Investment Opportunity

Climate Alliance

£300k Allocation - £200k Committed So Far...

Removing CO2 to and transform it into alternatives for fossil-based products

Investment Memo

Aerleum

Deal Details:

Stage:

Seed

Round Size:

€3M

Valuation:

€8M

Allocation:

€250K

Minimum:

€5K

Pro-Rata Rights:

Vanilla Post Money Safe Terms

Technology Readiness Level (TRL):

4 (Technology validated in lab)

Location:

France

Closing in:

February 2024

The Highlights:

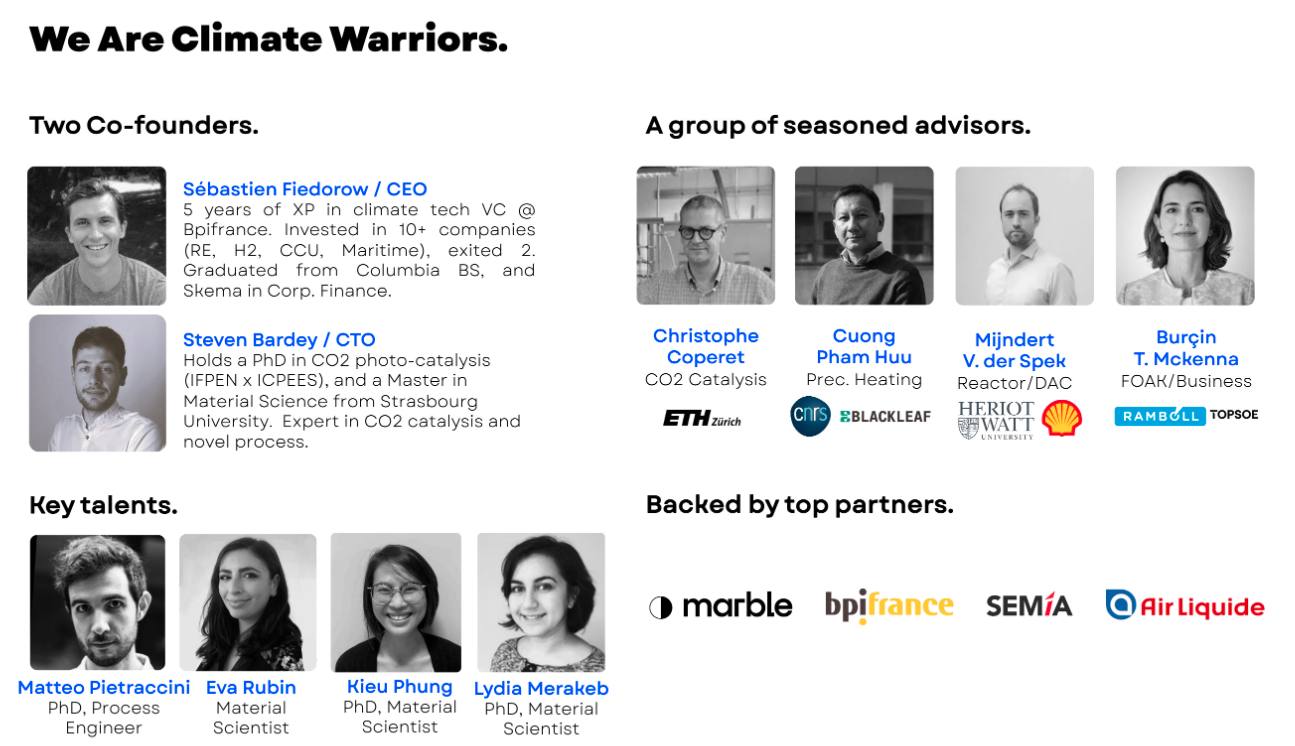

🚀 Backed by leading climate tech ecosystem players including Marble, bpiFrance and Air Liquide.

🦄 Signed an LOI to provide up to 10,000 tons of e-methanol per year at $1,200 per ton ($12,000,000 contract).

🏆 Almost closed their €3M round – €250k allocation left!

1. What is their mission?

Producing carbon neutral fuels and chemicals at cost parity with fossil based alternatives to lead the charge in the defossilization of hard-to-abate industries (maritime, aviation, etc.).

