Investment Opportunity

Climate Alliance

£300k Allocation - £200k Committed So Far...

Decarbonizing heavy industry at gigaton scale with an all-electric heater

Investment Memo

HyperHeat

Deal Details:

Stage:

Seed

Round Size:

€3M

Valuation:

€9-€12M

Allocation:

€200K

Minimum:

£5K

Pro-Rata Rights:

Vanilla Post Money Safe Terms

Technology Readiness Level (TRL):

4 (Technology validated in lab)

Location:

Germany

Closing in:

February 2024

HyperHeat's Key Highlights:

🚀 The only all-electric solution that can produce high-temperature heat up to 2000°C solely from renewable electrical power.

🦄 Sold three 40kW units to three partners (thermal storage supplier and furnace builders).

🏆 HyperHeat has a lead investor for the upcoming €3M round and is currently involved in term sheet negotiations.

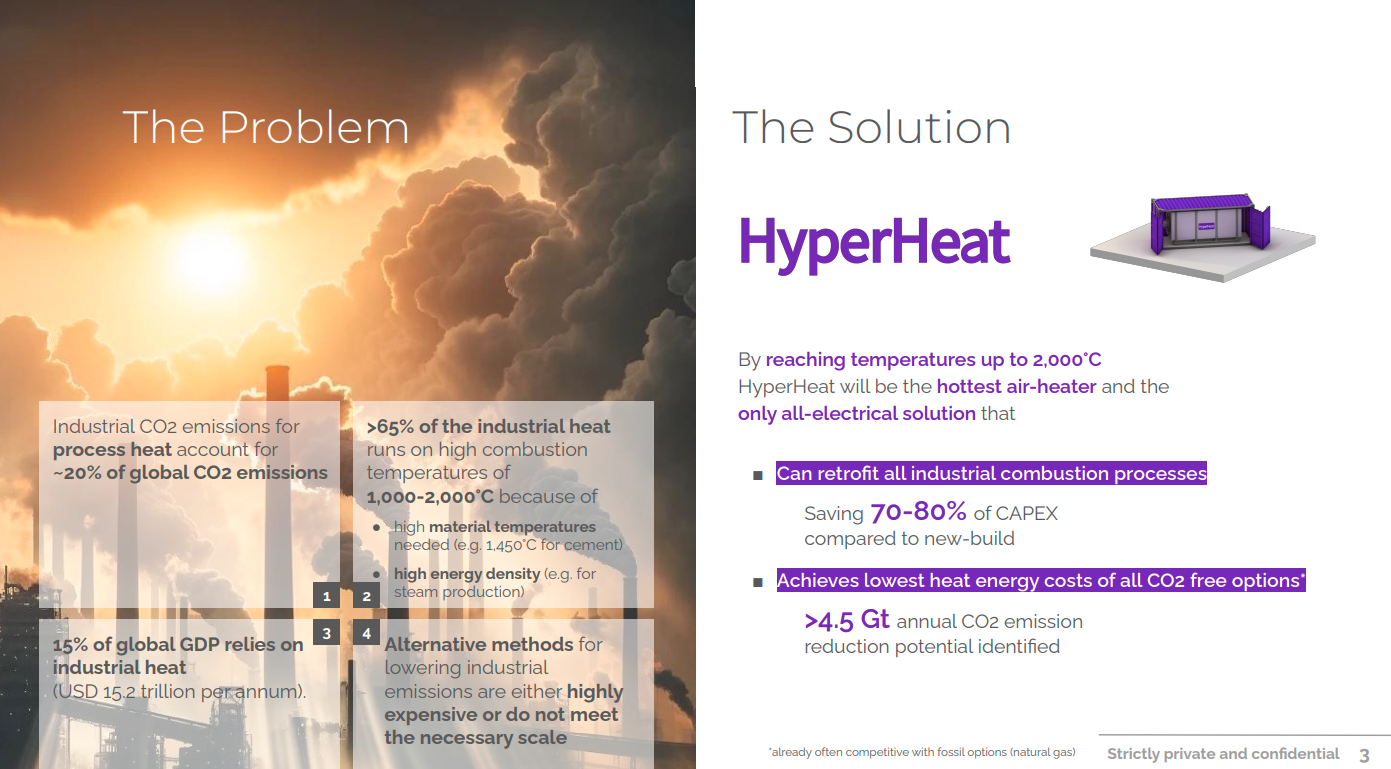

1. What is their mission?

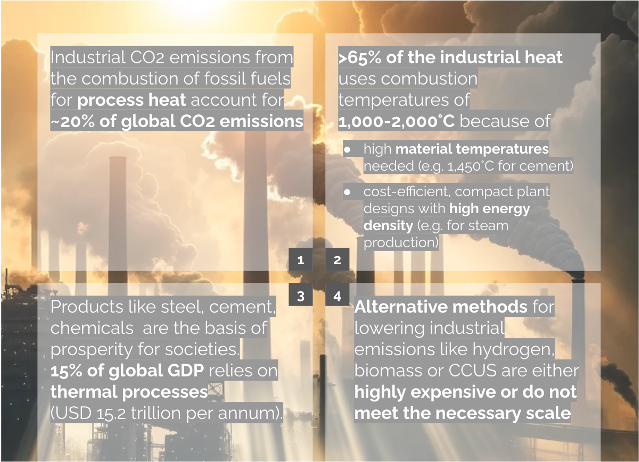

Building an all-electric heater that can directly replace fossil fuel burners for industrial heat (accounting for 20% of global CO2 emissions).

