Investment Opportunity

Climate Alliance

£300k Allocation - £200k Committed So Far...

Mining the sky!

Investment Memo

Homeostasis

Deal Details:

Stage:

Pre-Seed

Round Size:

€1.85M

Valuation:

€11.5M

Allocation:

€50K

Minimum:

£5K

Pro-Rata Rights:

Open to discussion

Technology Readiness Level (TRL):

4 (Technology validated in lab)

Location:

USA

Closing in:

February 2024

The Highlights:

🚀 UK-based and Y-Combinator startup backed by some of the best VCs in climate tech (Lower Carbon Capital, Climentum (Lead), & more).

🦄 Booked $1M in revenue so far, pipeline of 54 projects (incl. 9 mega-projects in partnership with Bühler) worth over $400M.

🏆 Following a $5M Series A round in 2023, Entocycle surpassed the initial Series A+ target, extending it to $2M, with $1.7M already allocated.

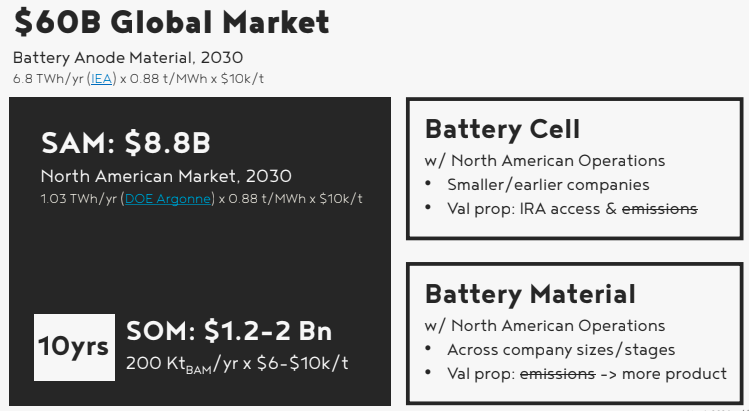

1. What is their mission?

Synthesizing battery graphite, a critical material for lithium ion batteries, from atmospheric CO2.

2. What problem are they working on?

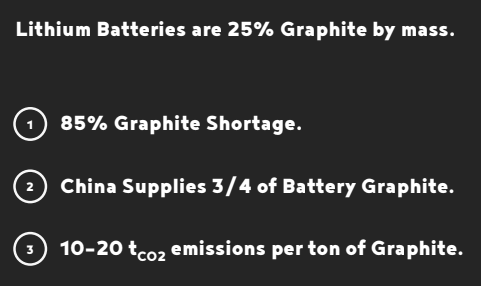

Graphite makes up the anodes of lithium-ion batteries. It is a critical material for energy storage.

However, the current supply is severely compromised. Graphite (crystalline carbon), which is a critical active anode material for lithium ion batteries (making up roughly 25% of the battery’s mass, on average), is particularly compromised on supply, cost, and emissions.

- Graphite Shortages for Lithium-Ion Batteries: Substantial shortages globally (as high as 85%, IMF) and North America (36-52% of 2030 needs will be met based on announced projects).

- China’s Graphite Supply Dominance: Heavy reliance on China (controls 3/4 of global supply, placed export restrictions on Western markets in October 2023).

- High Carbon Emissions from Graphite Production: High carbon emissions (10-20 tons of CO2 per ton of graphite).

