Investment Opportunity

Climate Alliance

£300k Allocation - £200k Committed So Far...

The world's leading provider of insect farming technology

Deal closed!

Investment opportunity #1

Entocycle

Deal Details:

Stage:

Series A+

Round Size:

£2M

Valuation:

£34M

Allocation:

£300K

Minimum:

£5K

Pro-Rata Rights:

Vanilla Post Money Safe Terms

Technology Readiness Level (TRL):

9 (Actual system proven in operational environment)

Location:

United Kingdom

Closing in:

February 2024

The Highlights:

🚀 UK-based and Y-Combinator startup backed by some of the best VCs in climate tech (Lower Carbon Capital, Climentum (Lead), & more).

🦄 Booked $1M in revenue so far, pipeline of 54 projects (incl. 9 mega-projects in partnership with Bühler) worth over $400M.

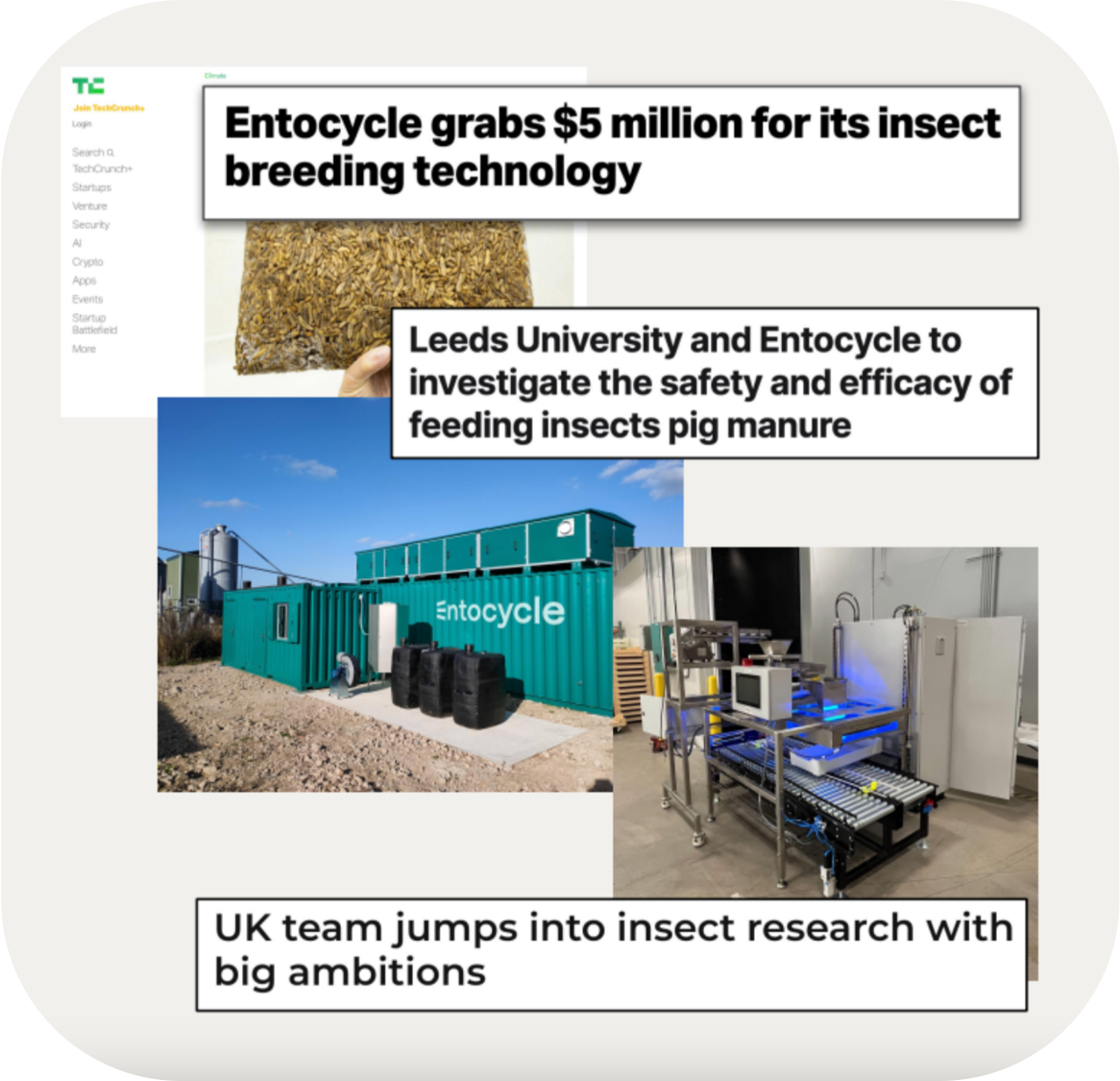

🏆 Following a $5M Series A round in 2023, Entocycle surpassed the initial Series A+ target, extending it to $2M, with $1.7M already allocated.

1. What is their mission?

The world’s leading provider of insect farms and insect farming technology aiming to revolutionize the way we feed animals.