2. What problem are they working on?

To transform more than 65% of industrial thermal processes that rely on fossil fuels, a cost-efficient solution is needed that can replace these fossil fuel burners as easily as possible.

Currently, energy-intensive sectors industries heavily rely on fossil fuel-based systems, contributing significantly to greenhouse gas emissions (20% of global emissions).

65% of industrial heat runs on high combustion temperatures (between 1,000-2,000°C).

Electrifying these temperatures is still an unsolved challenge.

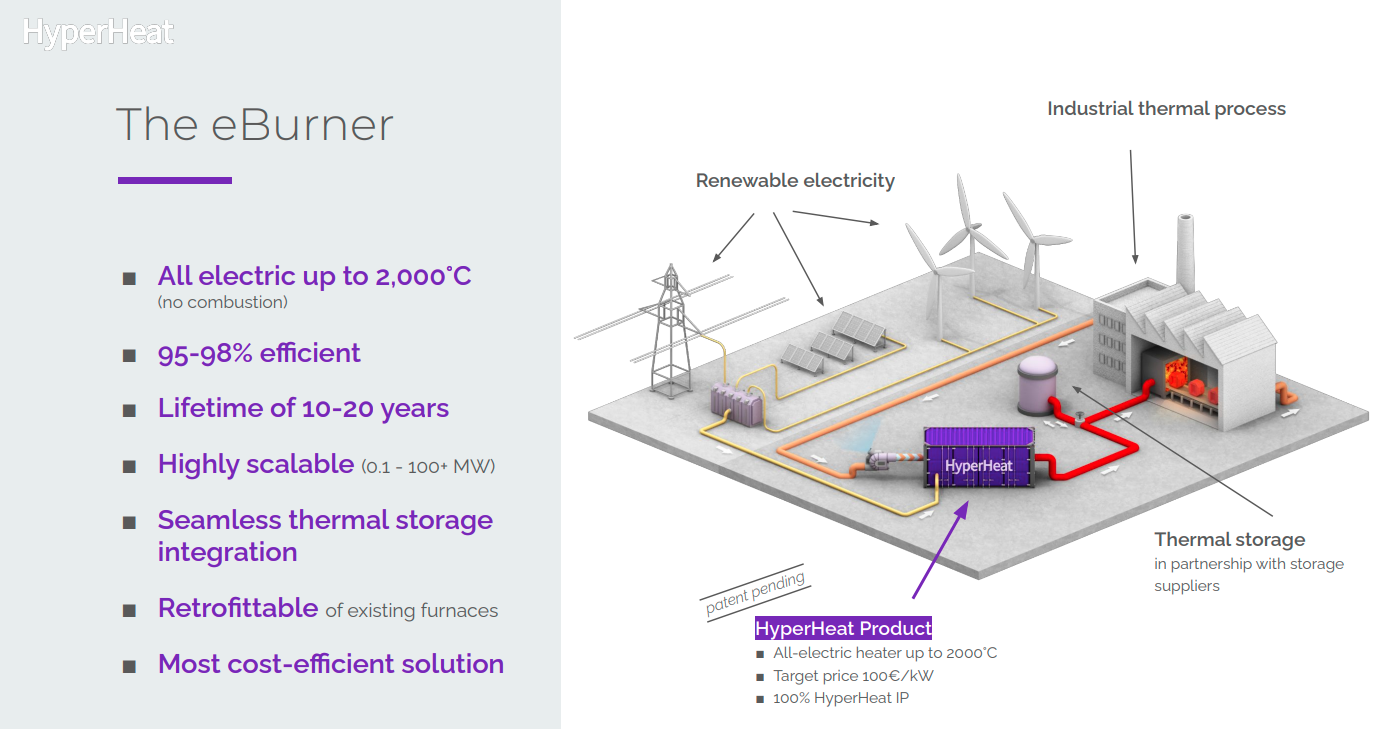

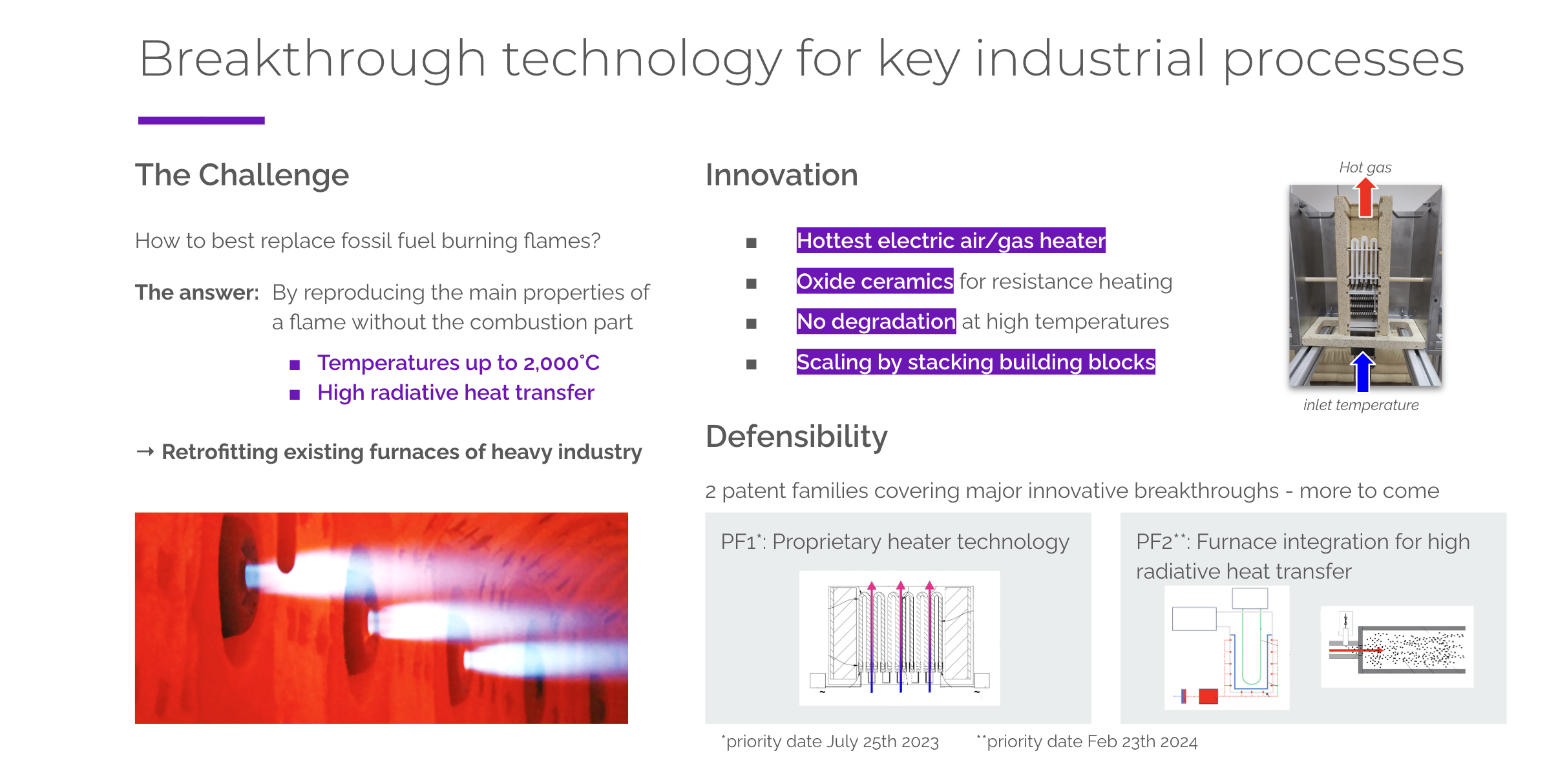

3. How does their solution represent a groundbreaking innovation?

Hyperheat’s mission is to develop a unique electric heater capable of producing high-temperature heat up to 2000°C solely from renewable electrical power.

HyperHeat has developed a breakthrough electric heater that outperforms existing technology (stuck at 1000°C), achieving up to 2000°C solely with renewable electricity.

The solution can be inducted into multiple hard-to-abate sectors such as steel, cement and chemicals to reduce CAPEX by 70-80% and achieve a 4.5Gt CO2 emission reduction.

This is achieved using so-called oxide ceramics that withstand extremely high temperatures without degradation.

HyperHeat’s patented innovation paves the way for retrofitting existing furnaces, offering industries a cost-effective transition to greener operations with unparalleled efficiency and longevity.

