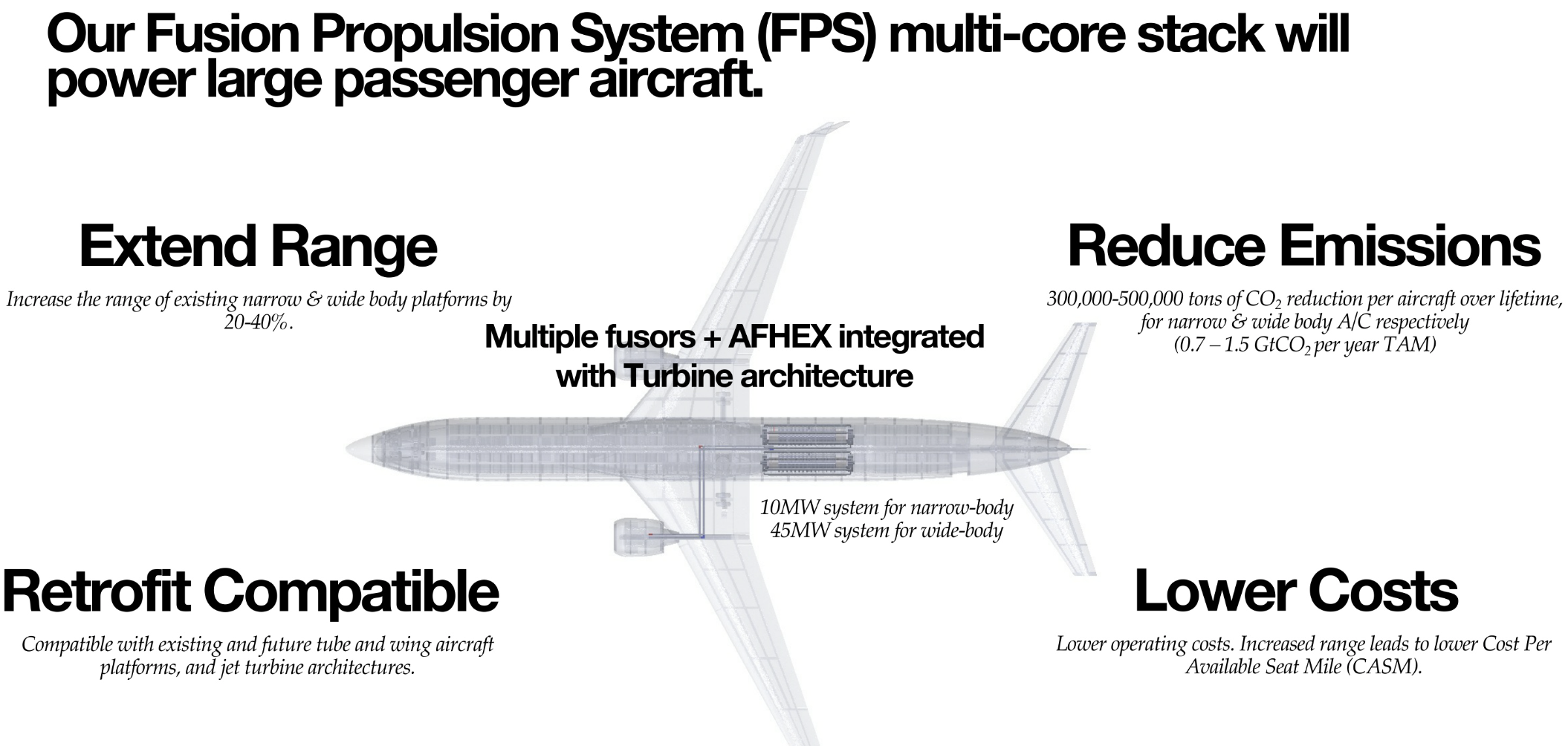

Bringing zero-emissions propulsion to narrow-body & wide-body aircraft without the green premium.