2. What problem are they working on?

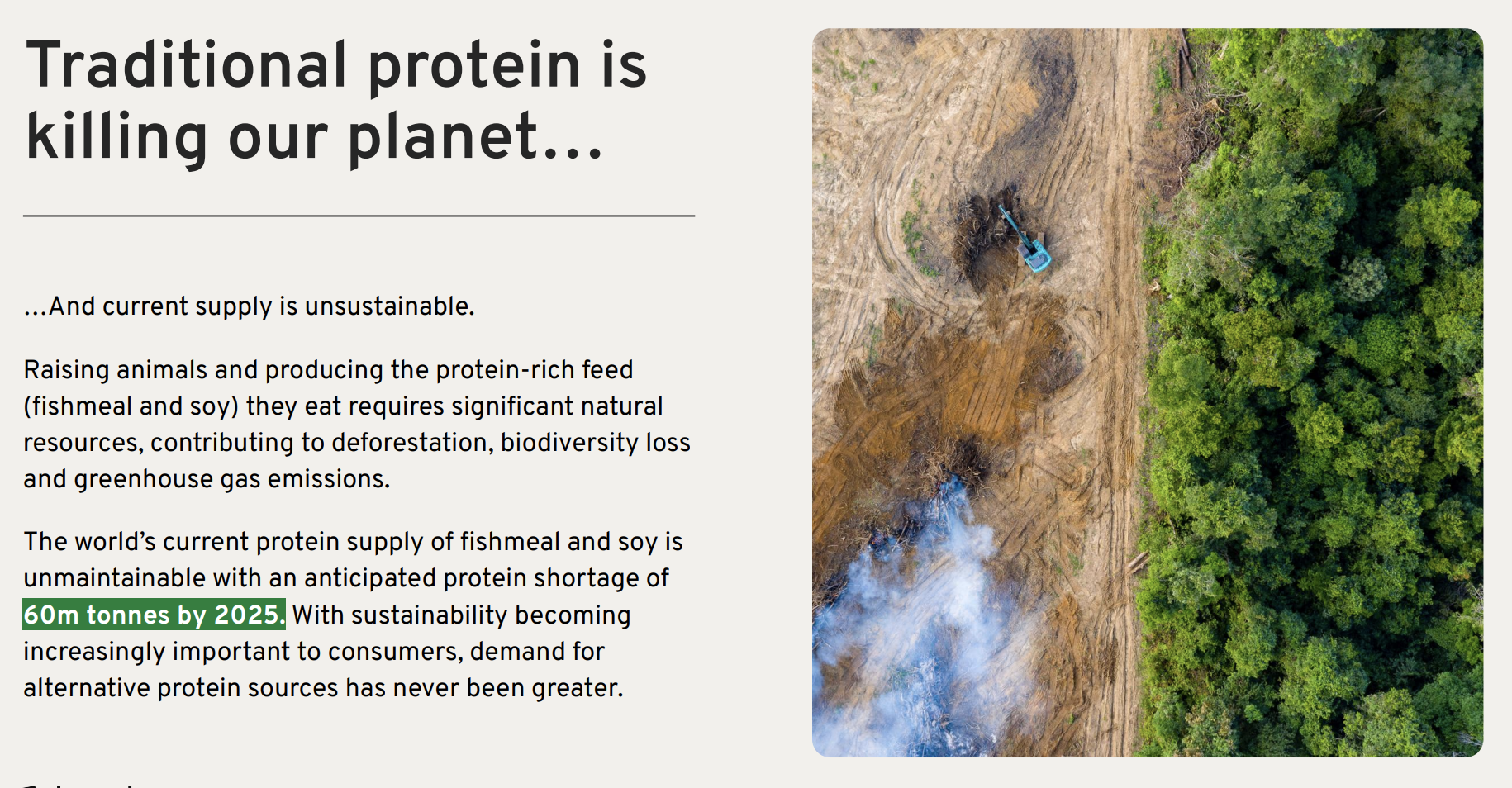

Traditional protein production, notably through raising animals for fishmeal and soy feed, drives deforestation, biodiversity loss, and greenhouse gas emissions by utilizing vast amounts of arable land – simple.

For soybean cultivation, nearly 80% produced is directed to animal feed and this is set to grow, exacerbating protein production issues.

An alternative solution is sourcing protein from insects, a natural part of animals’ diets like pigs, fish, and chickens, offering a promising way to mitigate livestock farming emissions.

With a projected 60 million ton shortage in fishmeal and soy protein supply by 2025 coincided by an increasing consumer demand for sustainable food supply chains, there’s a pressing need to adopt insect-based protein as an environmentally friendly alternative for feeding the global livestock.