4.5 Gt annual reduction potential until 2050 in four different categories

4. What sets the team apart?

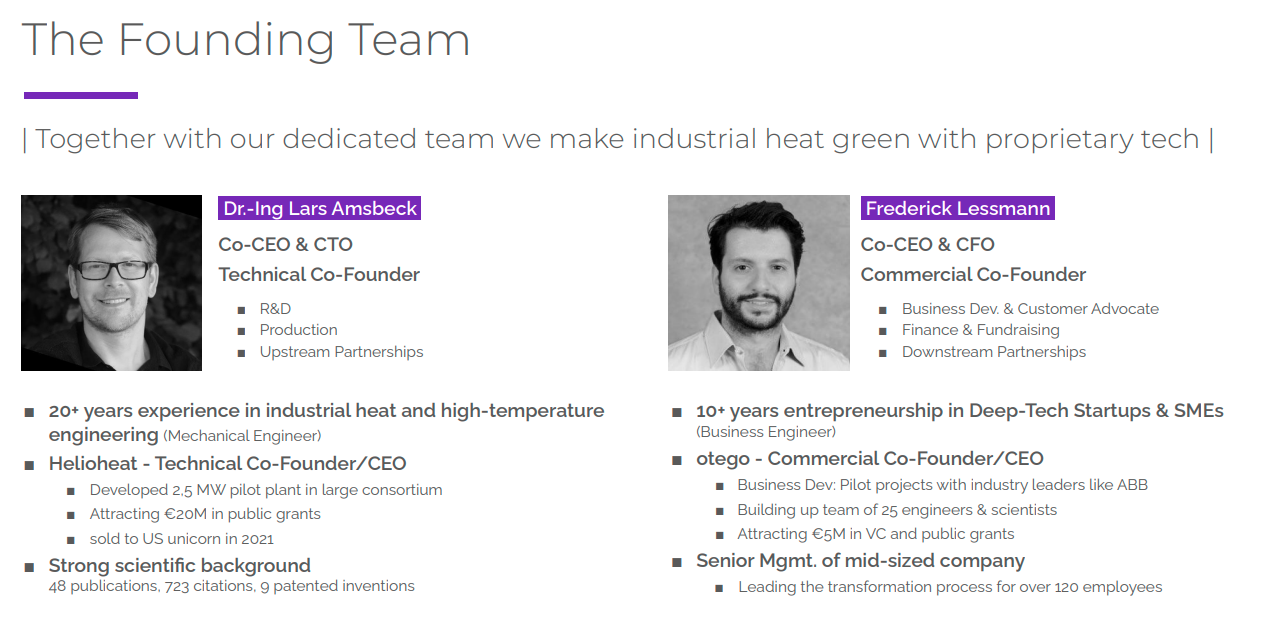

HyperHeat, founded by two experienced complementary founders, Dr. Lars Amsbeck and Frederick Lessmann, possesses a unique blend of expertise in renewable energy, industrial operations, and business development, offering valuable insights into the renewable heat domain.

6. What is their traction so far?

Within 12 months HyperHeat has achieved significant technical and commercial progress.

HyperHeat showcased a POC in the summer of 2023 and successfully built a 1,7 kW prototype based on oxide ceramic heating elements in Jan 2024.

Currently, the company is progressing toward the first market-ready 40kW heater.

HyperHeat sold three 40kW units to three partners (thermal storage suppliers and furnace builders), who will receive their shipment in Q3 of 2024.

The firm has identified the first easy-to-adapt applications, derived a comprehensive go-to-market strategy and is building long-term partnerships with leading technology providers like Linde, ThyssenKrupp Polysius etc.

5. What is their business model?

HyperHeat’s business model is rooted in manufacturing and supplying advanced electric heaters, targeting high profit margins (>50%) with per-unit sales.

Key revenue streams:

- Direct sale of eBurners.

- Ongoing operation & maintenance services, enhancing customer value through data-driven offerings.

Cost efficiencies are achieved via outsourced material procurement and in-house assembly, ensuring quality and scalability.

Strategic partnerships with EPCs, furnace builders and technology suppliers for plant integration solidify their market position in multiple verticals, streamlining delivery and commissioning to optimise the value chain.

HyperHeat’s innovation leads to unit economics that allows profit margins between 50-80% at the same product price as competing low-temperature solutions.

7. Who are their competitors?

In the power-to-heat market, HyperHeat sets itself apart from competitors by delivering unparalleled temperatures with renewable energy sources at very low costs.

Hyperheat’s technology surpasses traditional methods like resistive, induction, and plasma heating in efficiency, cost, and adaptability.

Competitors like Coolbrook and SaltX rely on technologies that will make them 3x more expensive even at the highest scale of production.

There is also a great number of companies offering very cheap thermal storage solutions like Rondo, Kraftblock, Brennmiller and others.

Currently, HyperHeat is successful in building partnerships with some of these companies since they face the problem of not being able to reach temperatures above 1000°C.

By enabling these storage companies, we as partners will be competitors to more integrated systems like Antora and ETS that work on a different yet, more costly solution.