2. What problem are they working on?

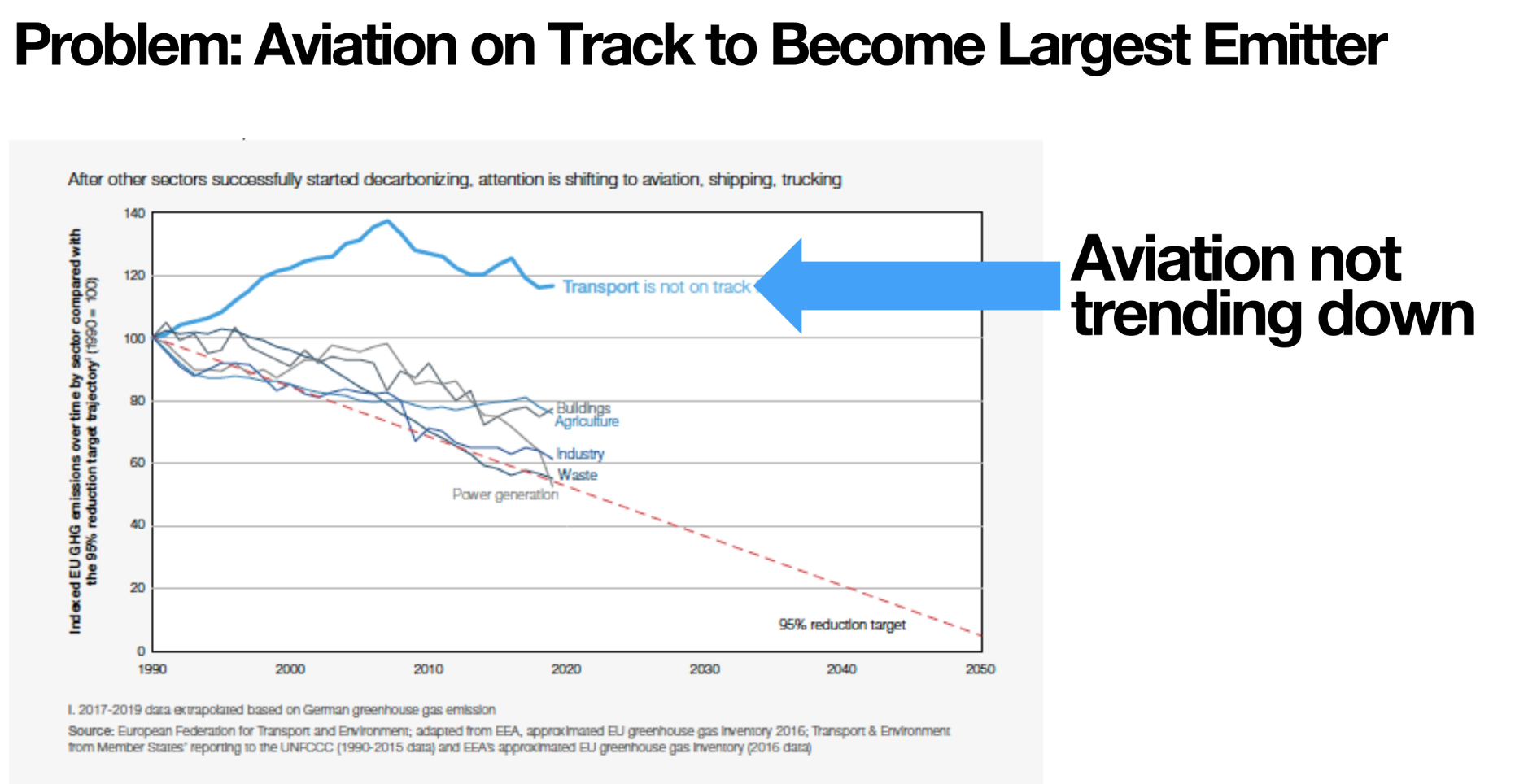

The aviation industry is currently not on track to decarbonize and reach the Net Zero 2050 targets.

Medium and long-haul aviation (combined responsible for ~73% of emissions) is inadequately addressed by the current and emerging set of sustainable fuels (i.e. SAF, hydrogen) and sustainable technologies (batteries & fuel cells), and will have to be offset as a result.