3. How does their solution represent a groundbreaking innovation?

Entocycle is inspired by accelerating a global transition to sustainable protein using insects.

The company’s insect farming technology aims to empower black soldier fly (BSF) companies to streamline operations by automating the counting and dosing of neonates, the flow of insect production with robotics and the counting and improvement of breeding adults.

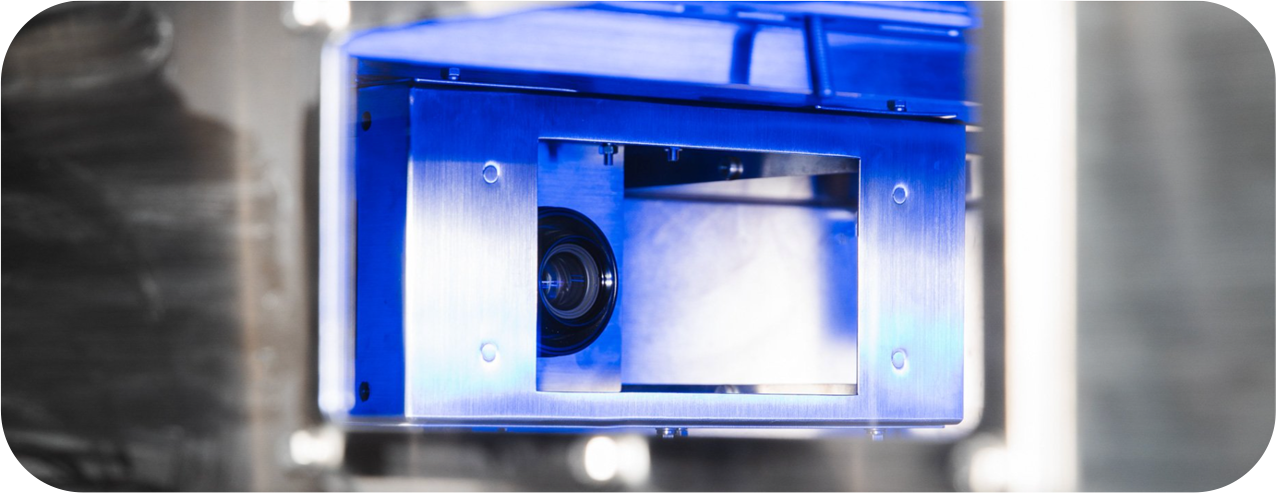

To do this, Entocycle has developed Entocycle Neo™, a hardware module designed for insect farms that provides comprehensive monitoring and data collection on the health and productivity of a black soldier fly colony.