3. How does their solution represent a groundbreaking innovation?

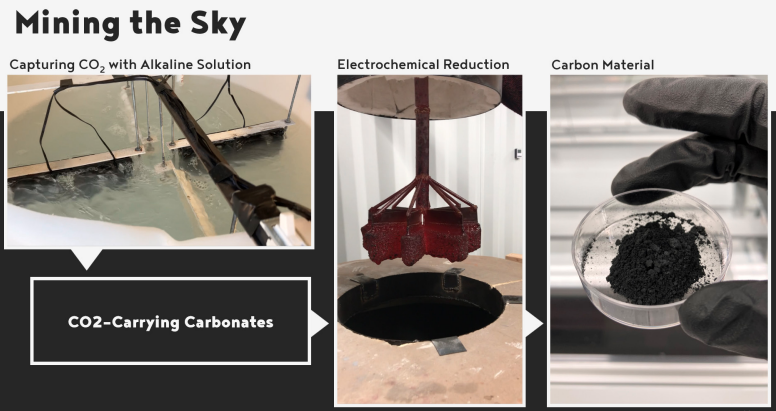

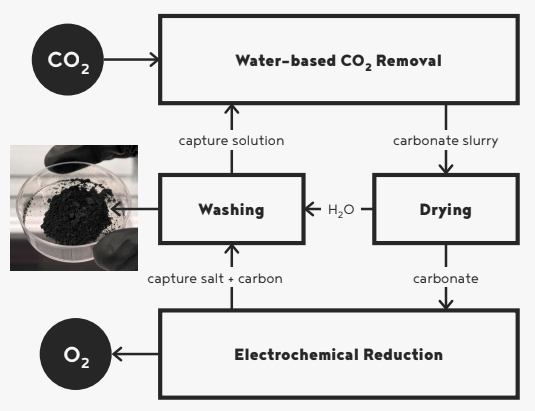

Homeostasis is developing a deep tech that captures and converts CO2 (from air or emissions sources) into graphite for lithium-ion batteries.

The firm couples mineralization with electrolysis to solve both carbon removal and carbon supply problem sets at the same time.

Homeostasis’ CO2 to graphite technology unlocks a massive supply of carbon that can be accessed virtually anywhere on Earth, and enables carbon negative production at, or potentially lower than, current market prices.

The company is optimizing for battery grade graphite, however is exploring other specialty carbons (e.g., hard carbons for sodium ion batteries), leveraging the same core technology.

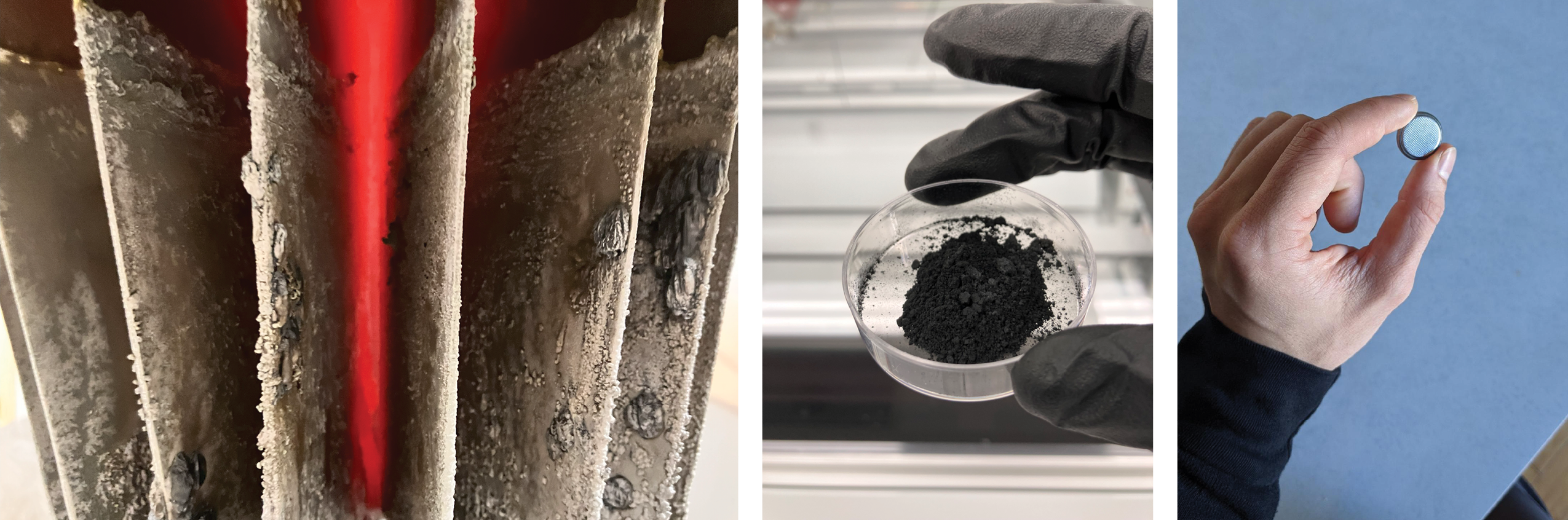

From left to right, Homeostasis ECR electrodes, carbon output from ECR, and coin cell produced using Homeostasis carbons.

4. What sets the team apart?

Introducing the innovative team behind Homeostasis, a company at the forefront of carbon capture and energy storage technology.

Makoto Eyre (CEO): Aerospace systems engineer at Blue Origin & NASA prior to founding Homeostasis – deep network of talented engineers to recruit from.