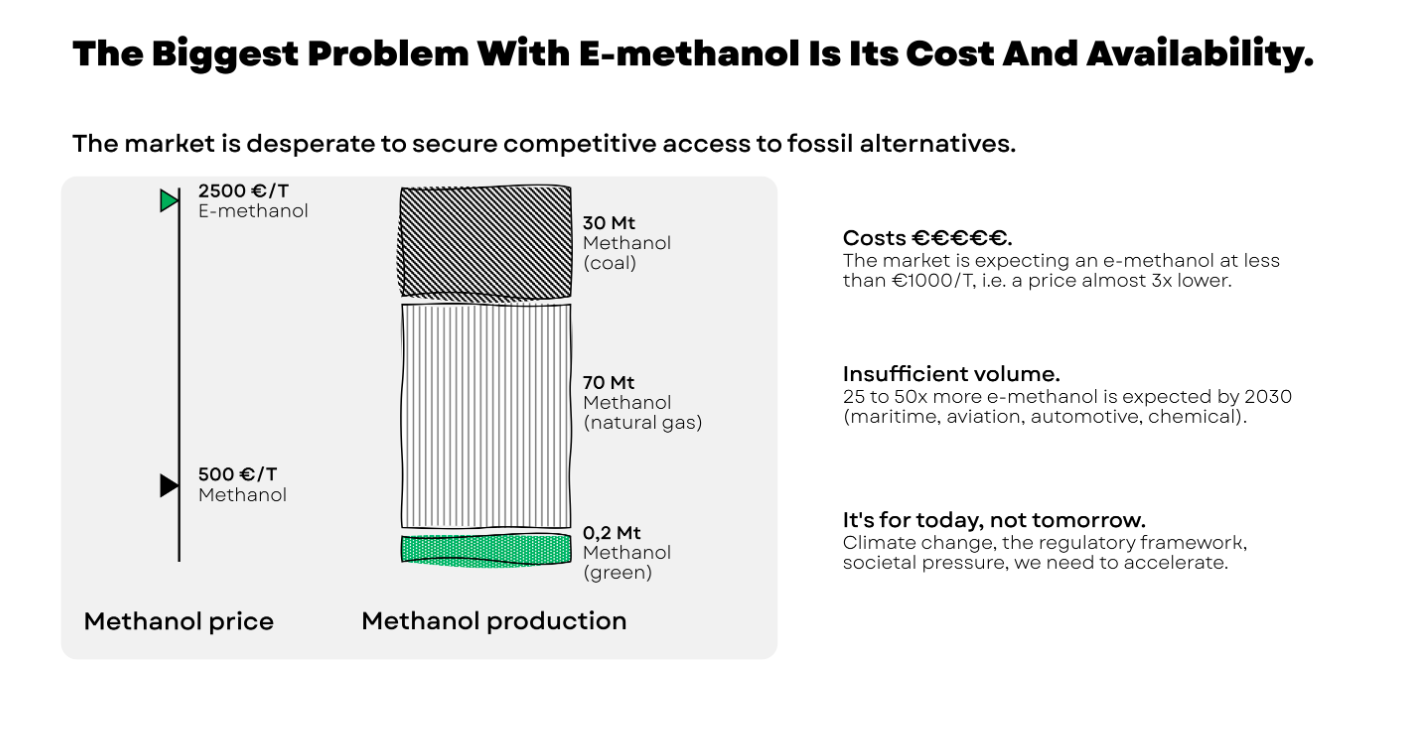

2. What problem are they working on?

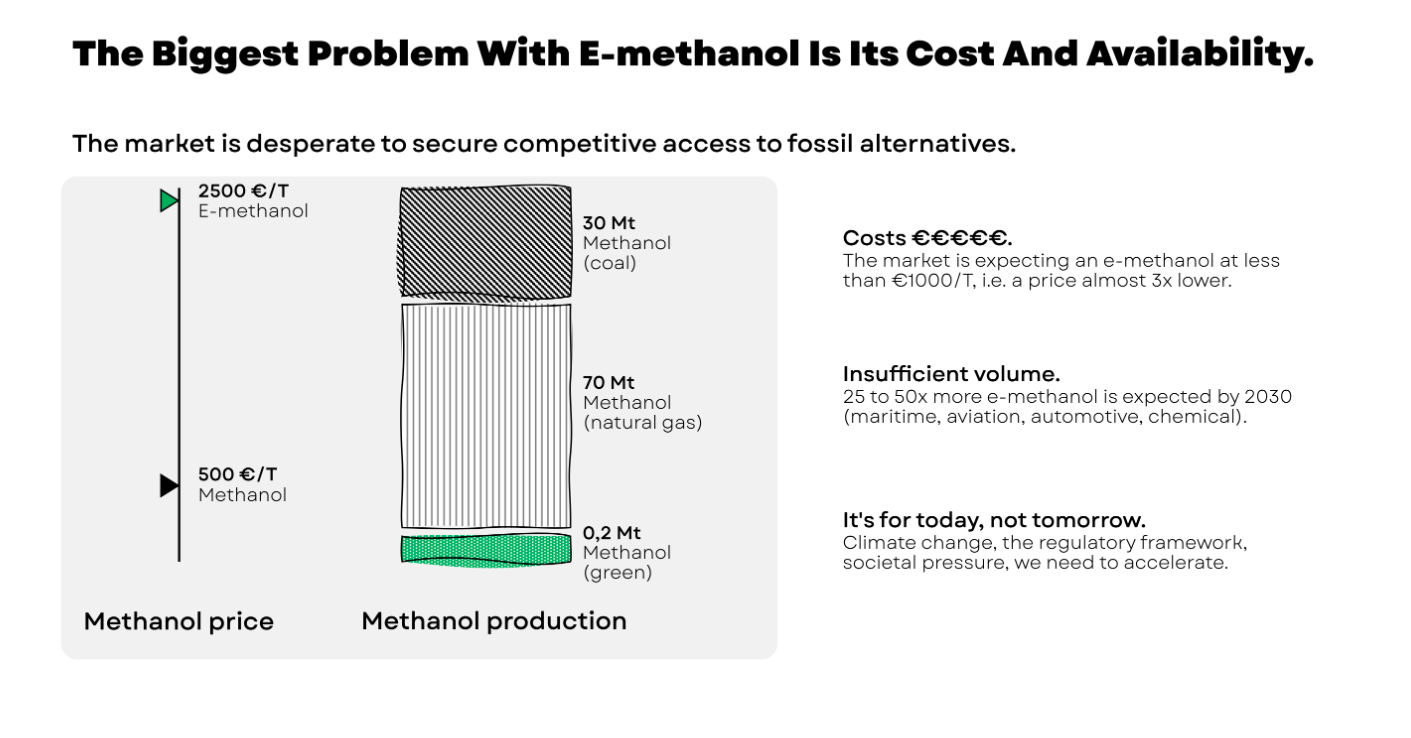

Today, synthetic fuels can be produced from CO2, but the energy intensity of current processes and access to feedstock are two major bottlenecks that hinder the competitiveness of CO2-based products.