Utilizing optical sensors and a sophisticated software solution, it analyzes images to measure production levels precisely.

Ultimately, Entocycle aims to boost productivity in insect farms through process automation to accurately control and produce insects at scale, enabling data feedback and true scale-up operations. This is conducted by ML/AI, robotic automation and control & data analytics for customers.

Implementing the company’s modules is anticipated to result in improved feed conversion rates and reduced mortality, enhancing overall efficiency, increasing precision, ensuring reliability, reducing costs and fundamentally boosting profitability.

8 Gigatons of CO2e potentially avoided by 2050

4. What sets the team apart?

Entocycle is home to a world-leading team of over 35 experts with expertise in entomology, engineering, automation, and the construction of factories for the animal feed and pet food markets.

Keiran Whitaker

Co-founder & CEO

- Background in Environmental Design & YC alumni.

- Recognized leader in the insect industry with a strong history of fundraising ($15m+)

- MSc Urban Regeneration and Development at Uni. of Manchester.

Matthew Simmonds

Managing Director

- Forbes 30 Under 30 Entrepreneur.

- Co-founder and CTO of a tech company which was sold to the NHS.

- MEng in Engineering at Uni. of Oxford.

Will Bisset

CCO

- Ex Commercial Director, Biomar and managing Director, Yora.

- Personally commercialised BSF products into 29 countries inc £15m+ in booked revenues.

- BSc in Marine Biology at Uni. of Exeter.

Paul Hillmann

CTO

- Former Head of R+D, Bühler Yijiete Ltd.

- Optical sorting wizard. Lead engineer and PM on $10m contract build a dynamic stage for Cirque du Soleil.

- MEng in Mechanical Engineering at Uni. of Manchester.

Amandine Collado

Head of Entomology

- 15 years experience in insect production.

- Leading specialists in the innovation and automation of BSF mass rearing.

- PhD in Genetic Control of Aedes Aegypti at Uni. of Oxford and MSc in Biodiversity at Uni. of Grenoble.