3. How does their solution represent a groundbreaking innovation?

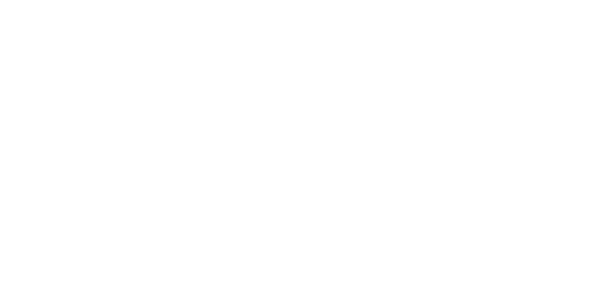

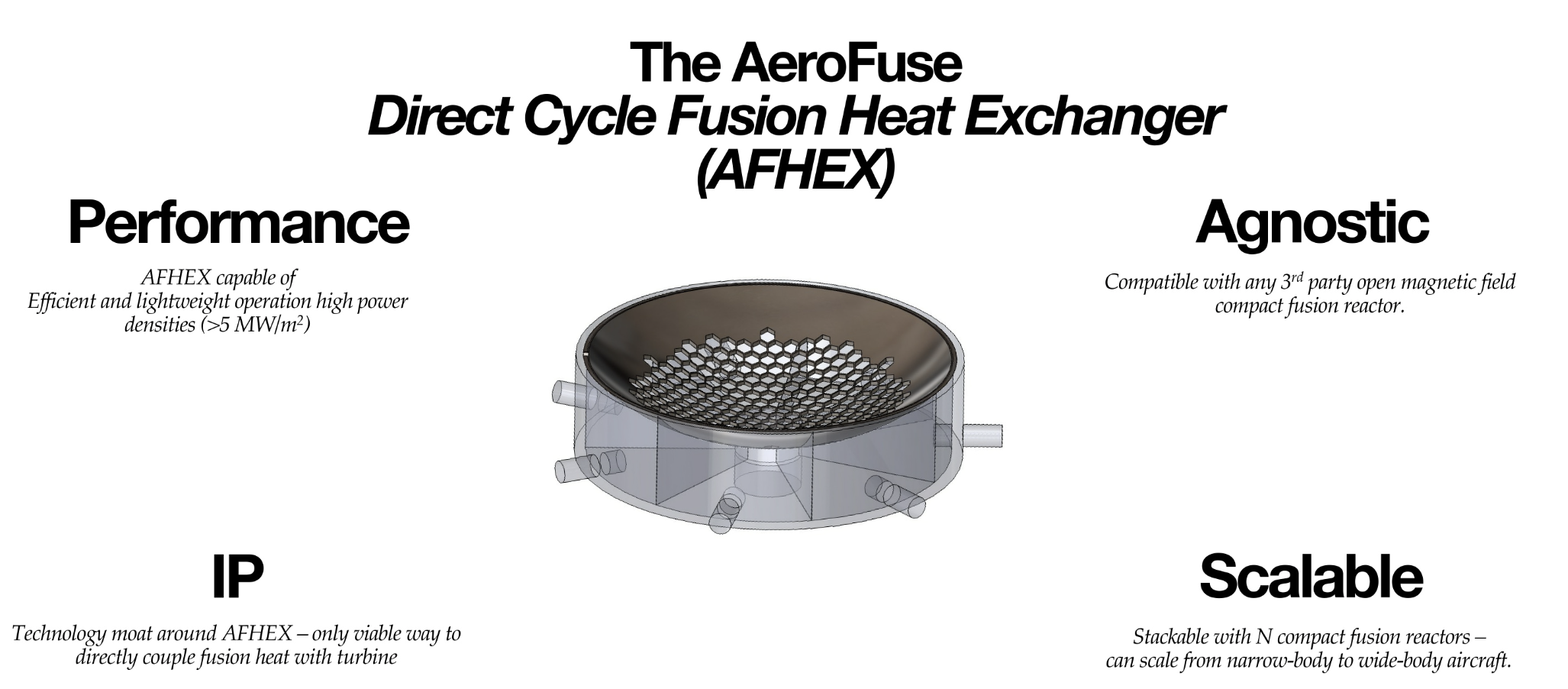

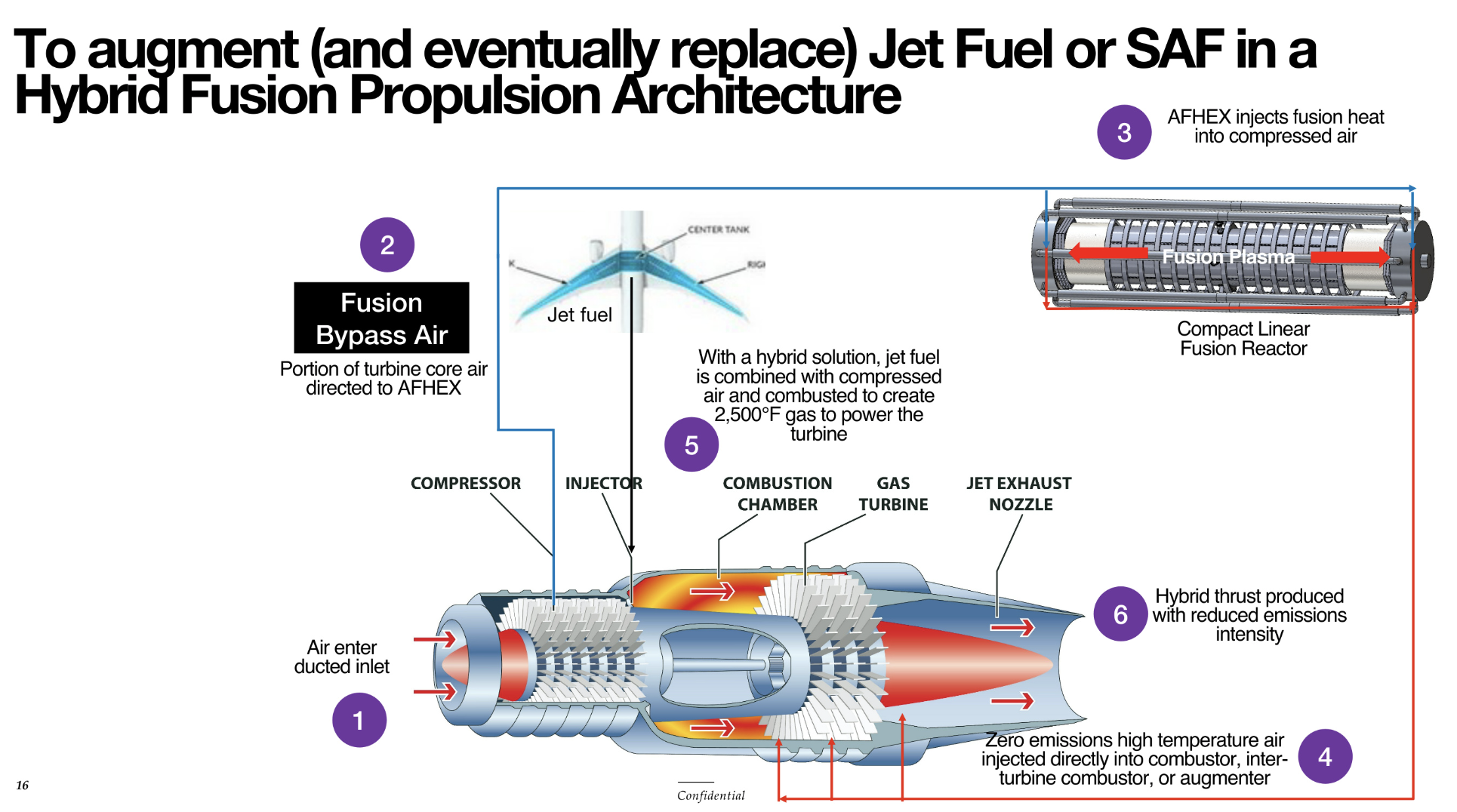

AeroFuse’s core innovation is to develop the heat exchanger technology to efficiently extract heat energy from fusion plasmas and integrate this process into existing gas turbine engines.