This is not acceptable by hard-to-abate industries.

3. How does their solution represent a groundbreaking innovation?

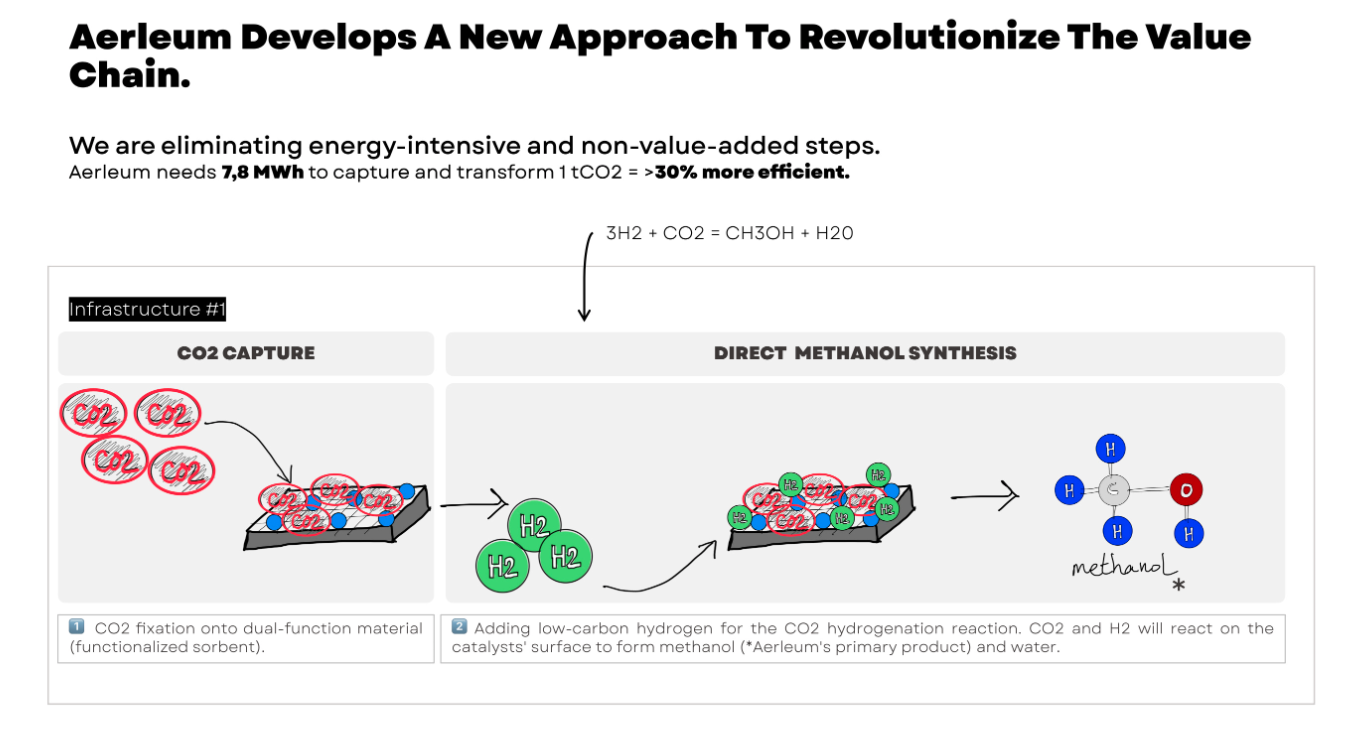

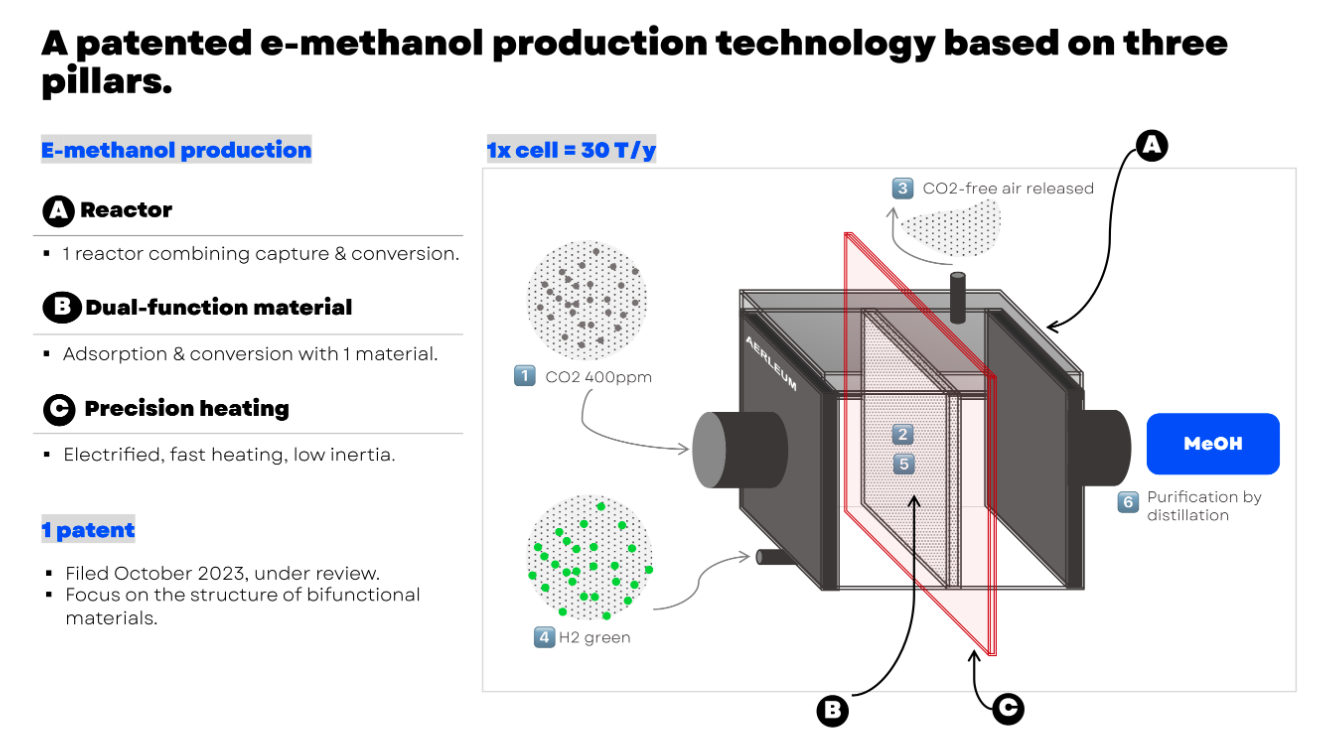

Aerleum has created a novel approach to transform atmospheric CO2 into e-fuels with a one-step approach.

The process is based on thermal catalysis to perform CO2 hydrogenation to e-methanol (our first product).

Aerleum has developed a dual-function material capable of adsorbing CO2 in atmospheric conditions.

This same material has been functionalized to perform the direct conversion of CO2 into e-fuels.

With this approach, they’re able to eliminate the largest energy penalties from the process – there’s no need for specific CO2 desorption steps, material regeneration, or logistics (which represents up to 90% of capture costs in conventional processes).

4. What sets the team apart?

Co-founder & CEO

- Background in Entrepreneurship and Investment.

- 5 years of experience as VC investor in early stage climate tech.