5. What is their business model?

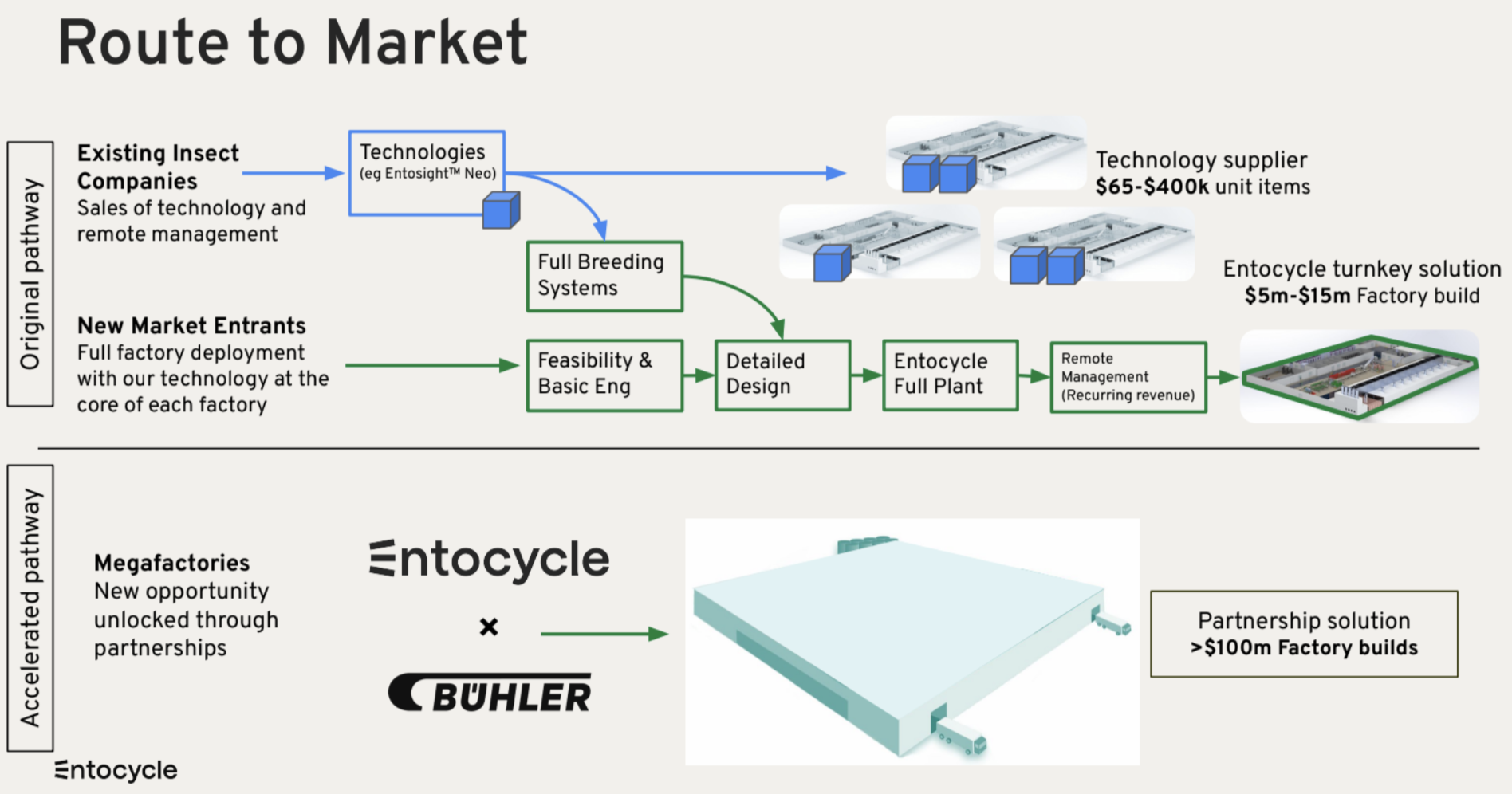

Entocycle has a dual business model.

1. Existing Insect Companies:

Entocycle empowers existing BSF producers to rapidly scale their production using their proprietary technology and remote management.

2. New Market Entrants:

- <45T day production: Entocycle provides complete BSF factories and breeding solutions with their proprietary technology and the heart of every factory.

- >45T day production: Entocycle provides BSF breeding solution (only), and Bühler delivers the processing and production systems and leads on overall delivery. These are larger deals, but Entocycle can focus on a smaller delivery

6. What is their traction so far?

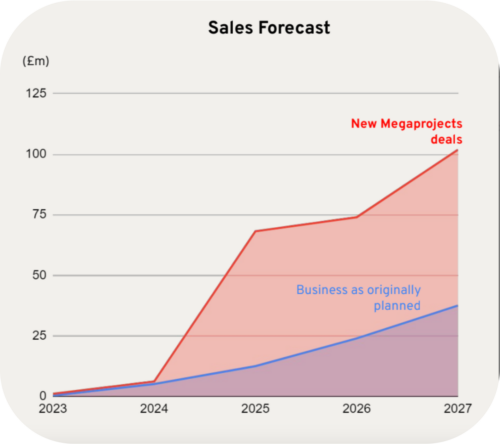

Entocycle is delivering on its Series A plan to provide technology and complete insect farms, hitting ~$1M booked in revenue.

- Installed and commissioned a small-scale insect farm in the North of the UK.

- Launched, installed + commissioned their flagship product the Entosight™ Neo inc. in the largest insect farm in North America.

- Design for 1st commercial-scale facility in the Middle East.

- Design for the largest insect facility in the world.

- Commissioning and opening their CfIT (Centre for Insect Technology) as a showroom and sales tool in London.

- Secured partnership deal with Bühler.

7. Who are their competitors?

Approximately 75% of the market favours Black Soldier Flies (BSF), while mealworms and crickets claim about 12% and 7% respectively.

The remaining share belongs to other insects, representing less than 1%.

