The 4 Most Ready-to-Capture Climate Tech Startups to Invest In

The recent Intergovernmental Panel on Climate Change (IPCC) report reads like the “The Day After Tomorrow” script. Except it’s not a sci-fi movie but a sci-entific reality.

Reducing our carbon footprint is not enough. We need to take CO2 off the atmosphere. A lot of it. Based on a recent study, we have to remove 10 gigatons of carbon dioxide by 2050 to meet the Paris-aligned decarbonization goals. After that, further 20 gigatons each year until 2100.

The good news is climate tech startups are coming up with new technologies for combatting climate change. Above all, direct air capture (DAC) is the one standing out.

But why should you pile into the DAC business?

First, it’s the most promising technology for removing CO2 from the air.

Besides having an inestimable value for our planet, the utilization of the captured CO2 could be worth $1 trillion by 2030. Also, while technology improvements will drive down the capital cost, the market for carbon credits may reach $50 billion by 2030. Which means CO2 capture’s return-on-investment (ROI) is more than captivating.

So, we’ve gathered the top 4 carbon direct air capture companies to invest in ASAP. We chose these as they’re ahead of all the others in their technology upscaling process.

Let’s see how they’re making our decarbonization dream true and profitable.

Back in 2020, this Swiss start-up broke the record for the largest investment ever made into DAC (USD 110M), receiving funds from Microsoft, Audi, Shopify and Stripe, among others.

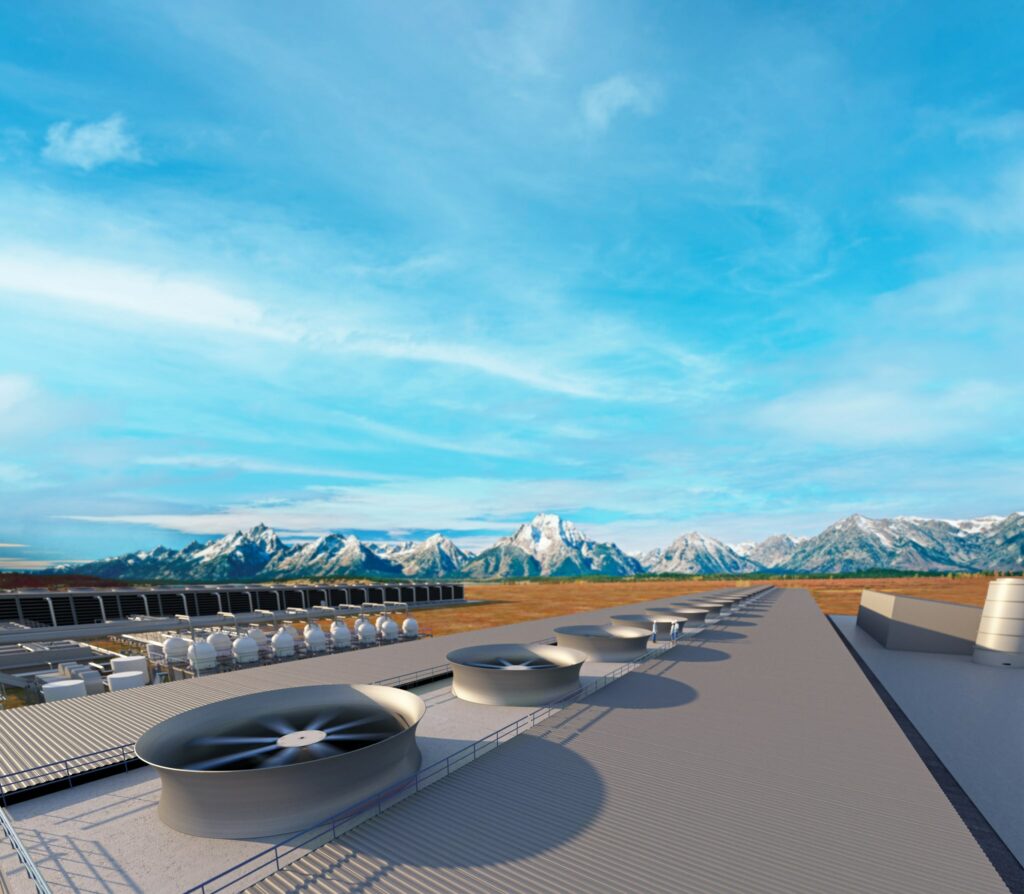

Last September Climeworks launched ORCA, the world’s first and largest climate positive DAC and storage system. The Iceland-based plant will capture 4,000 tons of CO₂ per year using massive fans with filters inside. The trapped CO2 will then be injected underground and turn into stone within 2 years using Carbfix technology.

And these CO2 busters already got their first client for their “carbon removal as a service”. With the aim of becoming carbon neutral by 2030, Swiss Re will venture USD $10 million over the next 10 years on Climeworks’ DAC tech.