Coolbrook employs a “rotodynamic reactor” to achieve 1700°C by mechanically transferring energy to gas through friction, surpassing the demonstrated 1100°C, but with anticipated high CAPEX and OPEX costs for the rotating machinery.

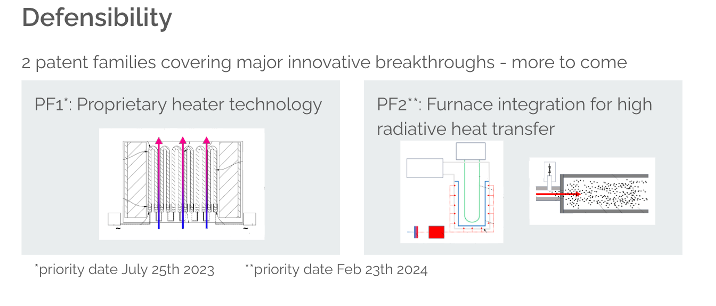

8. What is the defensibility and unfair advantage?

HyperHeat’s technology is protected by two patent families, ensuring FTO as well as competitive exclusivity.

One patent family covers the design principle of HyperHeat’s heater as well as the electrical connections and use of oxide ceramics, especially zirconium oxide. The second patent family covers the integration of an electric air/gas heater into a thermal process delivering a high portion of radiative heat transfer (often necessary for retrofitting).

HyperHeat’s heaters’ ability to achieve extreme temperatures with minimal degradation by using oxide ceramics is an unfair advantage, creating a high barrier to entry for competitors.