Ynsect, primarily associated with mealworms, misjudged the market, leaving them heavily dependent on the human food market for profitability, given impending regulatory changes.

BSF’s dominance is due to its rapid growth, cost-effectiveness, and ability to thrive on food waste, unlike mealworms.

Over 95% of insect companies focus on farming.

The most significant competitor is Bühler – with whom Entocycle partners to deliver factories together.

Essentially, Entocycle aims to win by collaborating for scalability with its direct competitor. It’s a win win!

8. What is the defensibility and unfair advantage?

Entocycle’s technological USP focuses on AI computer vision hardware/software systems that are remotely managed and provide unrivalled accuracy, speed and throughput.

The Technology is patented and protected with x2 family patents (2017 & 2020) in all major vital markets + 1 new currently under application, and industry-standard protocols of software and physical protection protect the software.

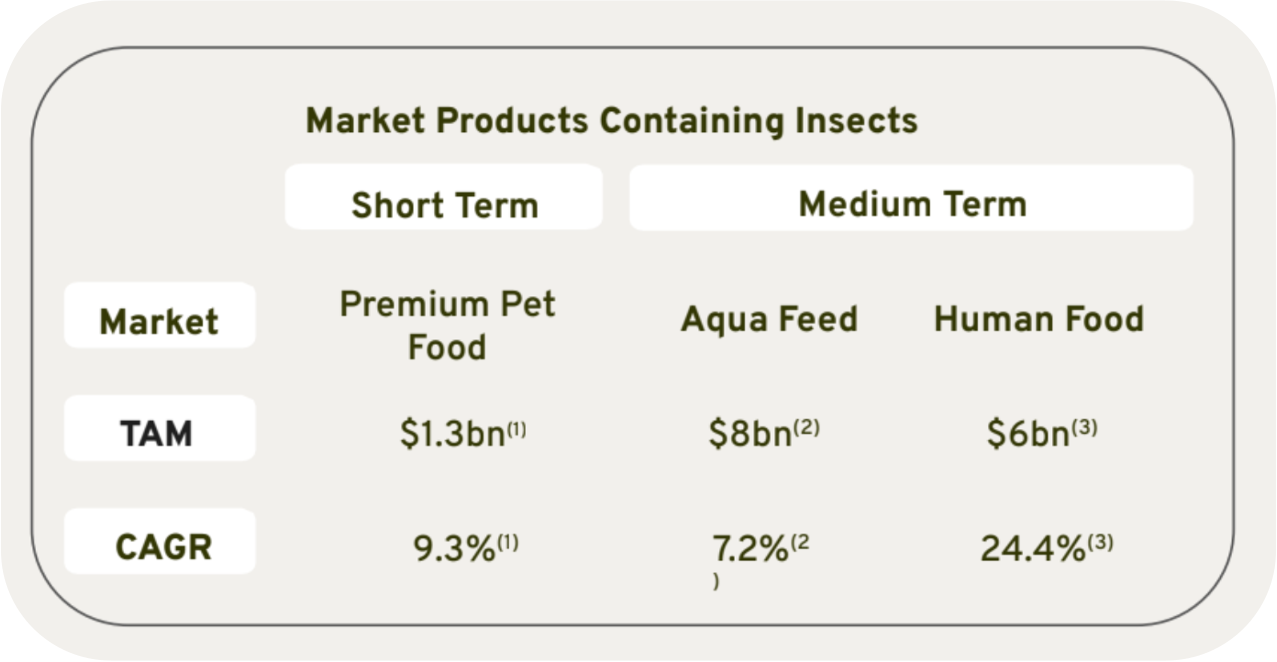

9. What is the estimated market size for the startup's target market?

Insects are gaining prominence across various markets, such as pet food, animal feed, direct human consumption, and as a sustainable solution for waste management.

This trend is contributing to the growth of the industry as the global insect protein market is showing no signs of slowing down.

Demand for insect protein is forecasted to reach 3 million tonnes and be worth $9.46bn by 2030.

