Why Non-Dilutive Funding?

In 2022, climate tech soared on the crest of investment waves, but the landscape has shifted significantly since then. Founders in the climate tech industry are now grappling with a sense of reality as they face a downturn.

The market dip and a decline in venture funding have taken a toll on climate tech funding in the first half of 2023, resulting in a staggering total of $13.1B, down 40% from H1’22 and 35% from H2’22.

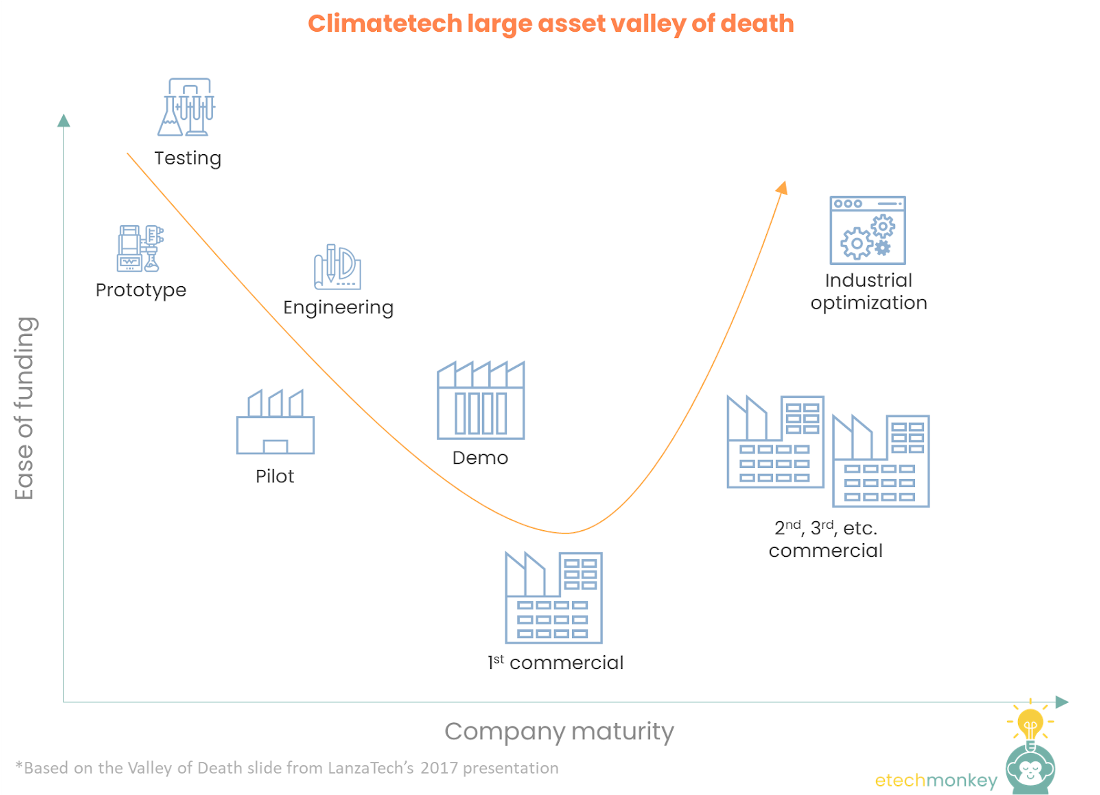

To navigate the challenges and attempt to mitigate the climate crisis, hardware solutions play a vital role but face a scaling problem as they require a high CAPEX plant or large infrastructure with less applicability for venture funding. Hence, they need diverse capital instruments within their structures to overcome the valley of death pitfalls.

The difficulty for funding is particularly difficult for hardware technologies at lower TRL levels at the stage of pilots and first demonstration, which demand more demonstrable success, uncertain returns, and lengthy payback time frames.

Unfortunately, these risks are often too high for many institutional investors to transition from pilot projects to FOAK, especially in high-emitting and hard-to-abate sectors like concrete, steel, and chemistry.

Understanding diverse capital structures and identifying non-dilutive funding sources is paramount for founders to help overcome critical milestones and navigate the complex layers of R&D to bring their products to market, especially as VC funding is not the only path available to startups.

Fortunately, non-dilutive funding presents a valuable opportunity to bridge the climate tech investment gap for startups. However, navigating its fractured landscape is a time investing headache, remaining a challenge to source and secure.

While this advice is primarily directed at founders, it is also essential to emphasise the role of grant providers and debt in making these capital options more accessible. In this fractured and unknown realm filled with hidden opportunities, concerted efforts from all stakeholders can significantly empower climate tech entrepreneurs in their mission to address the global climate crisis.

8 Soft Funding Application Prep Tips

Winning a grant is undeniably a competitive process, but fear not!

You can substantially boost your chances of success by arming yourself with the right strategy, meticulous preparation, and a well-crafted approach.