The technology will be available as a retro-fit and line-fit solution, and our approach maximizes the re-use of existing turbine technology and existing tube and wing aircraft architectures.

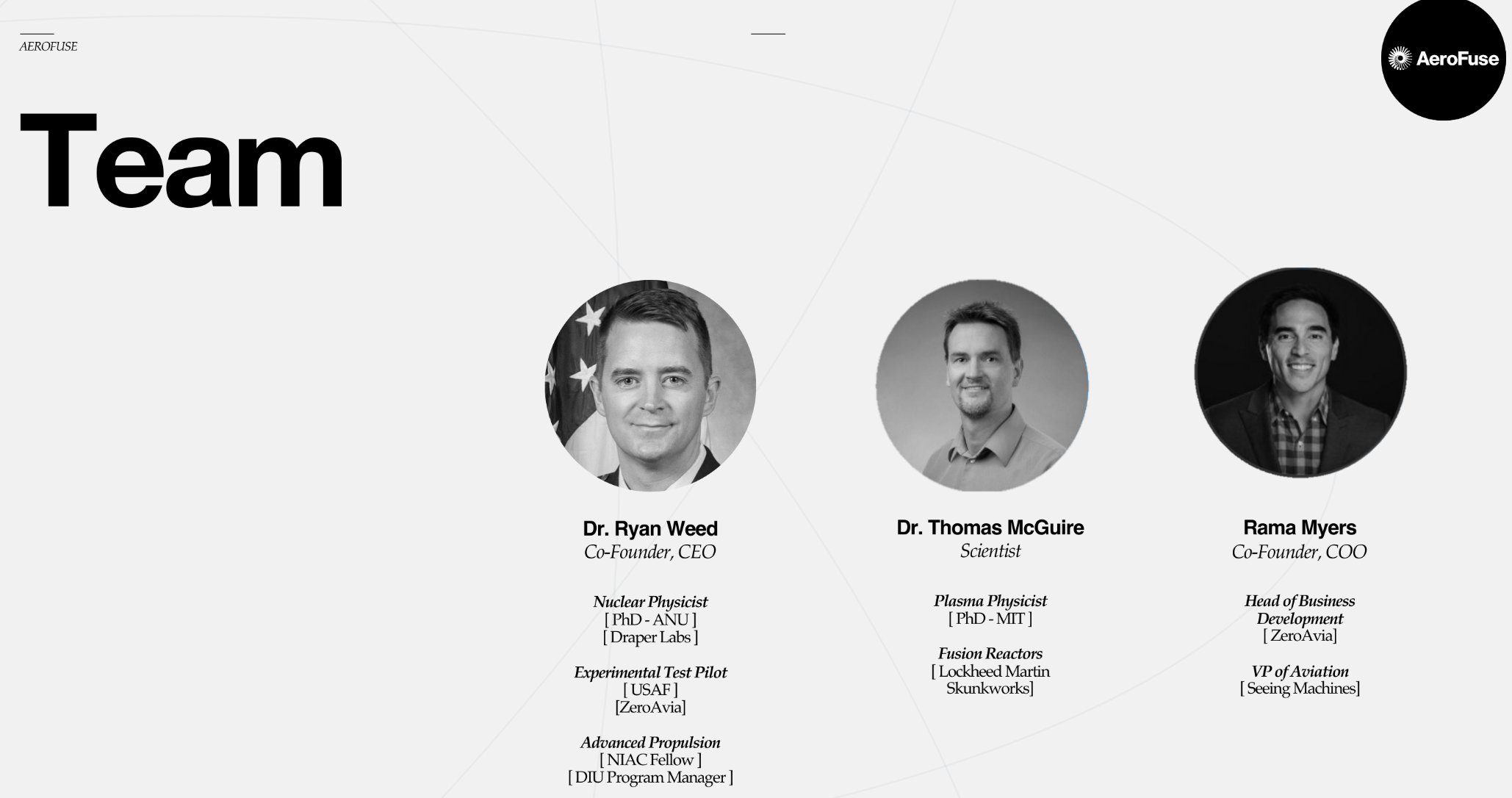

4. What sets the team apart?

AeroFuse’s groundbreaking endeavour is led by an ambitious and highly skilled team seeking to disrupt the airline industry with a line up of leading advisors to support their journey.