Furthermore, the global black soldier fly market specifically is expected to grow by 30.5% CAGR from 2022 to reach $3.96bn by 2033.

To date, Entocycle is delivering on their $5M Series A to book $1M in revenue by installing and commissioning a small-scale insect farm in North UK, launching their flagship product EntosightTM Neo inc. in the largest insect farm in North America and designing the 1st commercial-scale facility in Middle East.

The enormous step into the global market is explored across 3 markets:

1. Premium Pet Food (TAM $1.3bn)

2. Aqua Feed (TAM $8bn)

3. Human Food (TAM $6bn)

10. How does the company effectively mitigate both market and technological risks in their strategy?

Technological Risks:

The technological risk is mitigated by piggybacking off the Capex/Opex of the customers as they do not own the hardware after a sale. However, customers can still generate revenue from remote management and hardware/software upgrades.

From a technical standpoint, Entocycle has a CfIT (Centre for Insect Technology) in London where they are continuously upgrading their hardware, software and systems to maintain a technological edge. 99% of the industry is based in rural/remote locations, so central London allows them to attract and retain the best talent (proven by hiring from competitors).

Market Risks:

Entocycle is location and end-user market agnostic. The company supplies technology and facilities to insect producers selling insect products and services to the final market. As more markets open, Entocycle can target the fastest moving regions and markets with their existing strategy (i.e. if food and feed is no longer the most exciting industry but waste management is, Entocycle can still supply technology and factories to this new market).

The partnership with Bühler will allow Entocycle to deliver larger projects but deliver less (by volume), generating more revenues with a streamlined team and technology offering.

11. What’s the roadmap to scale?

Entocycle has utilised the opportunity to fast-track the companies’ acceleration with the development of megafactories.

The Current Pipeline ($400M+):

- 3 Mega Projects w/Bühler ($40m+ for Entocycle per deal with 1 deal targeting x8 factories)

- 6 Mega Projects [Entocycle leading negotiations] ($8m-$50m for Entocycle deal sizes)

- 28 projects for Tech Sales (£100k ave sales value)

- 17 small farm deals (£2.5m – £12m per deal)

By partnering with Bühler, one of the world’s largest plant manufacturers, places Entocycle at the heart of the world’s largest insect farming projects to drive the adoption of large-scale black soldier fly (BSF) farms worldwide.

Through this collaboration, Bühler and Entocycle tackle the issue by providing scalable, comprehensive solutions that notably decrease the time it takes for companies to establish an insect facility.

How can Entocycle protect itself?

1/ Entocycle’s IP defences are robust and continually fortified, bolstered by favourable legal frameworks in our operating regions.

2/ Reputation is paramount in this evolving market; any misstep risks irreparable damage and alienating potential partners.

3/ Buhler’s expertise lies in processing across various industries, now extending into insect utilization. Their strength aligns with our breeding focus, forming a complementary partnership.

This synergy positions Buhler as a strong exit option for Entocycle.

12. What are the key points towards their next fundraising round?

The firm’s BoD are excited by Entocycle’s growth in 2023 implementing their Series A strategy and wanted to increase their allocation to scale faster given the company’s success.

Entocycle has already oversubscribed the initial $1M target and extended it to $2M of which $1.7M is now allocated with another oversubscription about to happen.

13. Who else is investing in the deal?

The previous funding rounds confirms Entocycle as a leading global player in the rapidly-growing insect industry as it looks to place its cutting-edge technology at the heart of large-scale insect farms worldwide.

A line up of leading investors have invested, including Climentum Capital (BoD), The Venture Collective (BoD observer), Blue Ledge Capital, Team Pact Ventures, LowerCarbon Capital.

Alongside these firms, prominent world-class athletes such as Antoine Dupont (World Rugby player of the year in 2021), Nikola Karabatic (World’s best handball player and Olympic champion with France in 2008, 2012 and 2021), James Haskell (former England rugby international) and Antoine Brizard (Volleyball Olympic Champion with France in 2021) have invested.