- Invested in carbon capture, shipping decarbonization, green chemistry, green hydrogen technologies.

Co-founder & CTO

- Holds a PhD in CO2 conversion performed at the French Institute of Petroleum.

- Experienced in material synthesis and hardware engineering having worked at SOPREMA France, and CNRS.

5. What is their business model?

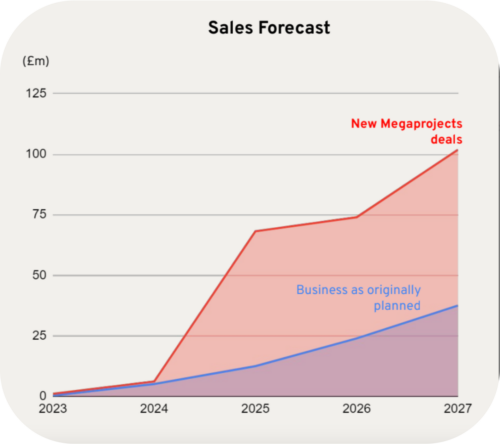

The first part of the business model is associated with validating the technology at an industrial scale, which involves producing and selling e-methanol.

The second step would be to license the technology/process and provide materials.

6. What is their traction so far?

Aerleum has validated the production of e-methanol from ambient air through our combined approach.

Up to now, Aerleum has signed a LOI to provide up to 10,000 tons of e-methanol per year at $1,200 per ton ($12,000,000 contract).

The company is in deep discussions with large shipowners for future off-take agreements, and we are partnering with major EPC companies for the industrialization of our technology.