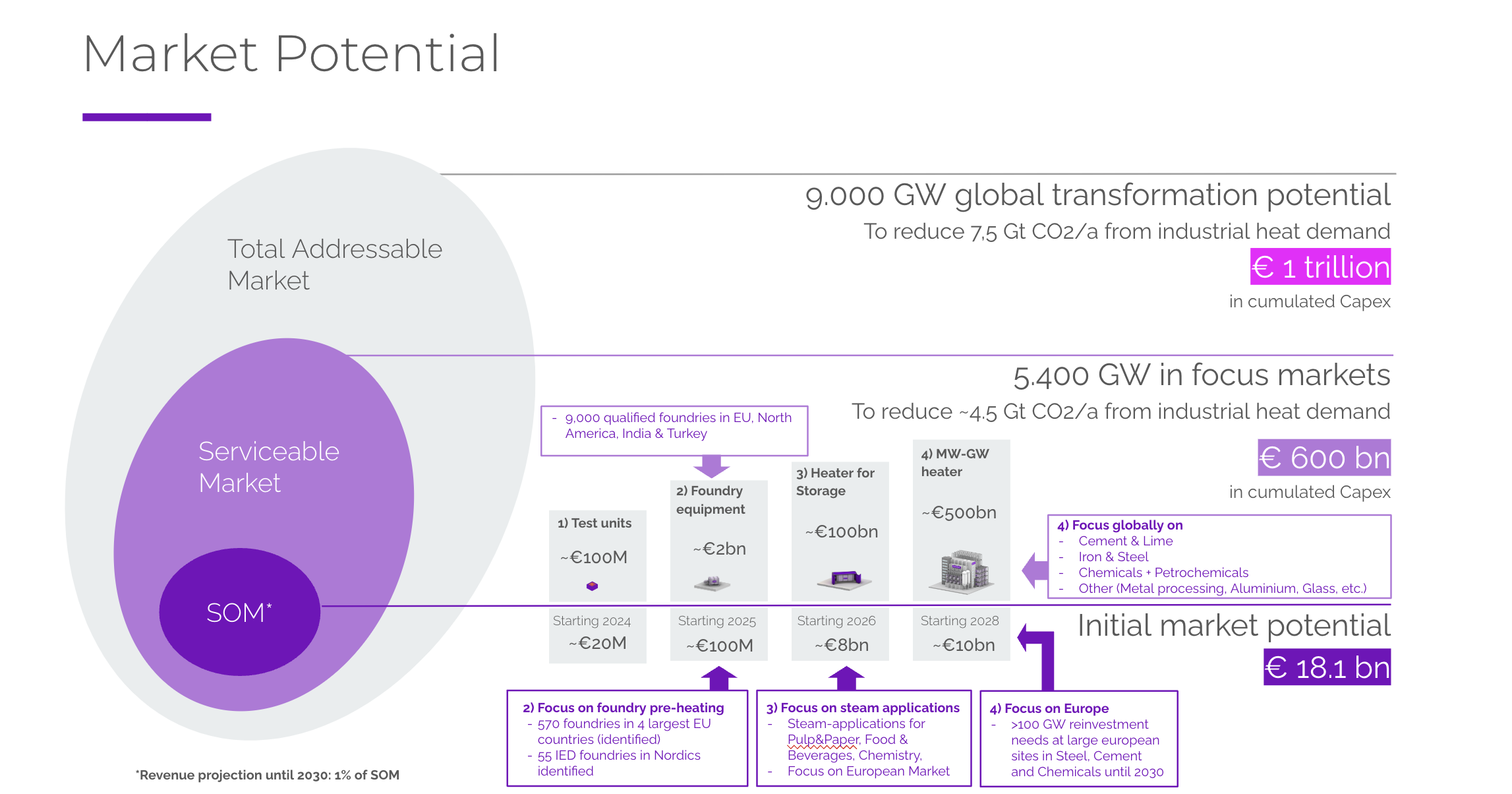

9. What is the estimated market size for the startup's target market?

TAM: Estimated at around €1 trillion in cumulated CAPEX to be invested due to environmental regulations and a shift towards sustainable practices (reducing 7.5 Gt CO2 annually).

SAM: HyperHeat’s total SAM, encompassing test units, eBurners for foundry equipment, Power-to-Heat units for thermal storage, and Power-to-Heat capacity for key industries, exceeds €602.1 billion.

SOM: HyperHeat faces an initial obtainable market potential of €18 billion for European pre-heating equipment, thermal storage enabling and installations in steel, cement and chemicals until 2030.

10. How does the company effectively mitigate both market and technological risks in their strategy?

HyperHeat’s risk mitigation strategy encompasses continuous innovation, leading to a strong IP portfolio, fast product iteration for production readiness, and quick execution together with their strategic partners.

The company aims to build a product business rather than a project business. This enables us to build market leadership quickly and to hold their market position by building up strong production capacities to meet demand in various verticals.