Co-founder & CEO

- Previously a USAF Test Pilot.

- Positron Dynamics Co-Founder, Blue Origin Engineer, NASA Innovative Advanced Concepts Fellow, PM at DIU, and Nuclear Scientist at Draper Labs.

- Physics PhD at the Australian National University and BS, Engineering at Colombia University.

Co-founder & COO

- Previously Head of BD for ZeroAvia (sold $1B of hydrogen-electric powertrains).

- VP of Aviation at Seeing Machines (developed pilot state monitoring market and licensed technology to Collins Aerospace).

- Principal at Climate Capital.

AeroFuse Advisors

5. What is their business model?

AeroFuse is still iterating on our business model based on customer and partner feedback, however our current baseline business model is to sell a Fusion Propulsion System (FPS) retrofit kit (includes fusion cores, heat exchanger technology and retrofit), as a “zero emissions” range extender to augment existing fuel.

The system will be sold with a 10% annual maintenance and fusion fuel cost, and will be be competitive with today’s jet fuel costs (NPV neutral), and cost superior to SAF.

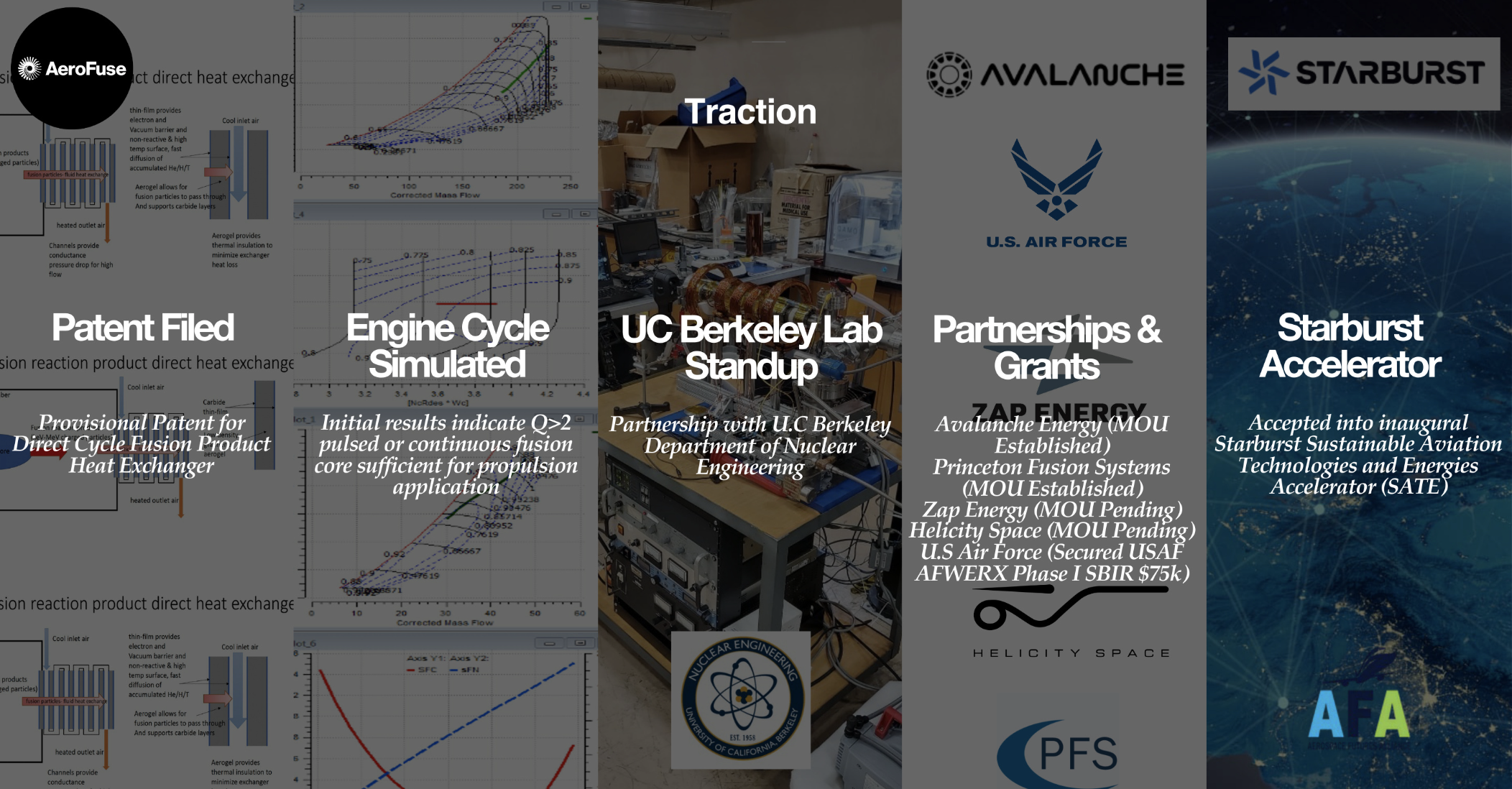

6. What is their traction so far?

Traction with 4 x aircraft OEMs (Airbus, Boeing, Embraer, Northrop Grumman) and 7 x airlines.