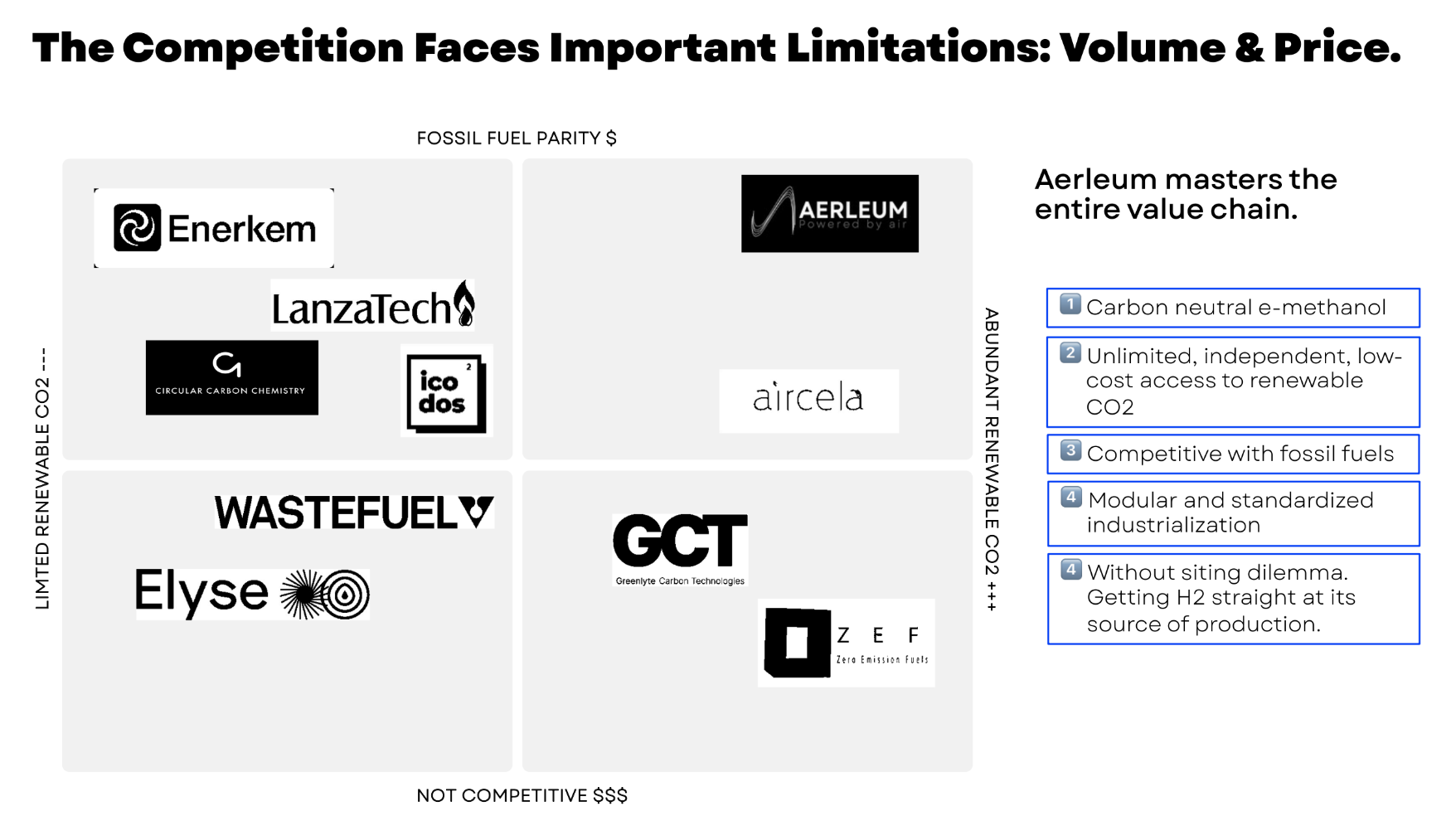

7. Who are their competitors?

Icodos, GCT, C1 Chemicals, and Enerkem are competitors in green methanol production. They employ various methods such as bio-methanol or electrochemistry, alongside thermal catalysis, but often focus on concentrated CO2 sources or only one step of the process.

Challenges include feedstock availability for bio-methanol and scalability issues for electrochemistry, while thermal catalysis remains the most viable option due to its industrial-scale use.

Competitors focusing on catalysis only will face obstacles securing renewable CO2 sources or dealing with the limitations of bio-methanol.

8. What is the defensibility and unfair advantage?

Aerleum has built a patented technology that enables the capture and conversion of CO2 in a single system.

The companies approach allows for a cost-competitive transformation of atmospheric CO2 into e-methanol.

By utilizing atmospheric CO2 as our feedstock, we have the flexibility to position our system where green hydrogen is produced under favorable conditions – we consume cheap hydrogen on-site, thereby avoiding the distribution costs associated with hydrogen and strengthening our economic case.