To help you on your journey, here’s some guidance on securing that coveted grant:

- It’s a process. Start early and treat it like fundraising with a well-maintained, sourced pipeline of non-dilutive opportunities.

- Like private fundraising rounds, this must be well structured and planned towards reaching each soft funding application deadline.

- And remember, it takes time to write the application, so consider engaging with experts to support you along the way.

- Review and double-check the grant small print, including eligibility criteria, objectives, and reporting requirements.

- Use the criteria as a model to focus on the narrative of the written text throughout the application. Tick them boxes.

- Ensure the startup story is concise and to the point. There is no time for waffling, as evaluators will have read several other applications in that same timeframe.

- Define the problem/solution clearly and tell the story through each section required within the application. It’s important to stick to the narrative of the startup.

- It is helpful to treat the reader as an investor. This means a project must be presented with clear and realistic milestones, KPIs, and a budget for all activities to define what will happen during the funding project and into the future.

- Deliver a comprehensive and meticulously structured timeline for the project, encompassing essential milestones and anticipated outcomes. By doing so, you will enable the grant provider to understand the project’s scope with a deliberated plan for seamless execution.

- Feedback is crucial. Whether from team members, board members or even a friend, having a second pair of eyes that know the technology well and those that don’t is very important. Remember to draft and present the application like a pitch deck; it needs to be clear and structured with a defined narrative signposted to the reader throughout the application.

Reviewing a submittable soft funding application is the last activity people want to do but it can pay off. Proofread, spell check, and ensure every point is clear for the reader. The simpler the better.

- Only some people can be a winner but keep on applying as sometimes; it is a number game. It can be frustrating when rejected, especially when the evaluator doesn’t apprehend the solution. This can either be that the application wasn’t clear enough or the evaluator is somewhat ill-placed in terms of their expertise and biases to understand the potential of the innovation.

- Apply and refine – it’s a practice of persistence and determination, much like fundraising.

Things to Keep In Mind

Asides from application tips, here are a few things to keep in mind when applying for grants and some non-dilutive funding alternatives:

While it is an excellent attribute for startups to be awarded several grants to focus on critical technological developments and milestones, it is sometimes the case that grant projects (somewhat lengthy at times) avoid focusing on critical elements for growth and scaling.

Diversity of investors, whether VCs, strategic Angels, syndicates etc., can also help guide startups towards their heading. A strategic mix of non-dilutive funding and equity is the best of both worlds.

After receiving a grant, it’s essential to know that specific grants may impose restrictions on altering the awarded project’s structure. Such limitations can hinder the intended impact of the grant and cause delays for startups compelled to stick to the initial plan solely to secure the grant funding. This can be particularly constraining since startups often need to pivot, especially during the early stages of development.

As well as this, ensure grant management processes are in place as non-dilutive funding often comes with continuous compliance and reporting requirements throughout the project lifecycle.

In contrast, VCs adopt a different approach to funding innovation. They assess projects at a higher level of abstraction, acknowledging the importance of flexibility for startups when it comes to development and scaling up. Being cognizant of these differences in funding mechanisms is crucial for startups to navigate their growth journey successfully.

Anticipate the possibility of having or raising equity to access specific grants. Certain grants may demand a matching capital contribution of 50% or even more, which could necessitate raising additional funds after receiving the grant.

While raising more equity capital might seem daunting, it offers a significant advantage by reducing risk for potential investors. Consequently, this extended runway ensures the company’s sustainability and provides ample time to thrive and achieve its goals.

Don’t forget the option of venture debt. More applicable for the later technological stages around TRL9 to act as a bridge or capital expenses to enable companies to reach the next round of equity. Both banks and non-bank lenders provide it, and some VCs as an additional service to equity funding.

Venture debt presents a compelling alternative to other debt financing methods, safeguarding against excessive dilution of equity stakes. Unlike traditional loans, it does not rely on collateral or your company’s cash flow. Instead, lenders prioritise your business’s growth potential and ability to attract further investment capital.

Moreover, venture debt offers flexibility through adjustable repayment terms that align with your current cash flow levels. This adaptability allows your company to navigate growth phases and seize opportunities without being burdened by rigid repayment schedules.

Pitch and win cash. Sometimes it is that simple. Just like applying for grants, keeping a close eye on open and upcoming competitions by maintaining a well-curated pipeline of applications is paramount.

These competitions offer small cash awards without any obligations, providing free capital, validation, and, most importantly, a sense of excitement for founders who make it to the finals. It’s a fantastic opportunity for founders to step outside the confines of their office and showcase their innovative ideas, all while potentially earning valuable resources to propel their ventures forward. Embracing these competitions can be a rewarding experience, offering more than just financial gains and creating a platform for founders to shine and gain recognition in their industry.

Non-Dilutive Funding Options - Database & Map

Submit Soft Funding Opportunities to Our List!

To better ensure climate tech startups can find appropriate soft funding programs and initiatives we’ve created a database and would love your additions to it.

If you have any soft funding opportunities to add to the list, please let us know!