All these companies are concerned that SAF will remain too costly for the industry to decarbonize and will have a limited impact on airlines’ scope 1 emission, and hydrogen and batteries will not be a solution to decarbonize large conventional aircraft Won & delivered AFWERX Phase 1 SBIR Air Force Operational Energy leadership has agreed to sign an MOU in support of our AFWERX SBIR Phase 2 application.

7. Who are their competitors?

Fusion augmented propulsion system will be cost competitive or cheaper than Kerosene, and several multiples cheaper than SAF (Twelve, Air Company, Neste), while offering reduced emissions.

Furthermore, fusion propulsion will meet the energy density requirements for medium and long haul aviation, whereas hydrogen (ZeroAvia, Universal Hydrogen) and battery (Ampaire, Heart Aerospace) propulsion will be limited to commuter and regional aviation, along with some range constrained short haul aviation.

8. What is the defensibility and unfair advantage?

Fusion fuels are millions of times more energy dense than jet fuels, which is an unfair advantage for propulsion.

AeroFuse has 4 x provisional patents covering the itengration of fusion cores with our heat exchanger, and interfacing this system with a gas turbine.

AeroFuse’s heat exchanger will be thin enough to be transparent to fusion charged particles, lightweight, robust enough to withstand extreme temperatures and pressures, and operate at high power required to meet aviation requirements.

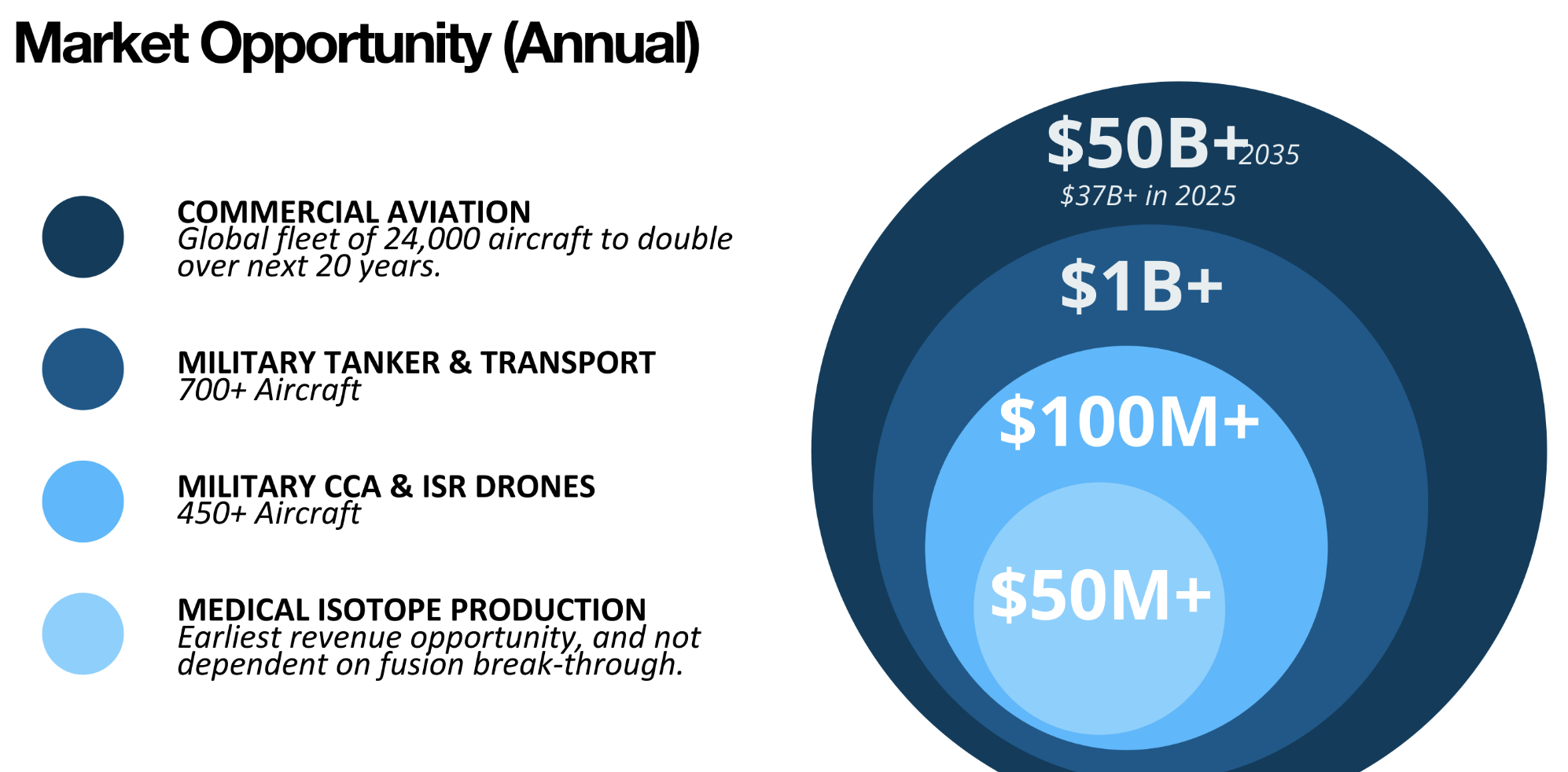

9. What is the estimated market size for the startup's target market?

AeroFuse’s technological has a large estimated market across the aviation industry:

- TAM $15.4B

- SAM $4.7B

- SOM $1.89B

10. How does the company effectively mitigate both market and technological risks in their strategy?

Technological Risk:

The largest technical risk is the reliance on compact fusion reactor as our energy source.

AeroFuse is mitigating this by building an agnostic heat exchanger technology which allows us to diffuse this risk across a dozen possible suppliers.

Regulation Risk:

Safety and regulatory risk are mitigated by using non-radioactive/aneutronic fuels, and by establishing early collaborations with FAA CECI.

To address public acceptance risk, AeroFuse plans to leverage the Fusion Industry Association (FIA) & Govt messaging & positioning.

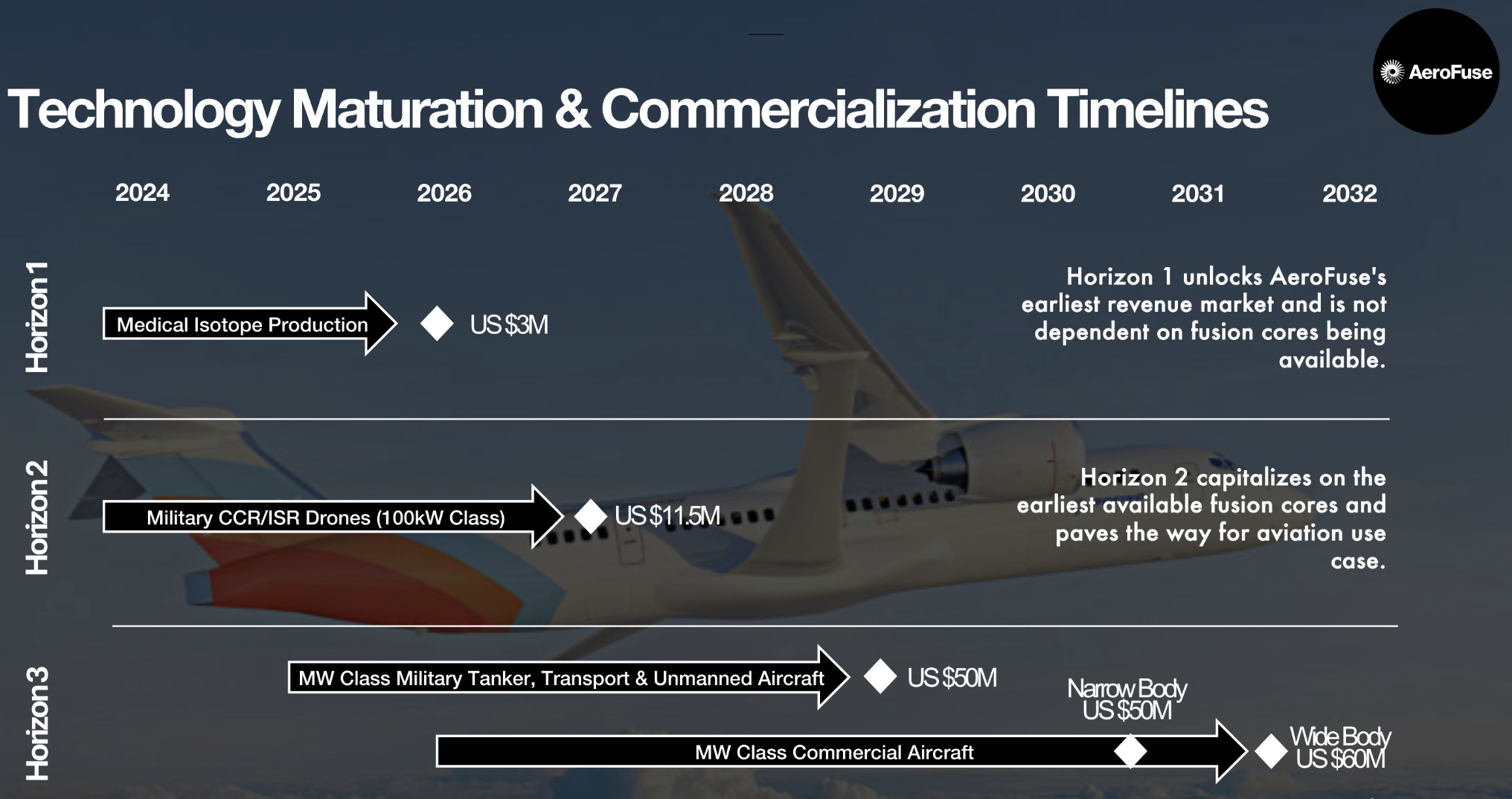

11. What’s the roadmap to scale?

We will scale through technology licensing & engine/airframe OEM partnerships.