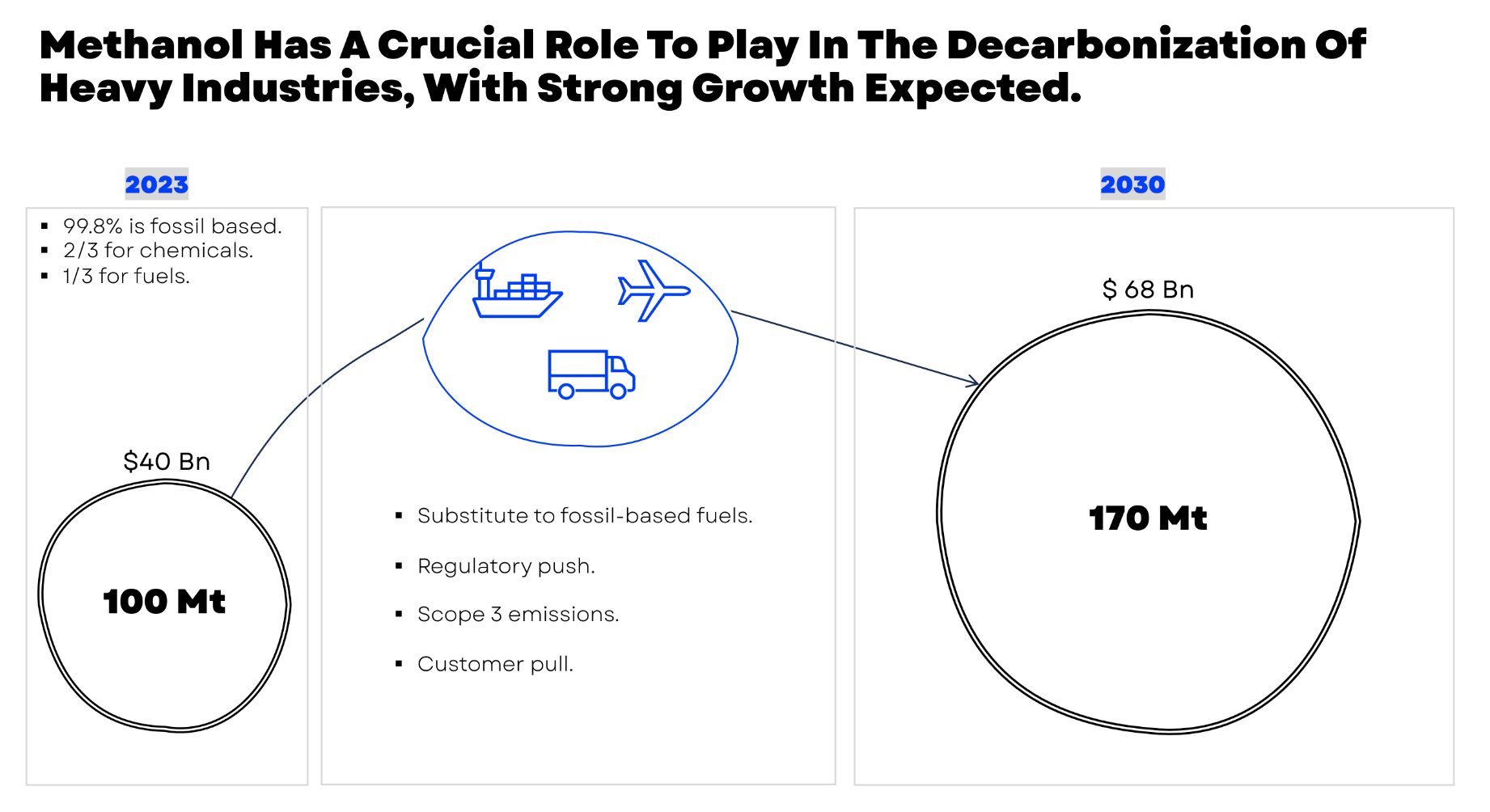

9. What is the estimated market size for the startup's target market?

Maritime is Aerleum’s primary target industry.

Annually, approximately 300,000,000 tons of fossil-based fuels are consumed in this sector, which faces stringent regulations aimed at reducing CO2 emissions.

Methanol is among the preferred options, with approximately 200 vessels currently built to run on methanol.

In the short term, this represents a $12 billion market, as each vessel burns 200 tons of fuel per day and operates for more than 300 days per year.

10. How does the company effectively mitigate both market and technological risks in their strategy?

Since day one, Aerleum has secured strong commercial partnerships, validated by maritime industry leaders ready for off-take agreements.

The company has prepared to penetrate niche markets as backups. While their technology is lab-validated, they have surrounded themselves with advisors and partners for scale-up, roadmap, and mitigation plans.

The current performances demonstrate that they could already scale-up our process to be competitive at industrial scale.