Dr. Julien Lombardi (CSO): Specializing in synthesis & characterization of transition nano particle crystals for energy storage.

Julien created the ‘Lombardi Device’ – a particular electrochemical carbonate reduction (ECR) apparatus that improves material quality and purity, while enabling 10x the rate of production.

5. What is their business model?

Homeostasis will be a technology developing & holding company, and will spin out Joint Ventures (JVs) with anchor partners/customers for large scale (>1,000 t/yr) material deployment projects.

The company has built their models to assume Homeostasis receives a %’age of earnings (our estimate is between 15-30%).

Smaller projects (<1000 t/yr), including our production pilot, will be built and operated in-house.

Revenue is direct sale of materials. Battery Graphite USD/t today: $8000 – $10,000

6. What is their traction so far?

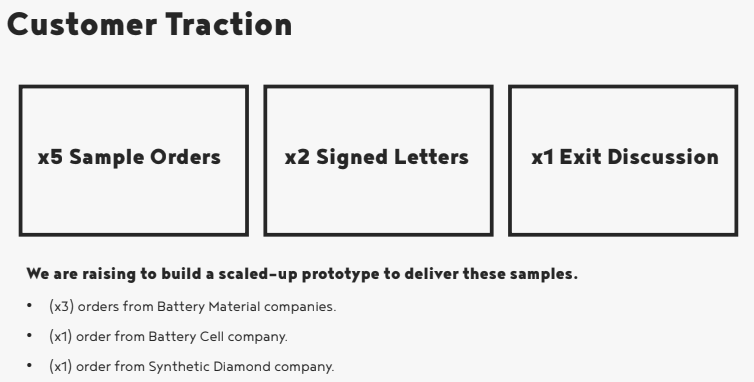

Homeostasis has four material sample orders from customers (2x battery material producers, 1x battery cell producer, 1x synthetic diamond producer).

The company has two signed LOIs, and have had an early conversation regarding a potential acquisition.

7. Who are their competitors?

3 competitor segments:

Natural (NG), Synthetic (SG), Electrochemical (EG). NG is mined.

SG is made from fossil fuels.

EG is made from carbonates (like us).

All producers today make NG or SG.

- Strength: known quantities as suppliers.

- Weak: limited/compromised supply.

EG (Maple Materials & Up Catalyst) still under development.

- Strength: ESG & supply narrative.

- Weak: unknown quantity as supplier, point-source capture.

Homeostasis unique in DAC & differentiated tech in Lombardi Device.

8. What is the defensibility and unfair advantage?

IP Advantage 1:

Homeostasis has a provisional, filing application to convert to full utility in May, that covers the full tech stack (mineralization CO2 capture coupled with carbonate electrolysis).

IP Advantage 2:

Homeostasis is filing a provisional in May covering the Lombardi Device (see ‘What sets the team apart?’)

Process Advantage: The company extracts their feedstock from the sky using passive carbon removal.

10. How does the company effectively mitigate both market and technological risks in their strategy?

Homeostasis’s primary target is graphite for Li-ion batteries.

However, the company is tracking and exploring alternative beachhead and growth products to be robust against external technological/market changes, and enable faster paths to revenue should a technical hurdle delay time to market.

Battery Market Risks:

– Hard carbon for Na-ion batteries

– Silicon-doped carbons (silicon carbide or silicon/graphite blend)

Other Market Risks:

– Synthetic diamond graphite

– Pigment (inks, charcoals)

11. What’s the roadmap to scale?

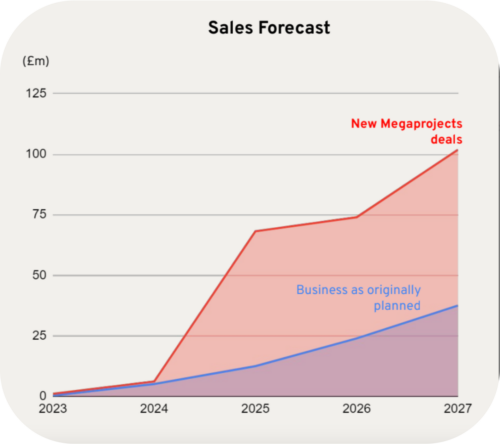

2024: refine material to MVP w/ early adopters (batch production, distributing samples)

2025: develop & fabricate MVP Pilot w/ anchor(s)

2026: fabricate & run Pilot (work out kinks in continuous operation, validate long duration battery tests w/ cell customers)

2027-2028: design & develop first Joint Venture (JV-1)