Once the core capability has been proven in flight c.2026 in a unmanned military drone (manned military & commercial flight demonstrators c.2027-28),

Furthermore, AeroFuse will establish Joint Development Agreements (JDA) & licensing agreements with one or more engine OEMs to produce a FAA certified product, which we will distribute globally through a network of Maintenance, Repair & Overhaul (MRO) partners for aircraft conversions.

12. What are the key points towards their next fundraising round?

AeroFuse is raising $1M to manufacture & demonstrate (in representative environment) our Direct Cycle Fusion Heat Exchanger.

In addition, pre-seed objectives include:

– Secure IP (convert 4 x provisional patents)

– Mature supply chain & establish MOUs with 2x fusion suppliers

– Customer / Market Development:

– Secure AFWERX Phase 2 grant ($1.25M) – Establish MOU with an engine OEM and/or airframe OEM

– Establish MOU with medical isotope production partner (first revenue opportunity from 2026)

13. Who else is investing in the deal?

Pre-Seed SAFE ($250k left) investors include:

– IAI Catalyst $200k

– Angels $25k

– Climate Capital $10k

– Interflight Global Capital has committed to $500k (closing Q2 2024)

14. Why now?

Here are the key factors contributing to the company’s potential success:

In 2022, LLNL’s National Ignition Facility (NIF) conducted the first controlled fusion experiment in history to reach fusion ignition, a milestone also known as scientific energy breakeven.

Although commercial scale fusion power plants are a decade away, $6B in private capital has now been deployed in companies/R&D.

AeroFuse has identified several of the leading compact fusion suppliers who are iterating rapidly & will likely produce engineering break even devices within the next 2-3 years.

FAQ - Alliance Members

Direct sourcing & Referral Deals: While inbound are strong numerous investors and players collaborate with us by sharing exceptional startups. We screen over 100 companies per month & select only on average 3-4 companies fit our thesis criteria.

Only VC’s lead deals will be presented to the Climate Alliance.

On average, we structure 1 deal per month for our Investors Alliance that includes a deadline for each deal.

The minimum investment amount is €10k per ticket. However, it is the sole discretion of each accredited investors to decide if the investments fits their personal criteria for investments.

No, our Climate Investor Alliance is invite-only for qualified and accredited, ensuring top-quality investors collaborate within an exclusive network.

- 0% Management Fees

- 20% Carry

- SPV Costs pro-rated to deal participants

- €99 (Eur.) Monthly Climate Alliance Club membership fee

We encourage investors to also perfom direct investments with the company if the founders find it a fit.

A Special Purpose Vehicle (SPV) is set up for each investments via the platform regulated Kapital. This SPV serves as a dedicated legal entity tailored for managing and executing the fund’s specific investments.

More about the “Kapital Platform” or “Platform”. The Platform is operated by HackVentures Ltd., a subsidiary of the HackGroup SA with offices in Switzerland and Luxembourg (HackVentures Sàrl, a registered Swiss limited liability company with registration number CHE-325.110.014.). They provide Financial Advisory Services under the Swiss Financial Service Act and Luxembourg based issuer services under the Securitisation Act 2004 & the Fiduciary Act 2003.

Yes, we encourage all the club members to be an active participant in the ecosystem by giving support with their network and provide expertise to each startup.

An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.

The “Accredited Investor” standard is set by the SEC and defines who is able to invest in certain private securities offerings.

All investors must at least meet US accreditation requirements.

Non-U.S. investors should also review the standards under their local law.

In no case shall STARTUP BASECAMP INC and its affiliates be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. This Platform is operated by STARTUP BASECAMP INC, a registered C.Corp company in USA.

Investing in private markets, venture funds and early stage companies involves risks, including illiquidity, lack of dividends, loss of investment and dilution. This communication is intended for accredited experienced investors, with sufficient experience and knowledge to understand the processes and risks involved. If you feel that you are not in a position to assess your expertise, please refrain from proceeding.

This website (the “STARTUP BASECAMP Platform” or “Platform”) is operated by STARTUP BASECAMP INC. Please note that the investment schemes mentioned are not subject to the supervision of the SEC, European Regulators or the FINMA, may not be distributed to non-qualified investors, and that investors, therefore do not benefit from the protection offered to retail investors. In no case shall STARTUP BASECAMP INC , its related entities and partners be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. The content of this website does not constitute an offer to enter into any transaction and is intended for general information purposes only. This is not an offer, solicitation of an offer, or advice to buy or sell securities in any jurisdiction where the STARTUP BASECAMP INC and its related entities & partners are not registered. The information contained on this Platform should not be considered by users as an alternative for the exercise of their own judgement, a careful analysis is necessary, and it is recommended to potential users, before making any decision, to always consult a qualified professional advisor to obtain appropriate advice, in particular financial, legal, accounting or tax.