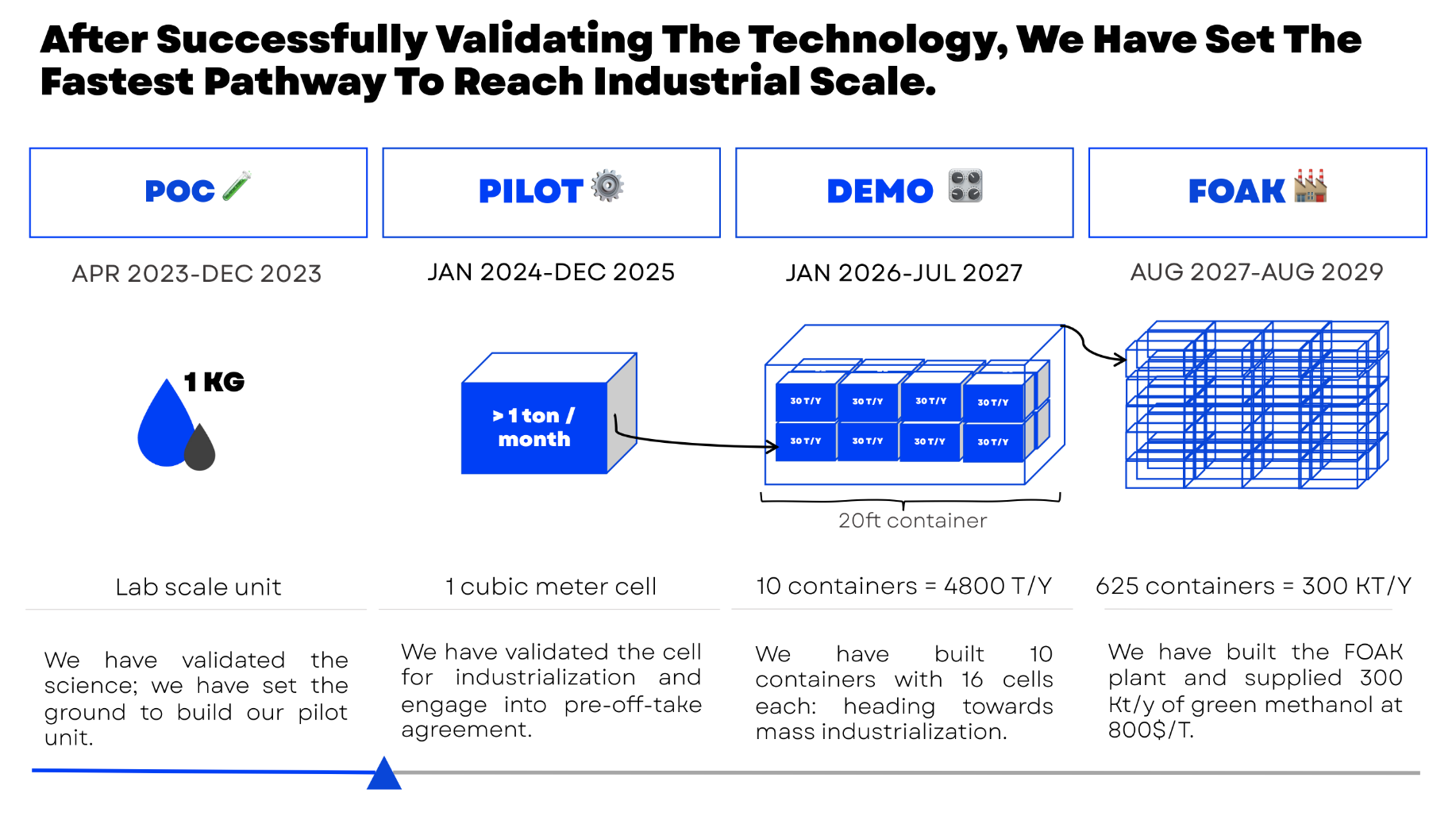

11. What’s the roadmap to scale?

In the next 18 months, Aerleum plans to finalize the design of our initial cell with a production capacity of 30 tons per year.

Following this, Aerleum intends to stack 16 cells within a 20-foot container to scale the production capacity to 480 tons per year.

The final step will be to integrate a specific number of containers to build the First-of-a-Kind (FOAK) facility.

12. What are the key points towards their next fundraising round?

For the next round, three main milestones/elements are required for Aerleum:

(1) Produce e-methanol at a cost below $1,200 per ton;

(2) Hire C-level executives for industrialization;

(3) Sign off-take agreements.

13. Who else is investing in the deal?

Marble is a venture studio that co-founded the company and invested at its origin.

Aerleum has received a term-sheet from a German deeptech lead VC.

14. Why now?

Here are the key factors contributing to the company’s potential success:

- High Level Science: The science has reached Technology Readiness Levels 4-5, indicating a high degree of maturity.

- IP Protection: Aerleum’s patented technology provides a substantial competitive advantage, enabling the cost-competitive production of carbon-neutral e-methanol, aligning perfectly with the growing demand for sustainable alternatives.

- Early-Stage Traction: Regulatory pressures and increasing customer demand further accelerate our time-to-market. Aerleum has already gained significant commercial and industrial traction, positioning us for large-scale opportunities.