While this Canadian company has captured CO2 only at a pilot-scale so far, their carbon busting power will dwarf Climeworks’.

Scheduled to go live in the US in 2022, their first commercial facility will vacuum 1 million tons of CO2 per year out of the air. That’s as much carbon as that removed by 40m trees.

Using the same technology as Climeworks, CE will either store carbon dioxide deep underground or reuse it to make biofuels.

Canada’s Shopify was the first client to shop from the CE’s CO2 yet-to-be-filled shelf, with an early bird purchase of USD $1 million worth of carbon.

This US-based company is just running behind Climeworks and CE in the carbon capture race.

Propelled by two giant investors like Coca-Cola and Exxon Mobile, they’re currently developing a commercial-scale carbon capture and utilisation (CCU) plant.

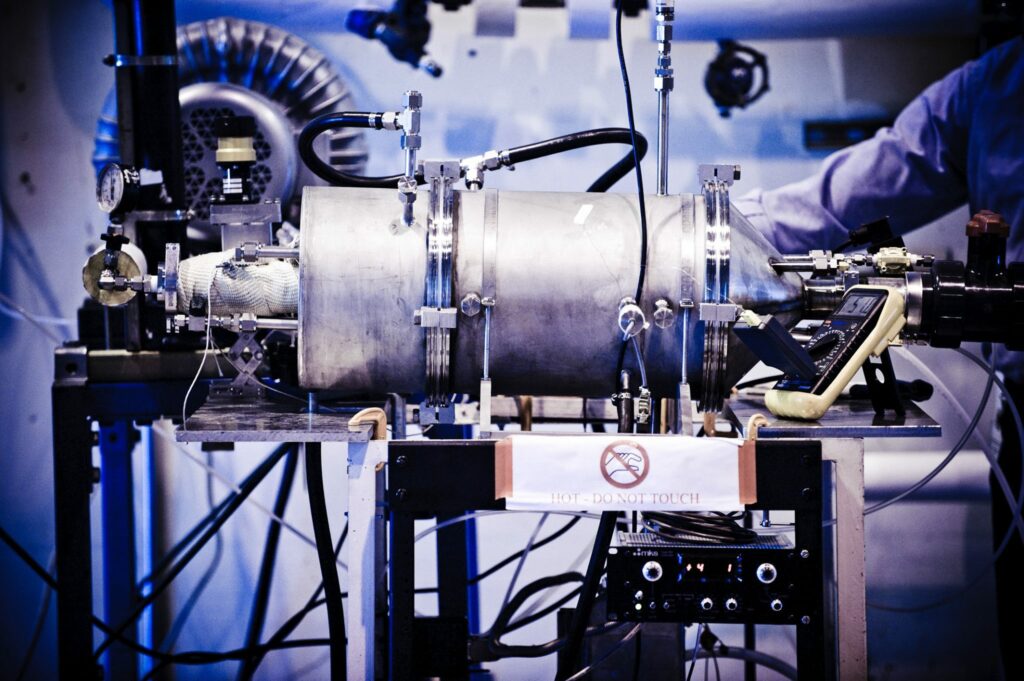

GT technology traps CO2 onto chemically modified sponges. Just think of converters in car engines.

Once fully scaled-up, their modular plant can capture up to 2 million tons of CO2 per year.

In the meantime, last July Black & Veatch received $2.5 million from the U.S. Department of Energy (DOE) to build a GT DAC pilot which will suck 100,000 tons of CO2 out of the sky per year.

Using limestone to turn CO2 into a rock within days, this American carbon removal company is working hard so that the next generations could inherit a safer planet. They’re touting to pull 1 billion tons of carbon off the air by 2035.

Once reached commercial scale, their carbon mineralization, a.k.a. enhanced weathering, will capture CO2 at $50 per ton, which is cheaper than what Climeworks and CE are offering.

After raising millions of dollars’ worth of investments from Breakthrough Energy Ventures, Lowercarbon Capital, and others, they won their first buyer. Stripe stroke a green deal with Heirloom for removing 250 tons of carbon at $2,054 per ton.

Conclusion

There you go. Here are the front runners of the carbon capture competition.

While these climate tech startups are doing a great job, the DAC technology scale-up calls for a huge carbon capture funding. Up to 1.9% of the global GDP each year.

But that’s nothing compared to the environmental and economic ROI you’ll get.

Ready to capture the carbon wave?

Antonio Salituro

Antonio Salituro is a freelance climate tech copywriter and blogger promoting sustainable companies and startups fighting against climate change.

Interested in Submitting a Guest Blog?

We love sharing the thoughts and insight from climate tech industry founders, investors and experts.

If you have knowledge you want to share with our expansive network, or have work you want to republish here, please get in touch!