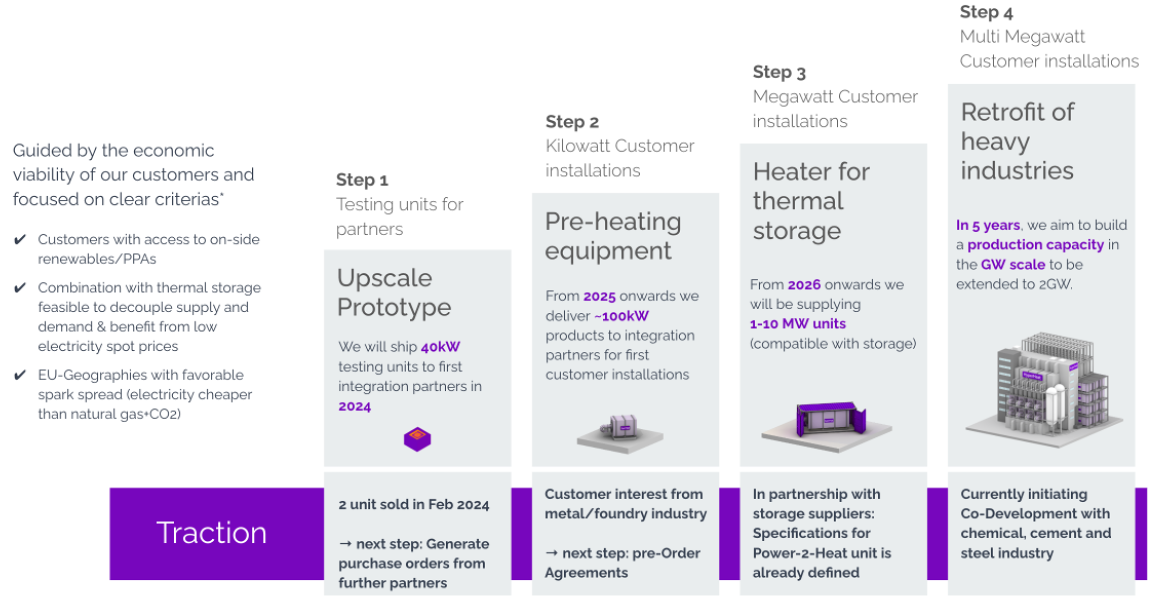

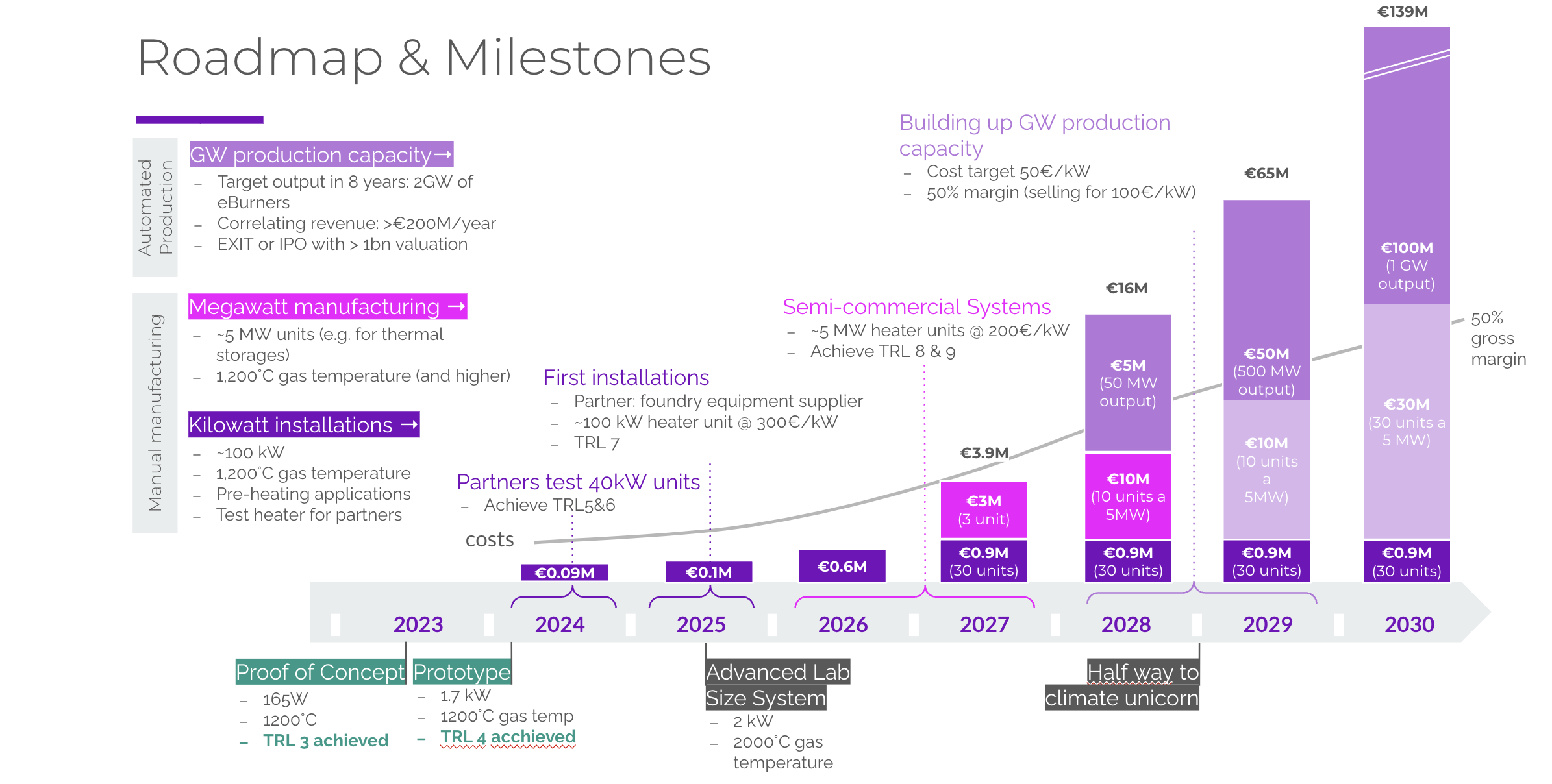

11. What’s the roadmap to scale?

HyperHeat’s scaling strategy focuses on technology refinement, production scale-up, and industry collaboration.

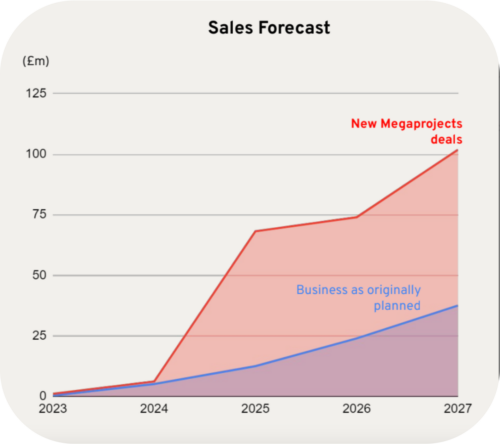

Key milestones include technology validation at TRL 5/6 in the summer of 2024, launching smaller 100kW TRL7 pilot projects for pre-heating equipment in 2025 (pilot customers already in place) and scaling to MW installations in 2026.

For the chemical vertical, HyperHeat is already building up partnerships with Linde and global petrochemical companies. These partnerships for the cement and steel verticals will be built in 2024

Step 1: Partner Test Units (2024/25)

HyperHeat is working with established partners (EPCs) across various sectors to build a scalable business model.

In this phase, the goal is to sell 3-4 test heaters annually to strategic partners, enabling initial customer pilot installations.

Already sold 2 test units to Promeos and Kraftblock.

Step 2: Foundry Electrification (2025)

At the end of 2025, HyperHeat aims to have an order book of at least 100MW capacity (which correlates to €20-30M revenue) to build a 100MW production in 2026/27.