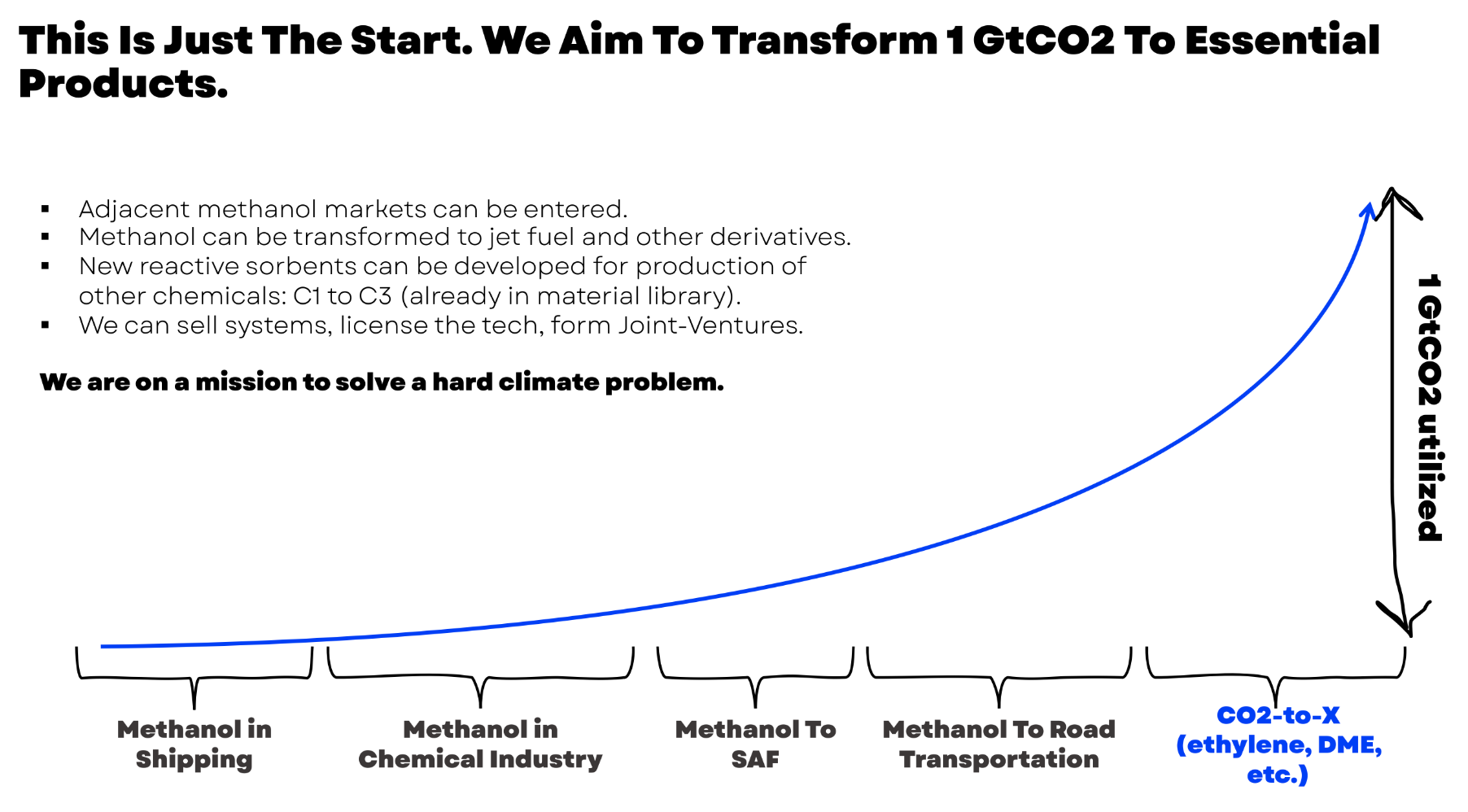

- Wide Vision: The companies vision extends beyond e-methanol to encompass a comprehensive CO2-to-X platform.

FAQ - Alliance Members

Direct sourcing & Referral Deals: While inbound are strong numerous investors and players collaborate with us by sharing exceptional startups. We screen over 100 companies per month & select only on average 3-4 companies fit our thesis criteria.

Only VC’s lead deals will be presented to the Climate Alliance.

On average, we structure 1 deal per month for our Investors Alliance that includes a deadline for each deal.

The minimum investment amount is €10k per ticket. However, it is the sole discretion of each accredited investors to decide if the investments fits their personal criteria for investments.

No, our Climate Investor Alliance is invite-only for qualified and accredited, ensuring top-quality investors collaborate within an exclusive network.

- 0% Management Fees

- 20% Carry

- SPV Costs pro-rated to deal participants

- €99 (Eur.) Monthly Climate Alliance Club membership fee

We encourage investors to also perfom direct investments with the company if the founders find it a fit.

A Special Purpose Vehicle (SPV) is set up for each investments via the platform regulated Kapital. This SPV serves as a dedicated legal entity tailored for managing and executing the fund’s specific investments.

More about the “Kapital Platform” or “Platform”. The Platform is operated by HackVentures Ltd., a subsidiary of the HackGroup SA with offices in Switzerland and Luxembourg (HackVentures Sàrl, a registered Swiss limited liability company with registration number CHE-325.110.014.). They provide Financial Advisory Services under the Swiss Financial Service Act and Luxembourg based issuer services under the Securitisation Act 2004 & the Fiduciary Act 2003.

Yes, we encourage all the club members to be an active participant in the ecosystem by giving support with their network and provide expertise to each startup.

An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.

The “Accredited Investor” standard is set by the SEC and defines who is able to invest in certain private securities offerings.

All investors must at least meet US accreditation requirements.

Non-U.S. investors should also review the standards under their local law.

In no case shall STARTUP BASECAMP INC and its affiliates be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. This Platform is operated by STARTUP BASECAMP INC, a registered C.Corp company in USA.

Investing in private markets, venture funds and early stage companies involves risks, including illiquidity, lack of dividends, loss of investment and dilution. This communication is intended for accredited experienced investors, with sufficient experience and knowledge to understand the processes and risks involved. If you feel that you are not in a position to assess your expertise, please refrain from proceeding.

This website (the “STARTUP BASECAMP Platform” or “Platform”) is operated by STARTUP BASECAMP INC. Please note that the investment schemes mentioned are not subject to the supervision of the SEC, European Regulators or the FINMA, may not be distributed to non-qualified investors, and that investors, therefore do not benefit from the protection offered to retail investors. In no case shall STARTUP BASECAMP INC , its related entities and partners be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. The content of this website does not constitute an offer to enter into any transaction and is intended for general information purposes only. This is not an offer, solicitation of an offer, or advice to buy or sell securities in any jurisdiction where the STARTUP BASECAMP INC and its related entities & partners are not registered. The information contained on this Platform should not be considered by users as an alternative for the exercise of their own judgement, a careful analysis is necessary, and it is recommended to potential users, before making any decision, to always consult a qualified professional advisor to obtain appropriate advice, in particular financial, legal, accounting or tax.