2028-2029: construct JV-1

2030: operate JV-1

12. What are the key points towards their next fundraising round?

– Produce Materials: Fulfill sample orders & start next generation of battery tests from material produced by Big Lombardi (mid Q2 2024)

– Gen 2 & 3 Batteries: Achieve >350 mAh/g & +500 cycles in multi-layered lithium pouch cell (Q4 2024)

– MVP: ready for MVP production, through feedback cycle with prospective customer and 3rd party lab (Q1 2025)

– Pilot Anchor: Secure anchor customer for the Pilot operational in 2026 (Q1 2025)

– Seed Funding: Raise $7M Seed round for the 2026 Pilot (Q2 2025)

13. Who else is investing in the deal?

Angels: Giles Eyre, Jonathan Kuo, Leland Gardner

VCs: R/GA Ventures

14. Why now?

A perfect confluence of market factors:

- Risks (shortage, geopolitical risk, high emissions/ESG risk) getting in the way of substantial growth (EV, ESS, batteries).

- Global (TAM) & N. American (SAM) problem.

- The latter is facing at least 50% deficit of graphite by 2030.

Homeostasis is ready to build a scaled up device to engage customer traction further. Investment now will springboard us forward into this next stage: MVP & pilot.

Next round, 2025, currently targeting $7M raise at $35M cap.

FAQ - Alliance Members

Direct sourcing & Referral Deals: While inbound are strong numerous investors and players collaborate with us by sharing exceptional startups. We screen over 100 companies per month & select only on average 3-4 companies fit our thesis criteria.

Only VC’s lead deals will be presented to the Climate Alliance.

On average, we structure 1 deal per month for our Investors Alliance that includes a deadline for each deal.

The minimum investment amount is €10k per ticket. However, it is the sole discretion of each accredited investors to decide if the investments fits their personal criteria for investments.

No, our Climate Investor Alliance is invite-only for qualified and accredited, ensuring top-quality investors collaborate within an exclusive network.

- 0% Management Fees

- 20% Carry

- SPV Costs pro-rated to deal participants

- €99 (Eur.) Monthly Climate Alliance Club membership fee

We encourage investors to also perfom direct investments with the company if the founders find it a fit.

A Special Purpose Vehicle (SPV) is set up for each investments via the platform regulated Kapital. This SPV serves as a dedicated legal entity tailored for managing and executing the fund’s specific investments.

More about the “Kapital Platform” or “Platform”. The Platform is operated by HackVentures Ltd., a subsidiary of the HackGroup SA with offices in Switzerland and Luxembourg (HackVentures Sàrl, a registered Swiss limited liability company with registration number CHE-325.110.014.). They provide Financial Advisory Services under the Swiss Financial Service Act and Luxembourg based issuer services under the Securitisation Act 2004 & the Fiduciary Act 2003.

Yes, we encourage all the club members to be an active participant in the ecosystem by giving support with their network and provide expertise to each startup.

An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.

The “Accredited Investor” standard is set by the SEC and defines who is able to invest in certain private securities offerings.

All investors must at least meet US accreditation requirements.

Non-U.S. investors should also review the standards under their local law.

In no case shall STARTUP BASECAMP INC and its affiliates be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. This Platform is operated by STARTUP BASECAMP INC, a registered C.Corp company in USA.

Investing in private markets, venture funds and early stage companies involves risks, including illiquidity, lack of dividends, loss of investment and dilution. This communication is intended for accredited experienced investors, with sufficient experience and knowledge to understand the processes and risks involved. If you feel that you are not in a position to assess your expertise, please refrain from proceeding.

This website (the “STARTUP BASECAMP Platform” or “Platform”) is operated by STARTUP BASECAMP INC. Please note that the investment schemes mentioned are not subject to the supervision of the SEC, European Regulators or the FINMA, may not be distributed to non-qualified investors, and that investors, therefore do not benefit from the protection offered to retail investors. In no case shall STARTUP BASECAMP INC , its related entities and partners be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. The content of this website does not constitute an offer to enter into any transaction and is intended for general information purposes only. This is not an offer, solicitation of an offer, or advice to buy or sell securities in any jurisdiction where the STARTUP BASECAMP INC and its related entities & partners are not registered. The information contained on this Platform should not be considered by users as an alternative for the exercise of their own judgement, a careful analysis is necessary, and it is recommended to potential users, before making any decision, to always consult a qualified professional advisor to obtain appropriate advice, in particular financial, legal, accounting or tax.