Step 3: Enhancing Thermal Storage (Post-2025)

HyperHeat aims to improve thermal storage systems using its high-temperature heaters.

Step 4: Large-Scale Industry Retrofits (Post-2025)

HyperHeat plans to retrofit major industrial furnaces, targeting global corporations with strong decarbonization goals including cement, steel, and chemical production.

12. What are the key points towards their next fundraising round?

The fundraising of a €3M Seed round, which they aim to close within the next 8-12 weeks is geared towards accelerating product development, securing industry partnerships, and enhancing HyperHeat’s go-to-market strategy.

The proceeds will finance HyperHeat for 24 months and will be leveraged by public grants we currently apply for. The follow-on Series-A round will take place in Late 2026/early 2027.

The aim is to build up a 100MW production capacity, which allows for a break-even production of eBurners.

A major objective to be achieved before Series-A is an order book of at least 1 year of production (€20-30M revenue).

The financing needs are estimated to be €15M and will be covered by equity, dept and grants.

13. Who else is investing in the deal?

Currently, the cap table includes Lars (73.5%) and Frederick (24.5%) as founders and Thorsten Lipps as an advisor (2%).

We have received a public venture department of €320k and €80k of Business Angel convertible notes so far.

14. Why now?

HyperHeat is in a unique position to tackle one of the last major sectors that is only at the start of decarbonisation – industrial heat (20% of global CO2 emissions).

The company possesses a very experienced founding team offering the best technology to reach flame-like temperatures, being the only solution that can retrofit whole industries in time to stop climate change.

Having built a compelling business case and equity story, HyperHeat has already convinced a lead investor for the upcoming €3M round and is currently involved in term sheet negotiations.

FAQ - Alliance Members

Direct sourcing & Referral Deals: While inbound are strong numerous investors and players collaborate with us by sharing exceptional startups. We screen over 100 companies per month & select only on average 3-4 companies fit our thesis criteria.

Only VC’s lead deals will be presented to the Climate Alliance.

On average, we structure 1 deal per month for our Investors Alliance that includes a deadline for each deal.

The minimum investment amount is €10k per ticket. However, it is the sole discretion of each accredited investors to decide if the investments fits their personal criteria for investments.

No, our Climate Investor Alliance is invite-only for qualified and accredited, ensuring top-quality investors collaborate within an exclusive network.

- 0% Management Fees

- 20% Carry

- SPV Costs pro-rated to deal participants

- €99 (Eur.) Monthly Climate Alliance Club membership fee

We encourage investors to also perfom direct investments with the company if the founders find it a fit.

A Special Purpose Vehicle (SPV) is set up for each investments via the platform regulated Kapital. This SPV serves as a dedicated legal entity tailored for managing and executing the fund’s specific investments.

More about the “Kapital Platform” or “Platform”. The Platform is operated by HackVentures Ltd., a subsidiary of the HackGroup SA with offices in Switzerland and Luxembourg (HackVentures Sàrl, a registered Swiss limited liability company with registration number CHE-325.110.014.). They provide Financial Advisory Services under the Swiss Financial Service Act and Luxembourg based issuer services under the Securitisation Act 2004 & the Fiduciary Act 2003.

Yes, we encourage all the club members to be an active participant in the ecosystem by giving support with their network and provide expertise to each startup.

An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.

The “Accredited Investor” standard is set by the SEC and defines who is able to invest in certain private securities offerings.

All investors must at least meet US accreditation requirements.

Non-U.S. investors should also review the standards under their local law.

In no case shall STARTUP BASECAMP INC and its affiliates be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. This Platform is operated by STARTUP BASECAMP INC, a registered C.Corp company in USA.

Investing in private markets, venture funds and early stage companies involves risks, including illiquidity, lack of dividends, loss of investment and dilution. This communication is intended for accredited experienced investors, with sufficient experience and knowledge to understand the processes and risks involved. If you feel that you are not in a position to assess your expertise, please refrain from proceeding.

This website (the “STARTUP BASECAMP Platform” or “Platform”) is operated by STARTUP BASECAMP INC. Please note that the investment schemes mentioned are not subject to the supervision of the SEC, European Regulators or the FINMA, may not be distributed to non-qualified investors, and that investors, therefore do not benefit from the protection offered to retail investors. In no case shall STARTUP BASECAMP INC , its related entities and partners be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. The content of this website does not constitute an offer to enter into any transaction and is intended for general information purposes only. This is not an offer, solicitation of an offer, or advice to buy or sell securities in any jurisdiction where the STARTUP BASECAMP INC and its related entities & partners are not registered. The information contained on this Platform should not be considered by users as an alternative for the exercise of their own judgement, a careful analysis is necessary, and it is recommended to potential users, before making any decision, to always consult a qualified professional advisor to obtain appropriate advice, in particular financial, legal, accounting or tax.