14. Why now?

Here are the key factors contributing to the company’s potential success:

The Timing is Now: Entocycle’s solution adeptly resolves issues related to speed, costs, and environmental impact within the current animal feedstock supply chains of its diverse customer base in the agriculture industry with fully modular factories that can be scaled to customers’ needs. The company has strategically positioned itself, ensuring all necessary elements are in order to facilitate seamless scalability.

Ready for Enormous Scaling: Leveraging Bühler’s capabilities to construct megafactories, the company aims to meet the substantial demand from buyers requiring large quantities while simultaneously reducing carbon emissions in food chains and substituting ingredients that strain natural resources. Entocycle is meeting this demand head-on with a robust pipeline of 9 mega projects.

Core Pillars: Entocycle focuses on an enormous market, supported by a world-class dynamic team that has pioneered a leading-edge and a suite of patented technologies for black soldier fly (BSF) breeding, ensuring the seamless scaling of Entocycle’s operations.

FAQ - Alliance Members

Direct sourcing & Referral Deals: While inbound are strong numerous investors and players collaborate with us by sharing exceptional startups. We screen over 100 companies per month & select only on average 3-4 companies fit our thesis criteria.

Only VC’s lead deals will be presented to the Climate Alliance.

On average, we structure 1 deal per month for our Investors Alliance that includes a deadline for each deal.

The minimum investment amount is €10k per ticket. However, it is the sole discretion of each accredited investors to decide if the investments fits their personal criteria for investments.

No, our Climate Investor Alliance is invite-only for qualified and accredited, ensuring top-quality investors collaborate within an exclusive network.

- 0% Management Fees

- 20% Carry

- SPV Costs pro-rated to deal participants

- €99 (Eur.) Monthly Climate Alliance Club membership fee

We encourage investors to also perfom direct investments with the company if the founders find it a fit.

A Special Purpose Vehicle (SPV) is set up for each investments via the platform regulated Kapital. This SPV serves as a dedicated legal entity tailored for managing and executing the fund’s specific investments.

More about the “Kapital Platform” or “Platform”. The Platform is operated by HackVentures Ltd., a subsidiary of the HackGroup SA with offices in Switzerland and Luxembourg (HackVentures Sàrl, a registered Swiss limited liability company with registration number CHE-325.110.014.). They provide Financial Advisory Services under the Swiss Financial Service Act and Luxembourg based issuer services under the Securitisation Act 2004 & the Fiduciary Act 2003.

Yes, we encourage all the club members to be an active participant in the ecosystem by giving support with their network and provide expertise to each startup.

An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.

The “Accredited Investor” standard is set by the SEC and defines who is able to invest in certain private securities offerings.

All investors must at least meet US accreditation requirements.

Non-U.S. investors should also review the standards under their local law.

In no case shall STARTUP BASECAMP INC and its affiliates be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. This Platform is operated by STARTUP BASECAMP INC, a registered C.Corp company in USA.

Investing in private markets, venture funds and early stage companies involves risks, including illiquidity, lack of dividends, loss of investment and dilution. This communication is intended for accredited experienced investors, with sufficient experience and knowledge to understand the processes and risks involved. If you feel that you are not in a position to assess your expertise, please refrain from proceeding.

This website (the “STARTUP BASECAMP Platform” or “Platform”) is operated by STARTUP BASECAMP INC. Please note that the investment schemes mentioned are not subject to the supervision of the SEC, European Regulators or the FINMA, may not be distributed to non-qualified investors, and that investors, therefore do not benefit from the protection offered to retail investors. In no case shall STARTUP BASECAMP INC , its related entities and partners be responsible for any damages, direct or indirect, in any way whatsoever, including damages related to investment. The content of this website does not constitute an offer to enter into any transaction and is intended for general information purposes only. This is not an offer, solicitation of an offer, or advice to buy or sell securities in any jurisdiction where the STARTUP BASECAMP INC and its related entities & partners are not registered. The information contained on this Platform should not be considered by users as an alternative for the exercise of their own judgement, a careful analysis is necessary, and it is recommended to potential users, before making any decision, to always consult a qualified professional advisor to obtain appropriate advice, in particular financial, legal, accounting or tax.